Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COUSINS PROPERTIES INCORPORATED AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)<br />

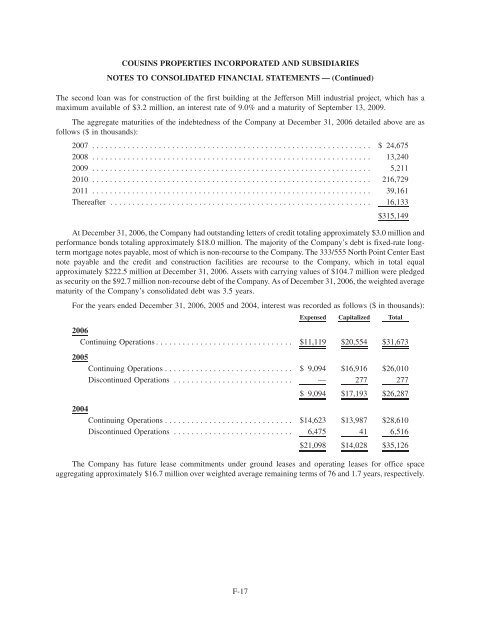

The second loan was for construction of the first building at the Jefferson Mill industrial project, which has a<br />

maximum available of $3.2 million, an interest rate of 9.0% and a maturity of September 13, 2009.<br />

The aggregate maturities of the indebtedness of the Company at December 31, <strong>2006</strong> detailed above are as<br />

follows ($ in thousands):<br />

2007 ............................................................... $ 24,675<br />

2008 ............................................................... 13,240<br />

2009 ............................................................... 5,211<br />

2010 ............................................................... 216,729<br />

2011 ............................................................... 39,161<br />

Thereafter ........................................................... 16,133<br />

$315,149<br />

At December 31, <strong>2006</strong>, the Company had outstanding letters of credit totaling approximately $3.0 million and<br />

performance bonds totaling approximately $18.0 million. The majority of the Company’s debt is fixed-rate longterm<br />

mortgage notes payable, most of which is non-recourse to the Company. The 333/555 North Point Center East<br />

note payable and the credit and construction facilities are recourse to the Company, which in total equal<br />

approximately $222.5 million at December 31, <strong>2006</strong>. Assets with carrying values of $104.7 million were pledged<br />

as security on the $92.7 million non-recourse debt of the Company. As of December 31, <strong>2006</strong>, the weighted average<br />

maturity of the Company’s consolidated debt was 3.5 years.<br />

For the years ended December 31, <strong>2006</strong>, 2005 and 2004, interest was recorded as follows ($ in thousands):<br />

Expensed Capitalized Total<br />

<strong>2006</strong><br />

Continuing Operations ............................... $11,119 $20,554 $31,673<br />

2005<br />

Continuing Operations ............................. $ 9,094 $16,916 $26,010<br />

Discontinued Operations ........................... — 277 277<br />

$ 9,094 $17,193 $26,287<br />

2004<br />

Continuing Operations ............................. $14,623 $13,987 $28,610<br />

Discontinued Operations ........................... 6,475 41 6,516<br />

$21,098 $14,028 $35,126<br />

The Company has future lease commitments under ground leases and operating leases for office space<br />

aggregating approximately $16.7 million over weighted average remaining terms of 76 and 1.7 years, respectively.<br />

F-17