Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

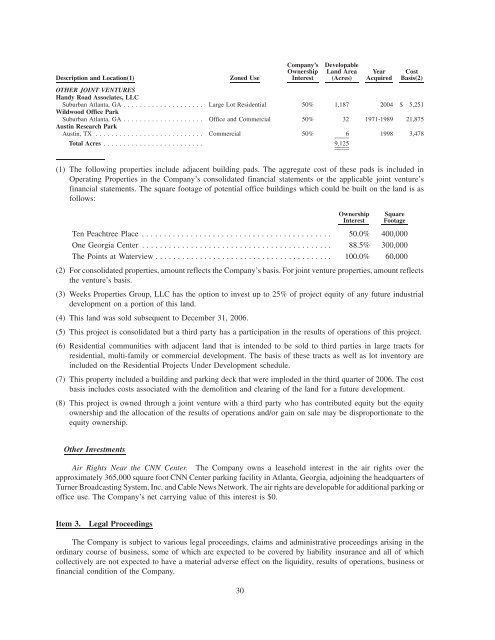

Description and Location(1) Zoned Use<br />

Company’s<br />

Ownership<br />

Interest<br />

Developable<br />

Land Area<br />

(Acres)<br />

Year<br />

Acquired<br />

Cost<br />

Basis(2)<br />

OTHER JOINT VENTURES<br />

Handy Road Associates, LLC<br />

Suburban Atlanta, GA ....................<br />

Wildwood Office Park<br />

Large Lot Residential 50% 1,187 2004 $ 5,251<br />

Suburban Atlanta, GA ....................<br />

Austin Research Park<br />

OfficeandCommercial 50% 32 1971-1989 21,875<br />

Austin, TX . .......................... Commercial 50% 6 1998 3,478<br />

Total Acres ......................... 9,125<br />

(1) The following properties include adjacent building pads. The aggregate cost of these pads is included in<br />

Operating <strong>Properties</strong> in the Company’s consolidated financial statements or the applicable joint venture’s<br />

financial statements. The square footage of potential office buildings which could be built on the land is as<br />

follows:<br />

Ownership<br />

Interest<br />

Square<br />

Footage<br />

Ten Peachtree Place ........................................... 50.0% 400,000<br />

One Georgia Center ........................................... 88.5% 300,000<br />

The Points at Waterview ........................................ 100.0% 60,000<br />

(2) For consolidated properties, amount reflects the Company’s basis. For joint venture properties, amount reflects<br />

the venture’s basis.<br />

(3) Weeks <strong>Properties</strong> Group, LLC has the option to invest up to 25% of project equity of any future industrial<br />

development on a portion of this land.<br />

(4) This land was sold subsequent to December 31, <strong>2006</strong>.<br />

(5) This project is consolidated but a third party has a participation in the results of operations of this project.<br />

(6) Residential communities with adjacent land that is intended to be sold to third parties in large tracts for<br />

residential, multi-family or commercial development. The basis of these tracts as well as lot inventory are<br />

included on the Residential Projects Under Development schedule.<br />

(7) This property included a building and parking deck that were imploded in the third quarter of <strong>2006</strong>. The cost<br />

basis includes costs associated with the demolition and clearing of the land for a future development.<br />

(8) This project is owned through a joint venture with a third party who has contributed equity but the equity<br />

ownership and the allocation of the results of operations and/or gain on sale may be disproportionate to the<br />

equity ownership.<br />

Other Investments<br />

Air Rights Near the CNN Center. The Company owns a leasehold interest in the air rights over the<br />

approximately 365,000 square foot CNN Center parking facility in Atlanta, Georgia, adjoining the headquarters of<br />

Turner Broadcasting System, Inc. and Cable News Network. The air rights are developable for additional parking or<br />

office use. The Company’s net carrying value of this interest is $0.<br />

Item 3. Legal Proceedings<br />

The Company is subject to various legal proceedings, claims and administrative proceedings arising in the<br />

ordinary course of business, some of which are expected to be covered by liability insurance and all of which<br />

collectively are not expected to have a material adverse effect on the liquidity, results of operations, business or<br />

financial condition of the Company.<br />

30