Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Cousins Properties Incorporated 2006 Annual Report - SNL Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COUSINS PROPERTIES INCORPORATED AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)<br />

Stock Options — At December 31, <strong>2006</strong>, 6,117,402 stock options awarded to key employees and outside<br />

directors pursuant to both the 1999 Plan and the Predecessor Plans were outstanding. The Company typically uses<br />

authorized, unissued shares to provide shares for option exercises. All stock options have a term of 10 years from the<br />

date of grant. Key employee stock options granted prior to December 28, 2000 had a vesting period of five years<br />

under both the 1999 Plan and the Predecessor Plans. Options granted on or after December 28, 2000 have a vesting<br />

period of four years. Outside director stock options are fully vested on the date of grant under the 1999 Plan but had<br />

a vesting period of one year under the Predecessor Plans.<br />

In <strong>2006</strong>, the Company amended the stock option certificates to add a retirement feature. Employees who meet<br />

the requirements of the retirement feature vest immediately in their stock options outstanding, and the vesting<br />

periods for shares outstanding were also changed to reflect accelerated expense for employees who become<br />

retirement-eligible within the next four years. The Company recognized additional compensation expense of<br />

$716,000, before any capitalization to projects under development or income tax benefit, in <strong>2006</strong> related to this<br />

modification. In addition, for all grants after December 11, <strong>2006</strong>, an employee who meets the requirements of the<br />

retirement feature will have the remaining original term to exercise their stock options after retirement. The<br />

certificates currently allow for an exercise period of one year after termination, which remains in force for grants<br />

prior to December 11, <strong>2006</strong> for retirement-eligible employees and for all other employees. Also in <strong>2006</strong>, the stock<br />

option certificates for grants after December 11, <strong>2006</strong> were amended to include a stock appreciation right. A stock<br />

appreciation right permits an employee to waive his or her right to exercise the stock option and to instead receive<br />

the value of the option, net of the exercise price and tax withholding, in stock, without requiring the payment of the<br />

exercise.<br />

The Company estimates the fair value of each option grant on the date of grant using the Black-Scholes optionpricing<br />

model. The risk free interest rate utilized in the Black-Scholes calculation is the interest rate on<br />

U.S. Treasury Strips having the same life as the estimated life of the Company’s option awards. The assumed<br />

dividend yield is based on the annual dividend rate for regular dividends at the time of grant. Expected life of the<br />

options granted was computed using historical data for certain grant years reflecting actual hold periods plus an<br />

estimated hold period for unexercised options outstanding using the mid-point between <strong>2006</strong> and the expiration<br />

date. Expected volatility is based on the historical volatility of the Company’s stock over a period relevant to the<br />

related stock option grant. For grants occurring after adoption of SFAS 123R, the Company expenses stock options<br />

with graded vesting using the straight line method over the vesting period.<br />

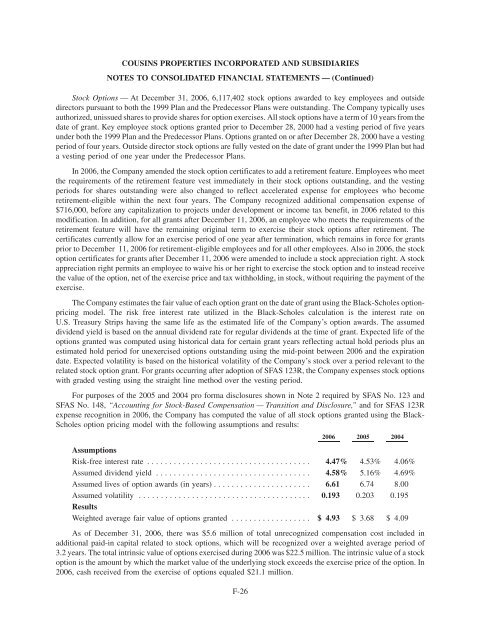

For purposes of the 2005 and 2004 pro forma disclosures shown in Note 2 required by SFAS No. 123 and<br />

SFAS No. 148, “Accounting for Stock-Based Compensation — Transition and Disclosure,” and for SFAS 123R<br />

expense recognition in <strong>2006</strong>, the Company has computed the value of all stock options granted using the Black-<br />

Scholes option pricing model with the following assumptions and results:<br />

<strong>2006</strong> 2005 2004<br />

Assumptions<br />

Risk-free interest rate ..................................... 4.47% 4.53% 4.06%<br />

Assumed dividend yield ................................... 4.58% 5.16% 4.69%<br />

Assumed lives of option awards (in years) . . . ................... 6.61 6.74 8.00<br />

Assumed volatility ....................................... 0.193 0.203 0.195<br />

Results<br />

Weighted average fair value of options granted .................. $ 4.93 $ 3.68 $ 4.09<br />

As of December 31, <strong>2006</strong>, there was $5.6 million of total unrecognized compensation cost included in<br />

additional paid-in capital related to stock options, which will be recognized over a weighted average period of<br />

3.2 years. The total intrinsic value of options exercised during <strong>2006</strong> was $22.5 million. The intrinsic value of a stock<br />

option is the amount by which the market value of the underlying stock exceeds the exercise price of the option. In<br />

<strong>2006</strong>, cash received from the exercise of options equaled $21.1 million.<br />

F-26