Directors - Boustead Holdings Berhad

Directors - Boustead Holdings Berhad

Directors - Boustead Holdings Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. OPERATING COST (cont’d.)<br />

During the year, the Group reviewed the recoverable amounts of new plantation developments in Sabah,<br />

Sarawak and Indonesia using discounted cash flow over one economic cycle at discount factors of<br />

between 8.5% to 10%. Key assumptions used for prices were RM1,600 per MT for palm oil and RM900<br />

per MT for palm kernel. FFB production was estimated at up to 26 MT per hectare for Sabah estates<br />

and 24 MT per hectare for Sarawak and Indonesia estates. These key assumptions are highly variable<br />

and will most likely fluctuate due to factors beyond the Group’s control. The review led to the recognition<br />

of impairment of RM19 million for the year ended 31 December 2006, totalling RM9.50 million each for<br />

biological assets and property, plant and equipment respectively.<br />

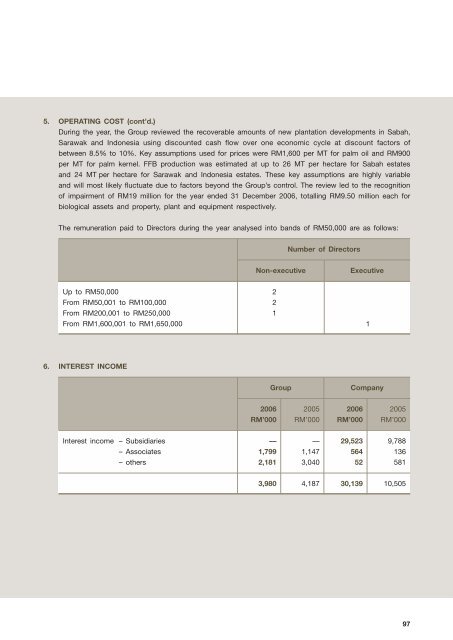

The remuneration paid to <strong>Directors</strong> during the year analysed into bands of RM50,000 are as follows:<br />

Number of <strong>Directors</strong><br />

Non-executive Executive<br />

Up to RM50,000 2<br />

From RM50,001 to RM100,000 2<br />

From RM200,001 to RM250,000 1<br />

From RM1,600,001 to RM1,650,000 1<br />

6. INTEREST INCOME<br />

Group Company<br />

2006 2005 2006 2005<br />

RM’000 RM’000 RM’000 RM’000<br />

Interest income – Subsidiaries –– –– 29,523 9,788<br />

– Associates 1,799 1,147 564 136<br />

– others 2,181 3,040 52 581<br />

3,980 4,187 30,139 10,505<br />

97