Annual Report 1998

Annual Report 1998

Annual Report 1998

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16<br />

Acquisitions<br />

A number of acquisitions were made during the year in line<br />

with SCA’s growth strategy for hygiene products. The financial<br />

uneasiness in the regions where SCA is expanding has created<br />

favorable opportunities for acquisitions although there is some<br />

uncertainty about profitability in the immediate future. Viewing<br />

the situation in a longer perspective, SCA still believes that<br />

future growth will be strong.<br />

In Russia, SCA acquired all the shares of Svetogorsk Tissue<br />

from Tetra-Laval. Svetogorsk Tissue, which is located in the St.<br />

Petersburg region, has the most modern tissue machine in<br />

Russia, built in 1989. Its production amounts to approximately<br />

20,000 tons per year, equal to about 20% of the<br />

Russian market. The acquisition offers possibilities to produce<br />

diapers and feminine hygiene products locally.<br />

In Colombia, SCA increased to 50% its stake in the Productos<br />

Familia tissue company, which in turn owns the Tecnopapel<br />

tissue company in Ecuador. Negotiations regarding the<br />

acquisition of 50% of the Brazilian tissue company Melhoramentos<br />

Papeis, which was announced in <strong>1998</strong>, are as yet not<br />

completed.<br />

SCA has also increased its involvement in Asia with the acquisition<br />

of Holland Pacific Paper, a Philippine tissue company.<br />

The company currently has the capacity to produce 22,000<br />

tons of tissue per year, plus capacity for 8,000 tons of specialty<br />

paper that can be converted to tissue production. The market<br />

share in the Philippines amounts to 22%.<br />

In Western Europe, SCA acquired three distributors of<br />

incontinence products in France whose total sales amount to<br />

SEK 140 M. SCA is thereby becoming the market leader in<br />

incontinence products in that country. Operations in the incontinence-product<br />

field were acquired in Finland.<br />

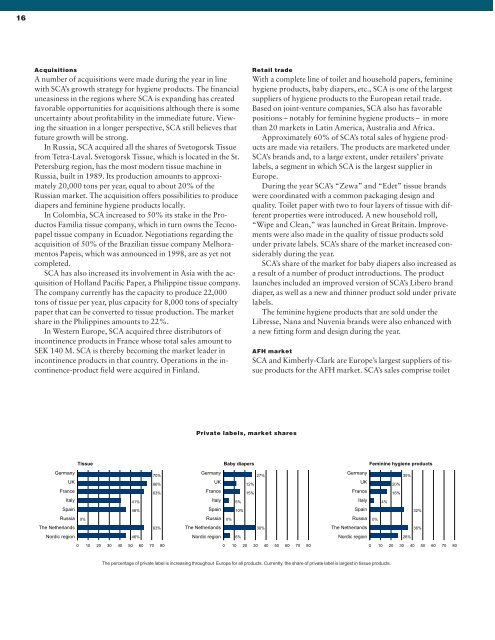

Tissue<br />

Germany<br />

UK<br />

France<br />

Italy<br />

Spain<br />

Russia 0%<br />

The Netherlands<br />

Nordic region<br />

41%<br />

46%<br />

46%<br />

70%<br />

66%<br />

63%<br />

63%<br />

0 10 20 30 40 50 60 70 80<br />

Private labels, market shares<br />

Baby diapers<br />

Germany<br />

27%<br />

UK<br />

12%<br />

France<br />

15%<br />

Italy 5%<br />

Spain 10%<br />

Russia 0%<br />

The Netherlands<br />

30%<br />

Nordic region 6%<br />

Retail trade<br />

With a complete line of toilet and household papers, feminine<br />

hygiene products, baby diapers, etc., SCA is one of the largest<br />

suppliers of hygiene products to the European retail trade.<br />

Based on joint-venture companies, SCA also has favorable<br />

positions – notably for feminine hygiene products – in more<br />

than 20 markets in Latin America, Australia and Africa.<br />

Approximately 60% of SCA’s total sales of hygiene products<br />

are made via retailers. The products are marketed under<br />

SCA’s brands and, to a large extent, under retailers’ private<br />

labels, a segment in which SCA is the largest supplier in<br />

Europe.<br />

During the year SCA’s “Zewa” and “Edet” tissue brands<br />

were coordinated with a common packaging design and<br />

quality. Toilet paper with two to four layers of tissue with different<br />

properties were introduced. A new household roll,<br />

“Wipe and Clean,” was launched in Great Britain. Improvements<br />

were also made in the quality of tissue products sold<br />

under private labels. SCA’s share of the market increased considerably<br />

during the year.<br />

SCA’s share of the market for baby diapers also increased as<br />

a result of a number of product introductions. The product<br />

launches included an improved version of SCA’s Libero brand<br />

diaper, as well as a new and thinner product sold under private<br />

labels.<br />

The feminine hygiene products that are sold under the<br />

Libresse, Nana and Nuvenia brands were also enhanced with<br />

a new fitting form and design during the year.<br />

AFH market<br />

SCA and Kimberly-Clark are Europe’s largest suppliers of tissue<br />

products for the AFH market. SCA’s sales comprise toilet<br />

0 10 20 30 40 50 60 70 80<br />

Germany<br />

Feminine hygiene products<br />

30%<br />

UK<br />

20%<br />

France<br />

16%<br />

Italy 4%<br />

Spain<br />

32%<br />

Russia 0%<br />

The Netherlands<br />

36%<br />

Nordic region<br />

26%<br />

The percentage of private label is increasing throughout Europe for all products. Currently, the share of private label is largest in tissue products.<br />

0 10 20 30 40 50 60 70 80