summary of moody's jda for banks - Bad Request

summary of moody's jda for banks - Bad Request

summary of moody's jda for banks - Bad Request

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Credit Research<br />

Financial Institutions<br />

May 29, 2007<br />

New notching mechanism with<br />

up to four notches<br />

Sector Report - Summary <strong>of</strong> Moody's JDA For Banks<br />

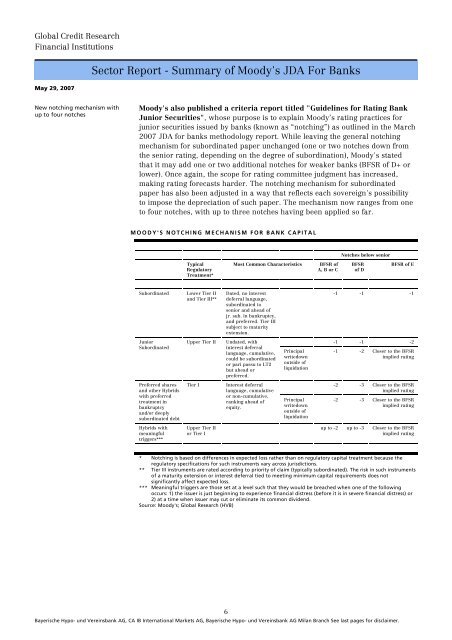

Moody's also published a criteria report titled "Guidelines <strong>for</strong> Rating Bank<br />

Junior Securities", whose purpose is to explain Moody’s rating practices <strong>for</strong><br />

junior securities issued by <strong>banks</strong> (known as “notching”) as outlined in the March<br />

2007 JDA <strong>for</strong> <strong>banks</strong> methodology report. While leaving the general notching<br />

mechanism <strong>for</strong> subordinated paper unchanged (one or two notches down from<br />

the senior rating, depending on the degree <strong>of</strong> subordination), Moody's stated<br />

that it may add one or two additional notches <strong>for</strong> weaker <strong>banks</strong> (BFSR <strong>of</strong> D+ or<br />

lower). Once again, the scope <strong>for</strong> rating committee judgment has increased,<br />

making rating <strong>for</strong>ecasts harder. The notching mechanism <strong>for</strong> subordinated<br />

paper has also been adjusted in a way that reflects each sovereign's possibility<br />

to impose the depreciation <strong>of</strong> such paper. The mechanism now ranges from one<br />

to four notches, with up to three notches having been applied so far.<br />

MOODY'S NOTCHING MECHANISM FOR BANK CAPITAL<br />

Typical<br />

Regulatory<br />

Treatment*<br />

Subordinated Lower Tier II<br />

and Tier III**<br />

Junior<br />

Subordinated<br />

Preferred shares<br />

and other Hybrids<br />

with preferred<br />

treatment in<br />

bankruptcy<br />

and/or deeply<br />

subordinated debt<br />

Hybrids with<br />

meaningful<br />

triggers***<br />

Bayerische Hypo- und Vereinsbank AG, CA IB International Markets AG, Bayerische Hypo- und Vereinsbank AG Milan Branch See last pages <strong>for</strong> disclaimer.<br />

6<br />

Most Common Characteristics BFSR <strong>of</strong><br />

A, B or C<br />

Dated, no interest<br />

deferral language,<br />

subordinated to<br />

senior and ahead <strong>of</strong><br />

jr. sub. in bankruptcy,<br />

and preferred. Tier III<br />

subject to maturity<br />

extension.<br />

Upper Tier II Undated, with<br />

interest deferral<br />

language, cumulative,<br />

could be subordinated<br />

or pari passu to LT2<br />

but ahead or<br />

preferred.<br />

Tier I Interest deferral<br />

language, cumulative<br />

or non-cumulative,<br />

ranking ahead <strong>of</strong><br />

equity.<br />

Upper Tier II<br />

or Tier I<br />

Principal<br />

writedown<br />

outside <strong>of</strong><br />

liquidation<br />

Principal<br />

writedown<br />

outside <strong>of</strong><br />

liquidation<br />

Notches below senior<br />

BFSR<br />

<strong>of</strong> D<br />

BFSR <strong>of</strong> E<br />

-1 -1 -1<br />

-1 -1 -2<br />

-1 -2 Closer to the BFSR<br />

implied rating<br />

-2 -3 Closer to the BFSR<br />

implied rating<br />

-2 -3 Closer to the BFSR<br />

implied rating<br />

up to -2 up to -3 Closer to the BFSR<br />

implied rating<br />

* Notching is based on differences in expected loss rather than on regulatory capital treatment because the<br />

regulatory specifications <strong>for</strong> such instruments vary across jurisdictions.<br />

** Tier III instruments are rated according to priority <strong>of</strong> claim (typically subordinated). The risk in such instruments<br />

<strong>of</strong> a maturity extension or interest deferral tied to meeting minimum capital requirements does not<br />

significantly affect expected loss.<br />

*** Meaningful triggers are those set at a level such that they would be breached when one <strong>of</strong> the following<br />

occurs: 1) the issuer is just beginning to experience financial distress (be<strong>for</strong>e it is in severe financial distress) or<br />

2) at a time when issuer may cut or eliminate its common dividend.<br />

Source: Moody's; Global Research (HVB)