Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

70<br />

ANNUAL REPORT <strong>2008</strong><br />

Notes to the consolidated financial statements<br />

<strong>2008</strong> Financial Year<br />

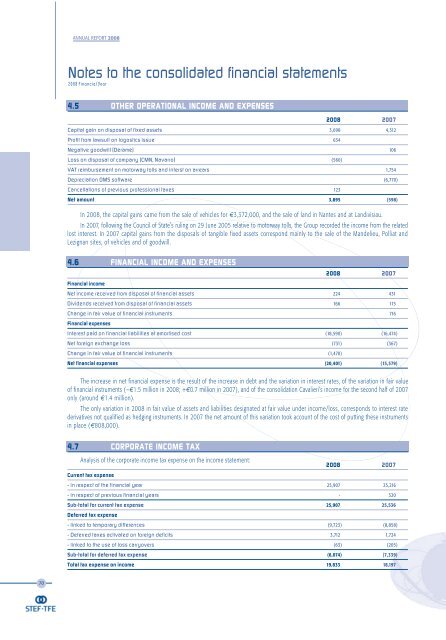

4.5 OTHER OPERATIONAL INCOME AND EXPENSES<br />

<strong>2008</strong> 2007<br />

Capital gain on disposal of fixed assets 3,698 4,312<br />

Profit from lawsuit on logostics issue 634<br />

Negative goodwill (Déramé) 106<br />

Loss on disposal of company (CMN, Navarro) (560)<br />

VAT reimbursement on motorway tolls and interst on arrears 1,754<br />

Depreciation OMS software (6,770)<br />

Cancellations of previous professional taxes 123<br />

Net amount 3,895 (598)<br />

In <strong>2008</strong>, the capital gains came from the sale of vehicles for €3,372,000, and the sale of land in Nantes and at Landivisiau.<br />

In 2007, following the Council of State’s ruling on 29 June 2005 relative to motorway tolls, the Group recorded the income from the related<br />

lost interest. In 2007 capital gains from the disposals of tangible fixed assets correspond mainly to the sale of the Mandelieu, Polliat and<br />

Lezignan sites, of vehicles and of goodwill.<br />

4.6 FINANCIAL INCOME AND EXPENSES<br />

Financial income<br />

4.7 CORPORATE INCOME TAX<br />

Analysis of the corporate income tax expense on the income statement:<br />

Current tax expense<br />

<strong>2008</strong> 2007<br />

- in respect of the financial year 25,907 25,216<br />

- in respect of previous financial years - 320<br />

Sub-total for current tax expense 25,907 25,536<br />

Deferred tax expense<br />

<strong>2008</strong> 2007<br />

Net income received from disposal of financial assets 224 431<br />

Dividends received from disposal of financial assets 166 115<br />

Change in fair value of financial instruments 716<br />

Financial expenses<br />

Interest paid on financial liabilities at amortised cost (18,590) (16,474)<br />

Net foreign exchange loss (731) (367)<br />

Change in fair value of financial instruments (1,470)<br />

Net financial expenses (20,401) (15,579)<br />

The increase in net financial expense is the result of the increase in debt and the variation in interest rates, of the variation in fair value<br />

of financial instruments (–€1.5 million in <strong>2008</strong>; +€0.7 million in 2007), and of the consolidation Cavalieri's income for the second half of 2007<br />

only (around €1.4 million).<br />

The only variation in <strong>2008</strong> in fair value of assets and liabilities designated at fair value under income/loss, corresponds to interest rate<br />

derivatives not qualified as hedging instruments. In 2007 the net amount of this variation took account of the cost of putting these instruments<br />

in place (€808,000).<br />

- linked to temporary differences (9,723) (8,858)<br />

- Deferred taxes activated on foreign deficits 3,712 1,724<br />

- linked to the use of loss carryovers (63) (205)<br />

Sub-total for deferred tax expense (6,074) (7,339)<br />

Total tax expense on income 19,833 18,197