JPMorgan Investment Funds

JPMorgan Investment Funds

JPMorgan Investment Funds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

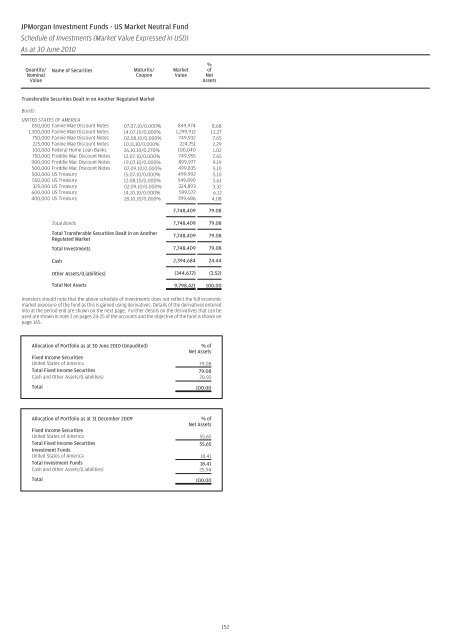

<strong>JPMorgan</strong> <strong>Investment</strong> <strong>Funds</strong> - US Market Neutral Fund<br />

Schedule of <strong>Investment</strong>s (Market Value Expressed in USD)<br />

As at 30 June 2010<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

Transferable Securities Dealt in on Another Regulated Market<br />

Bonds<br />

UNITED STATES OF AMERICA<br />

850,000 Fannie Mae Discount Notes 07.07.10/0.000% 849,974 8.68<br />

1,300,000 Fannie Mae Discount Notes 14.07.10/0.000% 1,299,912 13.27<br />

750,000 Fannie Mae Discount Notes 02.08.10/0.000% 749,932 7.65<br />

225,000 Fannie Mae Discount Notes 10.11.10/0.000% 224,751 2.29<br />

100,000 Federal Home Loan Banks 26.10.10/0.270% 100,040 1.02<br />

750,000 Freddie Mac Discount Notes 12.07.10/0.000% 749,955 7.65<br />

900,000 Freddie Mac Discount Notes 19.07.10/0.000% 899,977 9.19<br />

500,000 Freddie Mac Discount Notes 07.09.10/0.000% 499,835 5.10<br />

500,000 US Treasury 15.07.10/0.000% 499,992 5.10<br />

550,000 US Treasury 12.08.10/0.000% 549,890 5.61<br />

325,000 US Treasury 02.09.10/0.000% 324,893 3.32<br />

600,000 US Treasury 14.10.10/0.000% 599,572 6.12<br />

400,000 US Treasury 28.10.10/0.000% 399,686 4.08<br />

7,748,409 79.08<br />

Total Bonds 7,748,409 79.08<br />

Total Transferable Securities Dealt in on Another<br />

Regulated Market<br />

7,748,409 79.08<br />

Total <strong>Investment</strong>s 7,748,409 79.08<br />

Cash 2,394,684 24.44<br />

Other Assets/(Liabilities) (344,672) (3.52)<br />

Total Net Assets 9,798,421 100.00<br />

Investors should note that the above schedule of investments does not reflect the full economic<br />

market exposure of the fund as this is gained using derivatives. Details of the derivatives entered<br />

into at the period end are shown on the next page. Further details on the derivatives that can be<br />

used are shown in note 2 on pages 24-25 of the accounts and the objective of the fund is shown on<br />

page 165.<br />

Allocation of Portfolio as at 30 June 2010 (Unaudited)<br />

Fixed Income Securities<br />

% of<br />

Net Assets<br />

United States of America 79.08<br />

Total Fixed Income Securities 79.08<br />

Cash and Other Assets/(Liabilities) 20.92<br />

Total 100.00<br />

Allocation of Portfolio as at 31 December 2009<br />

Fixed Income Securities<br />

% of<br />

Net Assets<br />

United States of America 55.65<br />

Total Fixed Income Securities<br />

<strong>Investment</strong> <strong>Funds</strong><br />

55.65<br />

United States of America 18.41<br />

Total <strong>Investment</strong> <strong>Funds</strong> 18.41<br />

Cash and Other Assets/(Liabilities) 25.94<br />

Total 100.00<br />

152<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets

![Prospectus Simplifié daté de [Mars] 2005](https://img.yumpu.com/18875582/1/190x245/prospectus-simplifie-date-de-mars-2005.jpg?quality=85)