Transportation Management Report 2011 - Capgemini

Transportation Management Report 2011 - Capgemini

Transportation Management Report 2011 - Capgemini

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

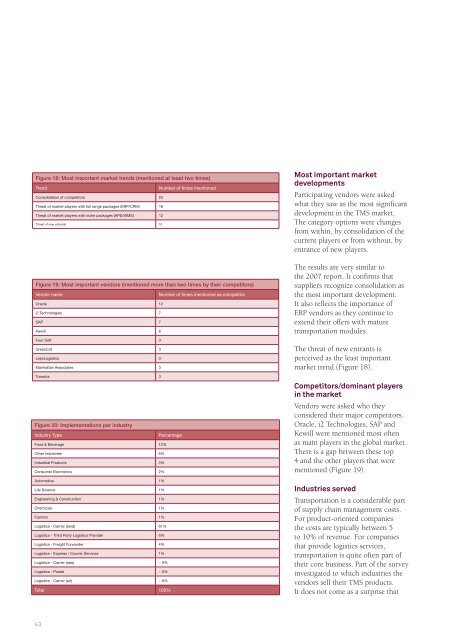

Figure 18: Most important market trends (mentioned at least two times)<br />

Trend Number of times mentioned<br />

Consolidation of competitors 23<br />

Threat of market players with full range packages (ERP/CRM) 18<br />

Threat of market players with niche packages (APS/WMS) 12<br />

Threat of new entrants 10<br />

Figure 19: Most important vendors (mentioned more than two times by their competitors)<br />

Vendor name Number of times mentioned as competitor<br />

Oracle 12<br />

i2 Technologies 7<br />

SAP 7<br />

Kewill 6<br />

Four Soft 3<br />

GreenCat 3<br />

LeanLogistics 3<br />

Manhattan Associates 3<br />

Transics 3<br />

Figure 20: Implementations per industry<br />

Industry Type Percentage<br />

Food & Beverage 12%<br />

Other Industries 6%<br />

Industrial Products 3%<br />

Consumer Electronics 2%<br />

Automotive 1%<br />

Life Science 1%<br />

Engineering & Construction 1%<br />

Chemicals 1%<br />

Fashion 1%<br />

Logistics - Carrier (land) 61%<br />

Logistics - Third Party Logistics Provider 6%<br />

Logistics - Freight Forwarder 4%<br />

Logistics - Express / Courier Services 1%<br />

Logistics - Carrier (sea) ~ 0%<br />

Logistics - Postal ~ 0%<br />

Logistics - Carrier (air) ~ 0%<br />

Total 100%<br />

43<br />

Most important market<br />

developments<br />

Participating vendors were asked<br />

what they saw as the most significant<br />

development in the TMS market.<br />

The category options were changes<br />

from within, by consolidation of the<br />

current players or from without, by<br />

entrance of new players.<br />

The results are very similar to<br />

the 2007 report. It confirms that<br />

suppliers recognize consolidation as<br />

the most important development.<br />

It also reflects the importance of<br />

ERP vendors as they continue to<br />

extend their offers with mature<br />

transportation modules.<br />

The threat of new entrants is<br />

perceived as the least important<br />

market trend (Figure 18).<br />

Competitors/dominant players<br />

in the market<br />

Vendors were asked who they<br />

considered their major competitors.<br />

Oracle, i2 Technologies, SAP and<br />

Kewill were mentioned most often<br />

as main players in the global market.<br />

There is a gap between these top<br />

4 and the other players that were<br />

mentioned (Figure 19).<br />

Industries served<br />

<strong>Transportation</strong> is a considerable part<br />

of supply chain management costs.<br />

For product-oriented companies<br />

the costs are typically between 5<br />

to 10% of revenue. For companies<br />

that provide logistics services,<br />

transportation is quite often part of<br />

their core business. Part of the survey<br />

investigated to which industries the<br />

vendors sell their TMS products.<br />

It does not come as a surprise that