Sparinvest SICAV Semi Annual Report 2010 R.C.S. Luxembourg B ...

Sparinvest SICAV Semi Annual Report 2010 R.C.S. Luxembourg B ...

Sparinvest SICAV Semi Annual Report 2010 R.C.S. Luxembourg B ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

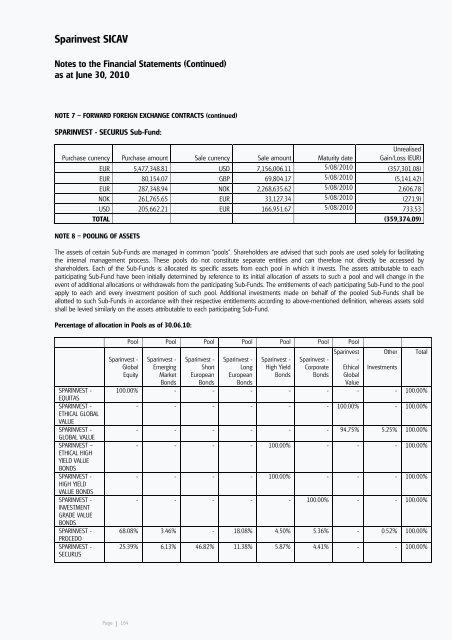

<strong>Sparinvest</strong> <strong>SICAV</strong><br />

Notes to the Financial Statements (Continued)<br />

as at June 30, <strong>2010</strong><br />

NOTE 7 – FORWARD FOREIGN EXCHANGE CONTRACTS (continued)<br />

SPARINVEST - SECURUS Sub-Fund:<br />

Purchase currency Purchase amount Sale currency Sale amount Maturity date<br />

Unrealised<br />

Gain/Loss (EUR)<br />

EUR 5,477,348.81 USD 7,156,006.11 5/08/<strong>2010</strong> (357,301.08)<br />

EUR 80,154.07 GBP 69,804.17 5/08/<strong>2010</strong> (5,141.42)<br />

EUR 287,348.94 NOK 2,268,635.62 5/08/<strong>2010</strong> 2,606.78<br />

NOK 261,765.65 EUR 33,127.34 5/08/<strong>2010</strong> (271.9)<br />

USD 205,662.21 EUR 166,951.67 5/08/<strong>2010</strong> 733.53<br />

TOTAL (359,374.09)<br />

NOTE 8 – POOLING OF ASSETS<br />

The assets of certain Sub-Funds are managed in common “pools”. Shareholders are advised that such pools are used solely for facilitating<br />

the internal management process. These pools do not constitute separate entities and can therefore not directly be accessed by<br />

shareholders. Each of the Sub-Funds is allocated its specific assets from each pool in which it invests. The assets attributable to each<br />

participating Sub-Fund have been initially determined by reference to its initial allocation of assets to such a pool and will change in the<br />

event of additional allocations or withdrawals from the participating Sub-Funds. The entitlements of each participating Sub-Fund to the pool<br />

apply to each and every investment position of such pool. Additional investments made on behalf of the pooled Sub-Funds shall be<br />

allotted to such Sub-Funds in accordance with their respective entitlements according to above-mentioned definition, whereas assets sold<br />

shall be levied similarly on the assets attributable to each participating Sub-Fund.<br />

Percentage of allocation in Pools as of 30.06.10:<br />

SPARINVEST -<br />

EQUITAS<br />

SPARINVEST -<br />

ETHICAL GLOBAL<br />

VALUE<br />

SPARINVEST -<br />

GLOBAL VALUE<br />

SPARINVEST –<br />

ETHICAL HIGH<br />

YIELD VALUE<br />

BONDS<br />

SPARINVEST -<br />

HIGH YIELD<br />

VALUE BONDS<br />

SPARINVEST -<br />

INVESTMENT<br />

GRADE VALUE<br />

BONDS<br />

SPARINVEST -<br />

PROCEDO<br />

SPARINVEST -<br />

SECURUS<br />

Pool Pool Pool Pool Pool Pool Pool<br />

<strong>Sparinvest</strong> Other Total<br />

<strong>Sparinvest</strong> - <strong>Sparinvest</strong> - <strong>Sparinvest</strong> - <strong>Sparinvest</strong> - <strong>Sparinvest</strong> - <strong>Sparinvest</strong> - -<br />

Global Emerging Short Long High Yield Corporate Ethical Investments<br />

Equity Market European European Bonds Bonds Global<br />

Bonds Bonds Bonds<br />

Value<br />

100.00% - - - - - - - 100.00%<br />

Page I 164<br />

- - - - - - 100.00% - 100.00%<br />

- - - - - - 94.75% 5.25% 100.00%<br />

- - - - 100.00% - - - 100.00%<br />

- - - - 100.00% - - - 100.00%<br />

- - - - - 100.00% - - 100.00%<br />

68.08% 3.46% - 18.08% 4.50% 5.36% - 0.52% 100.00%<br />

25.39% 6.13% 46.82% 11.38% 5.87% 4.41% - - 100.00%

![Prospectus Simplifié daté de [Mars] 2005](https://img.yumpu.com/18875582/1/190x245/prospectus-simplifie-date-de-mars-2005.jpg?quality=85)