fakultas ekonomi dan bisnis universitas hasanuddin makassar 2012

fakultas ekonomi dan bisnis universitas hasanuddin makassar 2012

fakultas ekonomi dan bisnis universitas hasanuddin makassar 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BAB V<br />

ANALISIS DAN PEMBAHASAN<br />

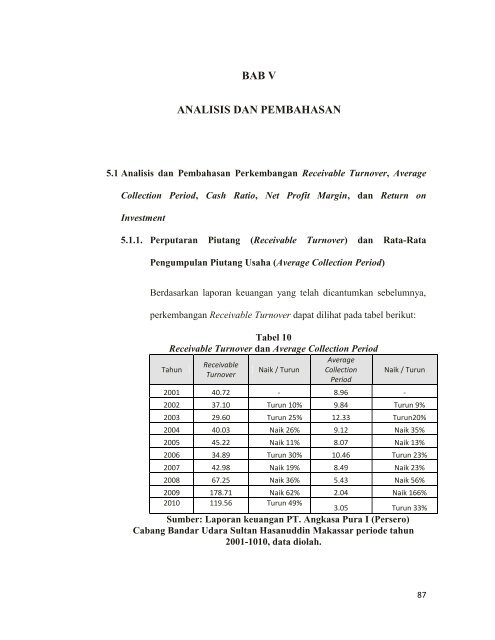

5.1 Analisis <strong>dan</strong> Pembahasan Perkembangan Receivable Turnover, Average<br />

Collection Period, Cash Ratio, Net Profit Margin, <strong>dan</strong> Return on<br />

Investment<br />

5.1.1. Perputaran Piutang (Receivable Turnover) <strong>dan</strong> Rata-Rata<br />

Pengumpulan Piutang Usaha (Average Collection Period)<br />

Berdasarkan laporan keuangan yang telah dicantumkan sebelumnya,<br />

perkembangan Receivable Turnover dapat dilihat pada tabel berikut:<br />

Tabel 10<br />

Receivable Turnover <strong>dan</strong> Average Collection Period<br />

Tahun<br />

Receivable<br />

Turnover<br />

Naik / Turun<br />

Average<br />

Collection<br />

Period<br />

Naik / Turun<br />

2001 40.72 - 8.96 -<br />

2002 37.10 Turun 10% 9.84 Turun 9%<br />

2003 29.60 Turun 25% 12.33 Turun20%<br />

2004 40.03 Naik 26% 9.12 Naik 35%<br />

2005 45.22 Naik 11% 8.07 Naik 13%<br />

2006 34.89 Turun 30% 10.46 Turun 23%<br />

2007 42.98 Naik 19% 8.49 Naik 23%<br />

2008 67.25 Naik 36% 5.43 Naik 56%<br />

2009 178.71 Naik 62% 2.04 Naik 166%<br />

2010 119.56 Turun 49%<br />

3.05 Turun 33%<br />

Sumber: Laporan keuangan PT. Angkasa Pura I (Persero)<br />

Cabang Bandar Udara Sultan Hasanuddin Makassar periode tahun<br />

2001-1010, data diolah.<br />

87