Laporan Tahunan 2011 - Commonwealth Bank

Laporan Tahunan 2011 - Commonwealth Bank

Laporan Tahunan 2011 - Commonwealth Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

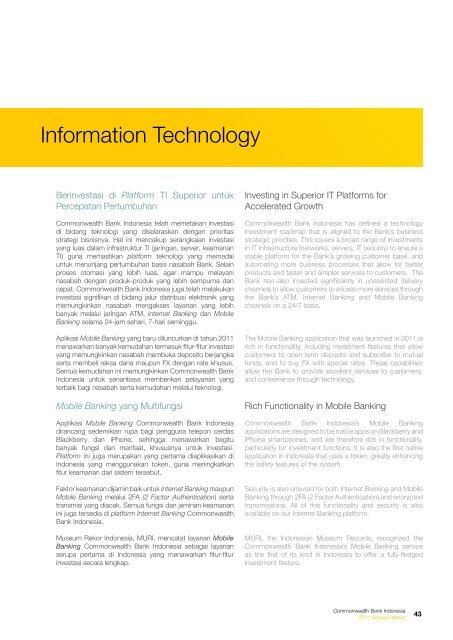

Information Technology<br />

Berinvestasi di Platform TI Superior untuk<br />

Percepatan Pertumbuhan<br />

<strong>Commonwealth</strong> <strong>Bank</strong> Indonesia telah memetakan investasi<br />

di bidang teknologi yang diselaraskan dengan prioritas<br />

strategi bisnisnya. Hal ini mencakup serangkaian investasi<br />

yang luas dalam infrastruktur TI (jaringan, server, keamanan<br />

TI) guna memastikan platform teknologi yang memadai<br />

untuk menunjang pertumbuhan basis nasabah <strong>Bank</strong>. Selain<br />

proses otomasi yang lebih luas, agar mampu melayani<br />

nasabah dengan produk-produk yang lebih sempurna dan<br />

cepat. <strong>Commonwealth</strong> <strong>Bank</strong> Indonesia juga telah melakukan<br />

investasi signifikan di bidang jalur distribusi elektronik yang<br />

memungkinkan nasabah mengakses layanan yang lebih<br />

banyak melalui jaringan ATM, Internet <strong>Bank</strong>ing dan Mobile<br />

<strong>Bank</strong>ing selama 24-jam sehari, 7-hari seminggu.<br />

Aplikasi Mobile <strong>Bank</strong>ing yang baru diluncurkan di tahun <strong>2011</strong><br />

menawarkan banyak kemudahan termasuk fitur-fitur investasi<br />

yang memungkinkan nasabah membuka deposito berjangka<br />

serta membeli reksa dana maupun FX dengan rate khusus.<br />

Semua kemudahan ini memungkinkan <strong>Commonwealth</strong> <strong>Bank</strong><br />

Indonesia untuk senantiasa memberikan pelayanan yang<br />

terbaik bagi nasabah serta kemudahan melalui teknologi.<br />

Mobile <strong>Bank</strong>ing yang Multifungsi<br />

Applikasi Mobile <strong>Bank</strong>ing <strong>Commonwealth</strong> <strong>Bank</strong> Indonesia<br />

dirancang sedemikian rupa bagi pengguna telepon cerdas<br />

Blackberry dan iPhone, sehingga menawarkan begitu<br />

banyak fungsi dan manfaat, khususnya untuk investasi.<br />

Platform ini juga merupakan yang pertama diaplikasikan di<br />

Indonesia yang menggunakan token, guna meningkatkan<br />

fitur keamanan dari sistem tersebut.<br />

Faktor keamanan dijamin baik untuk Internet <strong>Bank</strong>ing maupun<br />

Mobile <strong>Bank</strong>ing melalui 2FA (2 Factor Authentication) serta<br />

transmisi yang diacak. Semua fungsi dan jaminan keamanan<br />

ini juga tersedia di platform Internet <strong>Bank</strong>ing <strong>Commonwealth</strong><br />

<strong>Bank</strong> Indonesia.<br />

Museum Rekor Indonesia, MURI, mencatat layanan Mobile<br />

<strong>Bank</strong>ing <strong>Commonwealth</strong> <strong>Bank</strong> Indonesia sebagai layanan<br />

serupa pertama di Indonesia yang menawarkan fitur-fitur<br />

investasi secara lengkap.<br />

Investing in Superior IT Platforms for<br />

Accelerated Growth<br />

<strong>Commonwealth</strong> <strong>Bank</strong> Indonesia has defined a technology<br />

investment roadmap that is aligned to the <strong>Bank</strong>’s business<br />

strategic priorities. This covers a broad range of investments<br />

in IT infrastructure (networks, servers, IT security) to ensure a<br />

stable platform for the <strong>Bank</strong>’s growing customer base, and<br />

automating more business processes that allow for better<br />

products and faster and simpler services to customers. The<br />

<strong>Bank</strong> has also invested significantly in unassisted delivery<br />

channels to allow customers to access more services through<br />

the <strong>Bank</strong>’s ATM, Internet <strong>Bank</strong>ing and Mobile <strong>Bank</strong>ing<br />

channels on a 24/7 basis.<br />

The Mobile <strong>Bank</strong>ing application that was launched in <strong>2011</strong> is<br />

rich in functionality, including investment features that allow<br />

customers to open term deposits and subscribe to mutual<br />

funds, and to buy FX with special rates. These capabilities<br />

allow the <strong>Bank</strong> to provide excellent services to customers,<br />

and convenience through technology.<br />

Rich Functionality in Mobile <strong>Bank</strong>ing<br />

<strong>Commonwealth</strong> <strong>Bank</strong> Indonesia’s Mobile <strong>Bank</strong>ing<br />

applications are designed to be native apps on Blackberry and<br />

iPhone smartphones, and are therefore rich in functionality,<br />

particularly for investment functions. It is also the first native<br />

application in Indonesia that uses a token, greatly enhancing<br />

the safety features of the system.<br />

Security is also ensured for both Internet <strong>Bank</strong>ing and Mobile<br />

<strong>Bank</strong>ing through 2FA (2 Factor Authentication) and encrypted<br />

transmissions. All of this functionality and security is also<br />

available on our Internet <strong>Bank</strong>ing platform.<br />

MURI, the Indonesian Museum Records, recognized the<br />

<strong>Commonwealth</strong> <strong>Bank</strong> Indonesia’s Mobile <strong>Bank</strong>ing service<br />

as the first of its kind in Indonesia to offer a fully-fledged<br />

investment feature.<br />

<strong>Commonwealth</strong> <strong>Bank</strong> Indonesia<br />

<strong>2011</strong> Annual Report<br />

43