Audited Financial Report - PT SMART Tbk

Audited Financial Report - PT SMART Tbk

Audited Financial Report - PT SMART Tbk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>PT</strong> SINAR MAS AGRO RESOURCES<br />

AND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAAN<br />

Catatan atas Laporan Keuangan Konsolidasi<br />

31 Desember 2005 dan 2004 serta untuk Tahun-tahun<br />

yang Berakhir pada Tanggal Tersebut<br />

<strong>PT</strong> SINAR MAS AGRO RESOURCES<br />

AND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIES<br />

Notes to Consolidated <strong>Financial</strong> Statements<br />

December 31, 2005 and 2004 and<br />

For the Years then Ended<br />

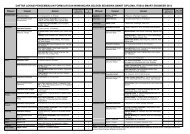

11. Aktiva Tetap (Lanjutan) 11. Property, Plant and Equiment (Continued)<br />

Beban penyusutan hak atas tanah merupakan<br />

beban amortisasi goodwill yang berasal dari<br />

perbedaan antara nilai wajar aktiva bersih dan<br />

nilai tercatat perolehanan aktiva anak<br />

perusahaan yang diakuisisi.<br />

Pengurangan aktiva tetap terutama merupakan<br />

penjualan/penghapusan peralatan dan<br />

perlengkapan kantor, kendaraan dan alat berat<br />

dengan rincian sebagai berikut:<br />

Depreciation expense of landrights pertains to<br />

the amortization of goodwill arising from the<br />

difference between the fair value and the<br />

Company’s shares in the book value of the net<br />

assets acquired.<br />

Deductions in property, plant and equipment<br />

mainly represent sale/disposal of office furniture<br />

and fixtures and transportation equipment with<br />

the following details:<br />

2005 2004<br />

Rp<br />

Rp<br />

Harga jual 30.863.515.784 5.695.016.777 Selling price<br />

Nilai buku 24.793.353.093 6.615.749.999 Net book value<br />

Laba (rugi) penjualan dan penghapusan<br />

Gain (loss) on sale and disposal of property,<br />

aktiva tetap 6.070.162.691 (920.733.222) plant and equipment<br />

Aktiva tetap dalam penyelesaian pada tanggal<br />

31 Desember 2005 dan 2004 sebagai berikut:<br />

The details of construction in progress as of<br />

December 31, 2005 and 2004 are as follows:<br />

2005 2004<br />

Rp<br />

Rp<br />

Mesin dan tangki 107.744.783.341 42.646.681.936 Machinery and storage tanks<br />

Bangunan 49.306.781.448 47.567.699.419 Buildings<br />

Prasarana jalan dan jembatan 10.808.152.040 10.468.179.222 Land improvements and bridges<br />

Jumlah 167.859.716.829 100.682.560.577 Total<br />

Persentase penyelesaian aktiva tetap masingmasing<br />

sebesar 5% sampai 95% per<br />

31 Desember 2005 dan 2 % sampai 99 % per<br />

31 Desember 2004. Estimasi penyelesaian aktiva<br />

tetap dalam penyelesaian per<br />

31 Desember 2005 dijadwalkan antara bulan<br />

Januari 2006 sampai dengan Desember 2006,<br />

sedangkan per 31 Desember 2004 dijadwalkan<br />

akan selesai antara bulan Januari 2005 sampai<br />

dengan Desember 2005.<br />

Alokasi beban penyusutan sebagai berikut:<br />

Percentage of completion of construction in<br />

progress ranged from 5% to 95% as of<br />

December 31, 2005, and 2 % to 99 % as of<br />

December 31, 2004. Estimated completion of<br />

construction in progress’ estimation as of<br />

December 31, 2005 is scheduled between<br />

January 2006 to December 2006, whereas, as of<br />

December 31, 2004 the estimated completion is<br />

scheduled between January 2005 to December<br />

2005.<br />

Allocation of depreciation expense as follows:<br />

2005 2004<br />

Rp<br />

Rp<br />

Biaya produksi 60.842.160.207 52.569.465.209 Manufacturing costs<br />

Penjualan 1.233.479.478 964.732.693 Selling<br />

Umum dan administrasi 21.656.981.596 18.823.332.845 General and administrative<br />

Lain-lain - 753.129.216 Miscellaneous<br />

Jumlah 83.732.621.281 73.110.659.963 Total<br />

- 46 -