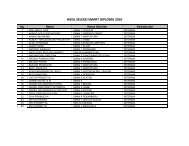

Audited Financial Report - PT SMART Tbk

Audited Financial Report - PT SMART Tbk

Audited Financial Report - PT SMART Tbk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

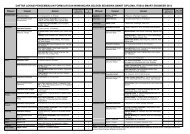

<strong>PT</strong> SINAR MAS AGRO RESOURCES AND TECHNOLOGY <strong>Tbk</strong><br />

<strong>PT</strong> SINAR MAS AGRO RESOURCES AND TECHNOLOGY <strong>Tbk</strong><br />

DAN ANAK PERUSAHAAN<br />

AND ITS SUBSIDIARIES<br />

Neraca Konsolidasi<br />

Consolidated Balance Sheets<br />

31 Desember 2005 dan 2004 (Lanjutan) December 31, 2005 and 2004 (Continued)<br />

Catatan/<br />

2005 Notes 2004<br />

Rp<br />

Rp<br />

KEWAJIBAN DAN EKUITAS<br />

LIABILITIES AND EQUITY<br />

KEWAJIBAN LANCAR<br />

CURRENT LIABILITIES<br />

Hutang bank jangka pendek 253.614.000.000 2c,15,32 - Short-term bank loans<br />

Hutang usaha 2c,16,32 Trade accounts payable<br />

Pihak yang mempunyai hubungan istimewa 279.013.905.109 2d,31b 234.568.730.002 Related parties<br />

Pihak ketiga 152.853.150.178 148.635.881.293 Third parties<br />

Hutang lain-lain 2c,32 Other payables<br />

Pihak yang mempunyai hubungan istimewa 24.575.000.000 2d,31g 28.325.000.000 Related parties<br />

Pihak ketiga 26.898.349.961 34.262.393.047 Third parties<br />

Uang muka pelanggan 2c,32,33e Advances from customers<br />

Pihak yang mempunyai hubungan istimewa - 2d,31h 93.966.032.145 Related parties<br />

Pihak ketiga 35.304.420.130 17.754.906.145 Third parties<br />

Biaya yang masih harus dibayar 72.337.660.396 2c,2d,31g,31i,32 64.281.917.094 Accrued expenses<br />

Hutang pajak 13.466.355.307 2x,17 7.155.095.312 Taxes payables<br />

Bagian hutang jangka panjang yang akan jatuh<br />

tempo dalam waktu satu tahun 172.485.625.065 2c,18,32 96.484.340.186 Current maturities of long-term debts<br />

JUMLAH KEWAJIBAN LANCAR 1.030.548.466.146 725.434.295.224 TOTAL CURRENT LIABILITIES<br />

KEWAJIBAN TIDAK LANCAR<br />

NONCURRENT LIABILITIES<br />

Kewajiban pajak tangguhan - bersih 107.119.160.876 2x,29 170.331.385.376 Deferred tax liabilities - net<br />

Cadangan imbalan pasti pasca-kerja 47.279.804.923 2w,28 45.143.321.000 Defined-benefit post-employment reserve<br />

Uang muka pelanggan - pihak yang mempunyai<br />

hubungan istimewa - 2c,2d,31h,32 821.179.858.300 Advances from customer - related party<br />

Hutang jangka panjang - setelah dikurangi bagian<br />

yang akan jatuh tempo dalam waktu satu tahun 400.929.415.812 2c,18,32 457.576.086.127 Long-term debts - net of current maturities<br />

Hutang kepada pihak yang mempunyai hubungan<br />

istimewa 1.082.290.455.631 2c,2d,31g,32 1.664.978.673.436 Due to related parties<br />

Hutang sub-ordinasi - 2c,19,32 436.630.000.000 Subordinated loan<br />

JUMLAH KEWAJIBAN TIDAK LANCAR 1.637.618.837.242 3.595.839.324.239 TOTAL NONCURRENT LIABILITIES<br />

KELEBIHAN BAGIAN RUGI BERSIH<br />

EXCESS OF EQUITY IN NET<br />

PERUSAHAAN ASOSIASI ATAS<br />

LOSSES OF AN ASSOCIATE<br />

BIAYA PEROLEHAN 479.269.466 2l,9 - OVER COST<br />

HAK MINORITAS ATAS AKTIVA<br />

MINORITY INTEREST IN NET<br />

BERSIH ANAK PERUSAHAAN 10.000.000 2b,20 10.000.000 ASSETS OF A SUBSIDIARY<br />

EKUITAS<br />

EQUITY<br />

Modal Saham - nilai nominal Rp 200 per saham<br />

Capital Stock - Rp 200 par value in 2005 and<br />

tahun 2005 dan Rp 1.000 per saham tahun 2004 Rp 1,000 par value in 2004<br />

Modal dasar - 5.000.000.000 saham tahun 2005 Authorized - 5,000,000,000 shares in 2005<br />

dan 1.000.000.000 saham tahun 2004 and 1,000,000,000 shares in 2004<br />

Modal ditempatkan dan disetor Issued and fully paid - 2,872,193,366<br />

penuh - 2.872.193.366 saham tahun 2005<br />

shares in 2005 and 297,360,000 shares<br />

dan 297.360.000 saham tahun 2004 574.438.673.200 21,22 297.360.000.000 in 2004<br />

Tambahan modal disetor 1.662.472.039.200 22 - Additional paid-in capital<br />

Selisih kurs penjabaran 116.703.860.204 2a,9 107.540.732.278 Difference in foreign currency translation<br />

Selisih transaksi perubahan ekuitas<br />

Difference arising from changes in subsidiaries'<br />

anak perusahaan 24.703.013.824 11 17.208.560.616 equity<br />

Selisih transaksi perubahan ekuitas<br />

Difference arising from changes in associated<br />

perusahaan asosiasi 26.467.936.017 2l,9 9.710.073.443 companies' equity<br />

Selisih nilai transaksi restrukturisasi entitas<br />

Difference arising from restructuring transactions<br />

sepengendali (11.987.787.393) 2o (11.987.787.393) of entities under common control<br />

Defisit (464.227.354.511) (768.430.702.867) Deficit<br />

JUMLAH EKUITAS 1.928.570.380.541 (348.599.123.923) TOTAL EQUITY<br />

JUMLAH KEWAJIBAN DAN EKUITAS 4.597.226.953.395 3.972.684.495.540 TOTAL LIABILITIES AND EQUITY<br />

Lihat catatan atas laporan keuangan konsolidasi yang merupakan bagian<br />

yang tidak terpisahkan dari laporan keuangan konsolidasi.<br />

See accompanying notes to consolidated financial statements which are<br />

an integral part of the consolidated financial statements.<br />

- 4 -