Audited Financial Report - PT SMART Tbk

Audited Financial Report - PT SMART Tbk

Audited Financial Report - PT SMART Tbk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>PT</strong> SINAR MAS AGRO RESOURCES<br />

AND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAAN<br />

Catatan atas Laporan Keuangan Konsolidasi<br />

31 Desember 2005 dan 2004 serta untuk Tahun-tahun<br />

yang Berakhir pada Tanggal Tersebut<br />

<strong>PT</strong> SINAR MAS AGRO RESOURCES<br />

AND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIES<br />

Notes to Consolidated <strong>Financial</strong> Statements<br />

December 31, 2005 and 2004 and<br />

For the Years then Ended<br />

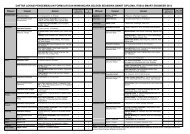

11. Aktiva Tetap (Lanjutan) 11. Property, Plant and Equiment (Continued)<br />

Tangki, bangunan, mesin dan peralatan, perabot<br />

dan peralatan kantor serta kendaraan<br />

diasuransikan kepada <strong>PT</strong> Asuransi Sinar Mas,<br />

pihak yang mempunyai hubungan istimewa<br />

(Catatan 31c), terhadap risiko kebakaran dan<br />

risiko lainnya berdasarkan suatu paket polis<br />

dengan jumlah pertanggungan masing-masing<br />

sebesar Rp 2.351.892.475.076 dan<br />

US$ 10.423.978 pada tanggal<br />

31 Desember 2005 dan Rp 1.405.973.848.628<br />

dan US$ 41.322.478 pada tanggal 31 Desember<br />

2004. Manajemen berpendapat bahwa nilai<br />

pertanggungan tersebut cukup untuk menutup<br />

kemungkinan kerugian atas aktiva yang<br />

dipertanggungkan.<br />

Manajemen berpendapat bahwa nilai tercatat<br />

semua aktiva Grup dapat terealisasi seluruhnya<br />

dan oleh karena itu, tidak diperlukan cadangan<br />

penurunan nilai aktiva, kecuali untuk beberapa<br />

anak perusahaan yang melakukan<br />

penggabungan usaha, sebagaimana dijelaskan di<br />

bawah ini.<br />

Sehubungan dengan penggabungan usaha dari<br />

beberapa anak perusahaan (Catatan 3) revaluasi<br />

aktiva tetap termasuk tanaman perkebunan<br />

dilakukan pada tahun 2005 dan 2004 oleh anak<br />

perusahaan tersebut, antara lain:<br />

• Revaluasi PRATITA dan BULUNGAN<br />

dilakukan oleh <strong>PT</strong> Asian Appraisal<br />

Indonesia, penilai independen, berdasarkan<br />

nilai pasar aktiva tersebut berdasarkan<br />

kelanjutan dari penggunaan yang ada yang<br />

berlaku pada tanggal 30 September 2005<br />

yang mengakibatkan peningkatan nilai<br />

sebesar Rp 8.796.141.171 pada aktiva<br />

tertentu (disajikan sebagai bagian dari<br />

“Selisih Transaksi Perubahan Ekuitas Anak<br />

Perusahaan” di bagian ekuitas dalam<br />

neraca konsolidasi sebesar<br />

Rp 7.494.453.208 setelah penyesuaian<br />

pajak tangguhan sebesar<br />

Rp 1.382.906.351) dan penurunan nilai<br />

sebesar Rp 81.218.388 pada aktiva tertentu<br />

(disajikan sebagai “Rugi Penurunan Nilai<br />

Aktiva Tetap” di bagian Penghasilan<br />

(Beban) Lain-lain dalam laporan laba rugi<br />

konsolidasi.<br />

• Revaluasi IGM dilakukan oleh <strong>PT</strong> Asian<br />

Appraisal Indonesia, penilai independen,<br />

berdasarkan nilai pasar aktiva tersebut yang<br />

berlaku pada tanggal 30 Juni 2004.<br />

Storage tanks, buildings, machinery and<br />

equipment, office furniture and fixtures and<br />

transportation equipment are insured with<br />

<strong>PT</strong> Asuransi Sinar Mas, a related party<br />

(Note 31c), against losses from fire and other<br />

risks under blanket policies with insurance<br />

coverage totaling Rp 2,351,892,475,076 and<br />

US$ 10,423,978 as of December 31, 2005 and<br />

Rp 1,405,973,848,628 and US$ 41,322,478 as of<br />

December 31, 2004, which in management’s<br />

opinion is adequate to cover possible losses from<br />

such risks.<br />

Management is of the opinion that the carrying<br />

value of all assets of the Group are fully<br />

recoverable, and hence, no write-down for<br />

impairment in asset value is necessary, except<br />

for certain subsidiaries which were affected by<br />

the merger as discussed below.<br />

With respect to the merger of certain subsidiaries<br />

(Note 3), revaluation of property, plant and<br />

equipment was conducted in 2005 and 2004 for<br />

those subsidiaries, as follows:<br />

• Revaluation of PRATITA and BULUNGAN<br />

was conducted by <strong>PT</strong> Asian Appraisal<br />

Indonesia, an independent appraiser, based<br />

on market value as of September 30, 2005,<br />

of the assuming continuance of existing<br />

usage of its assets which resulted to an<br />

increase in value of Rp 8,796,141,171 on<br />

certain assets (recognized as part of<br />

“Difference Arising from Changes in<br />

Subsidiaries’ Equity” in the equity section<br />

consolidated balance sheets which<br />

amounted to Rp 7,494,453,208 after<br />

adjustment of deferred tax of<br />

Rp 1,382,906,351) and a decrease in value<br />

of Rp 81,218,388 on certain assets<br />

(recognized as “Loss on Impairment of<br />

Property, Plant and Equipment” under<br />

Other Income (Charges) section under in<br />

the consolidated statements of income.<br />

• Revaluation of IGM was conducted by<br />

<strong>PT</strong> Asian Appraisal Indonesia, an<br />

independent appraiser, based on market<br />

value as of June 30, 2004<br />

- 48 -