OBBLIGAZIONI - Il Sole 24 Ore

OBBLIGAZIONI - Il Sole 24 Ore

OBBLIGAZIONI - Il Sole 24 Ore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10<br />

www.ilsole<strong>24</strong>ore.com/indicienumeri<br />

Martedì 14 Agosto 2012<br />

N. 2<strong>24</strong><br />

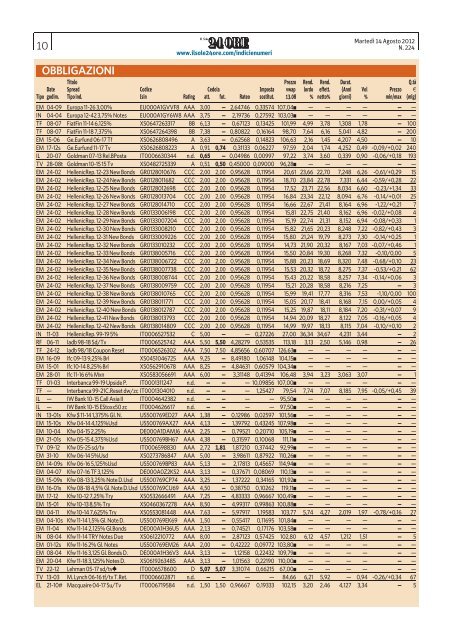

<strong>OBBLIGAZIONI</strong><br />

Titolo Prezzo Rend. Rend. Durat. Q.tà<br />

Date Spread Codice Cedola Imposta vwap lordo effett. (Anni Vol Prezzo #<br />

Tipo godim. Tipo ind. Isin Rating att. fut. Rateo sostitut. 13.08 % netto% giorni) % min/max (mlg)<br />

EM 04-09 Europa 11-26 3,00% EU000A1GVVF8 AAA 3,00 — 2,64746 0,33574 107,041 — — — — — —<br />

IN 04-04 Europa 12-42 3,75% Notes EU000A1GY6W8 AAA 3,75 — 2,19736 0,27592 103,031 — — — — — —<br />

TF 08-07 FiatFin 11-14 6,125% XS0647263317 BB 6,13 — 0,67123 0,13425 101,99 4,99 3,78 1,308 1,78 — 100<br />

TF 08-07 FiatFin 11-18 7,375% XS0647264398 BB 7,38 — 0,80822 0,16164 98,70 7,64 6,16 5,041 4,82 — 200<br />

EM 15-06 Ge.Eurfund 06-17 Tf XS0626808496 A 3,63 — 0,62568 0,14823 106,63 2,16 1,45 4,207 4,50 — 10<br />

EM 17-12s Ge.Eurfund 11-17 Tv XS0626808223 A 0,91 0,74 0,31133 0,06227 97,59 2,04 1,74 4,252 0,49 -0,09/+0,02 <strong>24</strong>0<br />

IL 20-07 Goldman 07-13 Rel.BPosta IT0006630344 n.d. 0,65 — 0,04986 0,00997 97,22 3,74 3,60 0,339 0,90 -0,06/+0,18 193<br />

TV 28-08t Goldman 10-15 15 Tv XS0482725339 A 0,51 0,50 0,45000 0,09000 96,281 — — — — — —<br />

EM <strong>24</strong>-02 HellenicRep. 12-23 New Bonds GR0128010676 CCC 2,00 2,00 0,95628 0,11954 20,61 23,66 22,70 7,<strong>24</strong>8 6,26 -0,61/+0,29 15<br />

EM <strong>24</strong>-02 HellenicRep. 12-<strong>24</strong> New Bonds GR0128011682 CCC 2,00 2,00 0,95628 0,11954 18,70 23,84 22,78 7,331 6,44 -0,59/+0,28 22<br />

EM <strong>24</strong>-02 HellenicRep. 12-25 New Bonds GR0128012698 CCC 2,00 2,00 0,95628 0,11954 17,52 23,71 22,56 8,034 6,60 -0,23/+1,34 33<br />

EM <strong>24</strong>-02 HellenicRep. 12-26 New Bonds GR0128013704 CCC 2,00 2,00 0,95628 0,11954 16,84 23,34 22,12 8,094 6,76 -0,14/+0,01 25<br />

EM <strong>24</strong>-02 HellenicRep. 12-27 New Bonds GR0128014710 CCC 2,00 2,00 0,95628 0,11954 16,66 22,67 21,41 8,164 6,96 -1,22/+0,21 7<br />

EM <strong>24</strong>-02 HellenicRep. 12-28 New Bonds GR0133006198 CCC 2,00 2,00 0,95628 0,11954 15,81 22,75 21,40 8,162 6,96 -0,02/+0,08 4<br />

EM <strong>24</strong>-02 HellenicRep. 12-29 New Bonds GR0133007204 CCC 2,00 2,00 0,95628 0,11954 15,19 22,74 21,31 8,152 6,94 -0,08/+0,33 1<br />

EM <strong>24</strong>-02 HellenicRep. 12-30 New Bonds GR0133008210 CCC 2,00 2,00 0,95628 0,11954 15,82 21,65 20,23 8,<strong>24</strong>8 7,22 -0,82/+0,43 3<br />

EM <strong>24</strong>-02 HellenicRep. 12-31 New Bonds GR0133009226 CCC 2,00 2,00 0,95628 0,11954 15,80 21,<strong>24</strong> 19,79 8,273 7,30 -0,14/+0,25 1<br />

EM <strong>24</strong>-02 HellenicRep. 12-32 New Bonds GR0133010232 CCC 2,00 2,00 0,95628 0,11954 14,73 21,90 20,32 8,167 7,03 -0,07/+0,46 1<br />

EM <strong>24</strong>-02 HellenicRep. 12-33 New Bonds GR0138005716 CCC 2,00 2,00 0,95628 0,11954 15,50 20,84 19,30 8,268 7,32 -0,10/0,00 5<br />

EM <strong>24</strong>-02 HellenicRep. 12-34 New Bonds GR0138006722 CCC 2,00 2,00 0,95628 0,11954 15,88 20,23 18,69 8,320 7,48 -0,68/+0,10 23<br />

EM <strong>24</strong>-02 HellenicRep. 12-35 New Bonds GR0138007738 CCC 2,00 2,00 0,95628 0,11954 15,53 20,32 18,72 8,275 7,37 -0,53/+0,21 62<br />

EM <strong>24</strong>-02 HellenicRep. 12-36 New Bonds GR0138008744 CCC 2,00 2,00 0,95628 0,11954 15,43 20,22 18,58 8,257 7,34 -0,14/+0,06 3<br />

EM <strong>24</strong>-02 HellenicRep. 12-37 New Bonds GR0138009759 CCC 2,00 2,00 0,95628 0,11954 15,21 20,28 18,58 8,216 7,25 — 3<br />

EM <strong>24</strong>-02 HellenicRep. 12-38 New Bonds GR0138010765 CCC 2,00 2,00 0,95628 0,11954 15,99 19,41 17,77 8,316 7,53 -1,10/0,00 100<br />

EM <strong>24</strong>-02 HellenicRep. 12-39 New Bonds GR0138011771 CCC 2,00 2,00 0,95628 0,11954 15,05 20,17 18,41 8,168 7,15 0,00/+0,05 4<br />

EM <strong>24</strong>-02 HellenicRep. 12-40 New Bonds GR0138012787 CCC 2,00 2,00 0,95628 0,11954 15,25 19,87 18,11 8,184 7,20 -0,31/+0,07 9<br />

EM <strong>24</strong>-02 HellenicRep. 12-41 New Bonds GR0138013793 CCC 2,00 2,00 0,95628 0,11954 14,94 20,09 18,27 8,122 7,05 -0,16/+0,05 4<br />

EM <strong>24</strong>-02 HellenicRep. 12-42 New Bonds GR0138014809 CCC 2,00 2,00 0,95628 0,11954 14,99 19,97 18,13 8,115 7,04 -0,10/+0,10 2<br />

IN 11-03 HellenicRep. 99-19 5% IT0006527532 C 5,00 — — 0,27226 27,00 36,34 34,67 4,231 3,44 — 2<br />

RF 06-11 Iadb 98-18 Sd/Tv IT0006525742 AAA 5,50 5,50 4,28279 0,53535 113,18 3,13 2,50 5,146 0,98 — 26<br />

TF <strong>24</strong>-12 Iadb 98/18 Coupon Reset IT0006526302 AAA 7,50 7,50 4,85656 0,60707 126,631 — — — — — —<br />

EM 16-09 Ifc 09-13 9,25% Brl XS0451046725 AAA 9,25 — 8,49180 1,06148 104,151 — — — — — —<br />

EM 15-01 Ifc 10-14 8,25% Brl XS0562910678 AAA 8,25 — 4,84631 0,60579 104,341 — — — — — —<br />

EM 28-01 Ifc 11-16 6% Mxn XS0583056691 AAA 6,00 — 3,31148 0,41394 106,48 3,94 3,23 3,063 3,07 — 1<br />

TF 01-03 Interbanca 99-19 Upside P. IT0001311<strong>24</strong>7 n.d. — — — 10,09856 107,001 — — — — — —<br />

TF — Interbanca 99-21C.Reset dw/zc IT0001304010 n.d. — — — 1,25427 79,54 7,74 7,07 8,185 7,95 -0,05/+0,45 39<br />

IL — IW Bank 10-15 Call Asia II IT0004642382 n.d. — — — — 95,501 — — — — — —<br />

IL — IW Bank 10-15 EStoxx50 zc IT0004626617 n.d. — — — — 97,501 — — — — — —<br />

IN 13-01s Kfw $ 11-14 1,375% Gl. N. US500769ED27 AAA 1,38 — 0,12986 0,02597 101,561 — — — — — —<br />

EM 15-10s Kfw 04-14 4,125%Usd US500769AX27 AAA 4,13 — 1,39792 0,43<strong>24</strong>5 107,981 — — — — — —<br />

EM 10-04 Kfw 04-15 2,25% DE000A1DAMJ6 AAA 2,25 — 0,79521 0,20710 105,191 — — — — — —<br />

EM 21-01s Kfw 05-15 4,375%Usd US500769BH67 AAA 4,38 — 0,31597 0,10068 111,111 — — — — — —<br />

TV 09-12 Kfw 05-25 sd/tv IT0006598830 AAA 2,72 1,81 1,87210 0,37442 92,991 — — — — — —<br />

EM 31-10 Kfw 06-14 5%Usd XS0273786847 AAA 5,00 — 3,98611 0,87922 110,261 — — — — — —<br />

EM 14-09s Kfw 06-16 5,125%Usd US500769BP83 AAA 5,13 — 2,17813 0,45657 114,941 — — — — — —<br />

EM 04-07 Kfw 07-16 TF 3,125% DE000A0Z2KS2 AAA 3,13 — 0,37671 0,08069 110,131 — — — — — —<br />

EM 15-09s Kfw 08-13 3,25% Note D.Usd US500769CP74 AAA 3,25 — 1,37222 0,34165 101,921 — — — — — —<br />

EM 16-01s Kfw 08-18 4,5% Gl. Note D.Usd US500769CU69 AAA 4,50 — 0,38750 0,10262 119,111 — — — — — —<br />

EM 17-12 Kfw 10-12 7,25% Try XS0532666491 AAA 7,25 — 4,83333 0,96667 100,491 — — — — — —<br />

EM 15-01 Kfw 10-13 8,5% Try XS0460367278 AAA 8,50 — 4,99317 0,99863 100,881 — — — — — —<br />

EM 04-11 Kfw 10-14 7,625% Try XS0553081448 AAA 7,63 — 5,97917 1,19583 103,77 5,74 4,27 2,019 1,97 -0,78/+0,16 27<br />

EM 04-10s Kfw 11-14 1,5% Gl. Note D. US500769EK69 AAA 1,50 — 0,55417 0,11695 101,841 — — — — — —<br />

EM 11-04 Kfw 11-14 2,125% Gl.Bonds DE000A1H36U5 AAA 2,13 — 0,74521 0,17176 103,581 — — — — — —<br />

IN 08-04 Kfw 11-14 TRY Notes Due XS0612210772 AAA 8,00 — 2,87123 0,57425 102,80 6,12 4,57 1,212 1,51 — 5<br />

EM 01-12s Kfw 11-16 2% Gl. Notes US500769EM26 AAA 2,00 — 0,42222 0,09772 103,801 — — — — — —<br />

EM 08-04 Kfw 11-16 3,125 Gl. Bonds D. DE000A1H36V3 AAA 3,13 — 1,12158 0,2<strong>24</strong>32 109,791 — — — — — —<br />

EM 20-04 Kfw 11-18 3,125% Notes D. XS0619263485 AAA 3,13 — 1,01563 0,22190 110,001 — — — — — —<br />

TV 22-12 Lehman 05-17 sd/tvY IT0006578600 D 5,07 5,07 3,31074 0,66215 67,001 — — — — — —<br />

TV 13-03 M. Lynch 06-16 tf/tv T.Ret. IT0006602871 n.d. — — — — 84,66 6,21 5,92 — 0,94 -0,26/+0,34 67<br />

EL 21-10# Macquaire 04-17 Su/Tv IT0006719584 n.d. 1,50 1,50 0,96667 0,19333 102,15 3,20 2,46 4,127 3,34 — 5