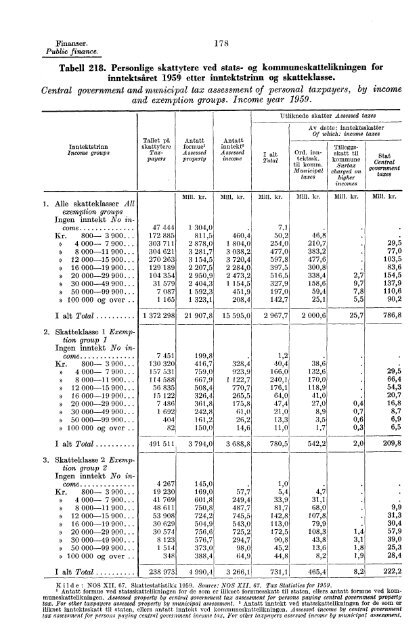

• ▪ • ▪ Finanser. 178 Public finance. Tabell 218. Personlige skattytere ved stats- og kommuneskattelikningen for inntekts taret 1959 etter inntektstrinn og skatteklasse. Central government and municipal tax assessment of personal taxpayers, by income and exemption groups. Income year 1959. Utliknede shatter Assessed taxes Inntektstrinn Income groups Tallet ph skattytere Taxpayers Antatt formue 1 A ssessed property Antatt inntekt' A ssessed income I alt Total Ord. inntektssk. til komm. Municipal taxes Av dette: inntektsskatter Of which: income taxes Tilleggsskatt til kommune Surtax charged on higher incomes Stat Central government taxes 1. Alle skatteklasser All exemption groups Ingen inntekt No income 47 444 Kr. 800- 3 900.. 172 885 a 4 000- 7 900.. 303 711 a 8 000-11 900.. 304 621 a 12 000-15 900.. 270 263 a 16 000-19 900.. 129 189 a 20 000-29 900.. . 104 354 a 30 000-49 900 31 579 a 50 000-99 900 7 087 a 100 000 og over 1 165 I alt Total 1 372 2981 2. Skatteklasse 1 Exemption group 1 Ingen inntekt No income 7 451 Kr. 800- 3 900 130 320 » 4 000- 7 900 157 531 a 8 000-11 900 114 588 a 12 000-15 900 56 835 » 16 000-19 900. • • 15 122 » 20 000-29 900. • • 7 486 » 30 000-49 900. • • 1 692 a 50 000-99 900. • • 404 a 100 000 og over 82 I alt Total S 491 511 3. Skatteklasse 2 Exemption group 2 Ingen inntekt No income 4 267 Kr. 800- 3 900 19 230 » 4 000- 7 900 41 769 a 8 000-11 900 48 611 a 12 000-15 900 53 908 » 16 000-19 900 30 629 a 20 000-29 900 30 574 » 30 000-49 900 8 123 » 50 000-99 900 1 514 a 100 000 og over 348 Mill. kr. Mill. kr. Mill. kr. Mill. kr. Mill. kr. Mill. kr. 1 304,0 . 7,1 . 811,5 460,4 50,2 46,8 . 2 878,0 1 804,0 254,0 210,7 29,5 3 281,7 3 038,2 477,0 383,2 77,0 3 154,5 3 720,4 597,8 477,6 103,5 2 207,5 2 284,0 397,5 300,8 . 83,6 2 950,9 2 473,2 516,5 338,4 2,7 154,5 2 404,3 1 154,5 327,9 158,6 9,7 137,9 1 592,3 451,9 197,0 59,4 7,8 110,6 1 323,1 208,4 142,7 25,1 5,5 90,2 21 907,8 15 595,0 2 967,7 2 000,6 25,7 786,8 199,8 . 1,2 . 416,7 328,4 40,4 38,6 759,0 923,9 166,0 132,6 29,5 667,9 1 122,7 240,1 170,0 66,4 508,4 770,7 176,1 118,9 54,3 326,4 265,5 64,0 41,0 20,7 361,8 175,8 47,4 27,0 0,4 16,8 242,8 61,0 21,0 8,9 0,7 8,7 161,2 26,2 13,3 3,5 0,6 6,9 150,0 14,6 11,0 1,7 0,3 6,5 3 794,0 3 688,8 780,5 542,2 2,0 209,8 145,0 . 1,0 . 169,0 57,7 5,4 4,7 601,8 249,4 33,9 31,1 750,8 487,7 81,7 68,0 9,9 724,2 745,5 142,8 107,8 31,3 504,9 543,0 113,0 79,9 30,4 756,6 725,2 172,5 108,3 1,4 57,9 576,7 294,7 90,8 43,8 3,1 39,0 373,0 98,0 45,2 13,6 1,8 25,3 388,4 64,9 44,8 8,2 1,9 28,4 I alt Total 238 973 4 990,4 3 266,1 731,1 465,4 8,2 222,2 Kilde : NOS XII. 67. SkattestatistikK 1959. Source: NOS XII. 67. Tax Statistics for 1959. 1 Antatt formue ved statsskattelikningen for de som er iliknet formuesskatt til staten, ellers antatt formue ved kommuneskattelikningen. Assessed property by central government tax assessment for persons paying central government property tax. For other taxpayers assessed property by municipal assessment. z Antatt inntekt ved statsskattelikningen for de som er iliknet inntektsskatt til staten, ellers antatt inntekt ved kommuneskattelikningen. Assessed income by central government tax assessment for persons paying central government income tax, For other taxpayers assessed income by municipal assessment.

17 0 Finanser. Public finance. Tabell 218 (forts.). Personlige skattytere ved scats- og kommuneskatteliknin.gen for inntektstret 1959 etter inntektstrinn og skatteklasse. Central government and municipal tax assessment of personal taxpayers - by income and exemption groups. Income year 1959. Utliknede skatter Assessed taxes Inntektstrinn Income groups 4. Skatteklasse 3 Exemption group 3 Ingen inntekt No income Kr. 800- 3 900 » 4 000- 7 900 o 8 000-11 900 o 12 000-15 900 o 16 000-19 900 o 20 000-29 900 # 30 000-49 900 o 50 000-99 900 o 100 000 og over Tallet ph skattytere Taxpayers A ntatt formue' Assessed property Mill. kr. Antatt inntekt 2 Assessed income Mill. kr. I alt Total Mill. kr. Av dette: inntektsskatter Of which: income taxes Ord. inntektssk. til komm. Municipal taxes Tilleggsskatt til kommune Surtax charged on higher incomes Stat Central government taxes Mill. kr. Mill. kr. Mill. kr. 15 389 417,1 2,1 21 264 204,3 67,3 4,1 3,3 52 459 760,7 310,7 31,8 28,0 56 686 745,6 570,3 74,2 69,7 0,7 61 650 739,6 852,1 132,1 110,7 17,4 33 229 505,9 588,0 105,0 79,1 22,9 25 423 644,7 598,6 128,3 83,6 0,6 39,7 6 775 514,0 247,4 73,0 35,1 2,2 31,0 1 257 298,2 79,7 35,4 10,6 1,4 19,7 197 208,2 33,6 22,5 3,9 0,9 14,2 I alt Total I 274 329 5 038,3 3 347,7 608,5 424,0 5,1 145,6 5. Skatteklasse 4 Exemption group 4 Ingen inntekt No income Kr. 800- 3 900.. o 4 000- 7 900.. O 8 000-11 900.. 0 12 000-15 900.. 0 16 000-19 900.. O 20 000-29 900.. 0 30 000-49 900.. 0 50 000-99 900.. 0 100 000 og over . 10 534 295,9 . 1,6 . 2 071 21,5 7,0 0,3 0,2 40 790 603,2 245,4 18,6 15,9 52 127 702,7 526,1 56,4 52,9 61 247 726,6 846,7 101,0 96,8 0,5 33 033 558,8 584,0 83,3 70,5 9,5 26 087 753,2 621,6 116,9 79,7 0,3 31,6 8 786 661,3 321,5 88,2 42,9 2,4 36,9 2 024 448,6 128,1 54,7 16,5 2,1 30,8 320 365,3 55,5 38,3 6,8 1,5 23,9 I alt Total I 237 019 5 137,1 3 335,9 559,3 382,2 6,3 133,2 6. Skatteklasse 5 og over Exemption group 5 and over Ingen inntekt No income Kr. 800- 3 900 o 4 000- 7 900 o 8 000-11 900 o 12 000-15 900 o 16 000-19 900 o 20 000-29 900 o 30 000-49 900 o 50 000-99 900 o 100 000 og over 9 803 246,2 1,2 . . . . 11 162 153,3 74,6 3,7 3,1 32 609 414,7 331,4 24,6 22,6 36 623 455,7 505,4 45,8 43,4 . 17 176 311,5 303,5 32,2 30,3 0,1 14 784 434,6 352,0 51,4 39,8 . 8,5 6 203 409,5 229,9 54,9 27,9 1,3 22,3 1 888 311,3 119,9 48,4 15,2 1,9 27,9 218 211,2 39,8 26,1 4,5 0,9 17,2 I alt Total I 130 466 2 948,0 1 288,3 186,8. 4,1 76,0 1 Jfr. note 1, foreghende side. See note 1, preceding page. 2 Jfr. note 2, foreghende side. See note 2, preceding page.

- Page 2 and 3:

Norges offisielle statistikk, rekke

- Page 4 and 5:

Standardtegn. Explanation of symbcl

- Page 6 and 7:

Preface The Statistical Yearbook of

- Page 8 and 9:

*8 Tabell Side 9. Hjemmehorende fol

- Page 10 and 11:

* 10 Tabell Side 64. Privat konsum

- Page 12 and 13:

*12 Tabell Side 117. Deltaking og g

- Page 14 and 15:

*14 Tabell Side 171. Registrerte sk

- Page 16 and 17:

*16 Tabell Side 226. Kommunenes bal

- Page 18 and 19:

*18 Tabell Side 277. Prisindeks for

- Page 20 and 21:

* 20 Tabell Side 328. Tilbakefall t

- Page 22 and 23:

*22 Tabell Side 395. Handelsflaten,

- Page 24 and 25:

*24 Side Driftsbygninger i jordbruk

- Page 26 and 27:

*26 Side Kaffe, forbruk 366 in.nfor

- Page 28 and 29:

*28 Side Rutebiler, busser 163-166,

- Page 30 and 31:

*30 Page unemployment 43 vocational

- Page 32 and 33:

*32 Page Investments .. 50, 52, 110

- Page 34 and 35:

*34 Page imports 127 production 83,

- Page 36 and 37:

Geografiske oppgaver m. v. 2 Geogra

- Page 38 and 39:

Geogr. og meteorol. oppgaver. 4 Geo

- Page 40 and 41:

Befolkning in. v. 6 Population etc.

- Page 42 and 43:

Befolkning m. v. 8 Population'_ etc

- Page 44 and 45:

Befolkning m. v. 10 Population etc.

- Page 46 and 47:

Befolkning m. v. 1. 2 Population et

- Page 48 and 49:

Befolkning In. v. 14 Population etc

- Page 50 and 51:

Befolkning m. v. 1 6 Population etc

- Page 52 and 53:

Folkemengdens bevegelse. 18 Vital s

- Page 54 and 55:

Befolkning m. v. 20 Population etc.

- Page 56 and 57:

Befolkning m. v. 92 Population etc.

- Page 58 and 59:

Befolkning m. v. 24 Population etc.

- Page 60 and 61:

,t O O O O 3 r■I Befolkning m. v.

- Page 62 and 63:

Befolkning m. v. 28 Population etc.

- Page 64 and 65:

Befolkning m. v. 30 Population etc.

- Page 66 and 67:

Befolkning og medisinalforhold. 32

- Page 68 and 69:

Befolkning og medisinalforhold. 34

- Page 70 and 71:

Befolkning og medisinalforhold. 36

- Page 72 and 73:

Befolkning og medisinalforhold. 38

- Page 74 and 75:

Arbeidsmarked. 40 Labour market. Nr

- Page 76 and 77:

Arbeidsmarked. 42 Labour market. Ar

- Page 78 and 79:

Arbeidsmarked. 44 Labour market. Ta

- Page 80 and 81:

Arbeidsmarked. 46 Labour market. Ta

- Page 82 and 83:

Arbeidsmarked. 48 Labour market. Ta

- Page 84 and 85:

Nasjonalregnskap. 50 National accou

- Page 86 and 87:

Nasjonalregn.skap. 52 National acco

- Page 88 and 89:

Nasjonalregnskap. 54 National accou

- Page 90 and 91:

Nasjonalregnskap. 56 National accou

- Page 92 and 93:

Jordbruk in. v. 5 8 Agriculture etc

- Page 94 and 95:

Jordbruk m. v. 60 Agriculture etc.

- Page 96 and 97:

Jordbruk m. v. 62 Agriculture etc.

- Page 98 and 99:

Jordbruk ill. V. 64 Agriculture etc

- Page 100 and 101:

Jordbruk m. v. 66 Agriculture etc.

- Page 102 and 103:

Jordbruk m. v. 68 Agriculture etc.

- Page 104 and 105:

Jordbruk m. v. 70 Agriculture etc.

- Page 106 and 107:

Jordbruk m. v. 72 Agriculture etc.

- Page 108 and 109:

Jordbruk m. v. 74 Agriculture etc.

- Page 110 and 111:

Jordbruk m. v. 76 A griculture etc.

- Page 112 and 113:

Jordbruk m. v. 7 8 Agriculture etc.

- Page 114 and 115:

Jordbruk m. v. 80 Agriculture etc.

- Page 116 and 117:

Jordbruk m. v. 82 Agriculture etc.

- Page 118 and 119:

Jordbruk. m. v. 84 Agriculture etc.

- Page 120 and 121:

Jordbruk. 8 Agriculture etc, Tabz11

- Page 122 and 123:

Jordbruk m. v. 88 Agriculture etc.

- Page 124 and 125:

Jordbruk, skogbruk rn. v. 90 Agricu

- Page 126 and 127:

Jordbruk, skogbruk m. v. 92 Agricul

- Page 128 and 129:

Jor dbruk, skogbruk m. v. 94 Agricu

- Page 130 and 131:

Fiske og fangst 96 Fisheries etc. T

- Page 132 and 133:

Fiske og fangst. 98 Fisheries, seal

- Page 134 and 135:

Fiske og fangst. Fisheries, sealing

- Page 136 and 137:

Fiske og fangst. 102 Fisheries, sea

- Page 138 and 139:

Fiske og fangst. 104 Fisheries. sea

- Page 140 and 141:

Fiske og fangsu. 106 Fisheries, sea

- Page 142 and 143:

Bergverk og industri m. v. 1OS Mini

- Page 144 and 145:

Berg verk og industri in. v. 110 Mi

- Page 146 and 147:

Bergverk og industri m. v. 112 Mini

- Page 148 and 149:

Bergverk og industri 111. v . 114 M

- Page 150 and 151:

Bergverk, industri etc. 116 Mining,

- Page 152 and 153:

Bergverk og industri tn. v. 1 Minin

- Page 154 and 155:

Bergverk og industri m. v. 120 Mini

- Page 156 and 157:

Berg verk og industri ire, v. Minin

- Page 158 and 159:

Bergverk og industri m. v. 124 Mini

- Page 160 and 161:

Utenrikshandel. 1 2 6 Foreign trade

- Page 162 and 163: U tenrikshandel. 128 Foreign trade.

- Page 164 and 165: Utenrikshandel. 130 Foreign trade.

- Page 166 and 167: Utenrikshandel. 132 Foreign trade.

- Page 168 and 169: Utenrikshandel. 134 Foreign trade.

- Page 170 and 171: Utenrikshandel. 136 Foreign trade.

- Page 172 and 173: Utenrikshandel. 138 Foreign trade.

- Page 174 and 175: Utenrikshandel. 140 Foreign trade.

- Page 176 and 177: Utenriksh andel. 142 Foreign trade.

- Page 178 and 179: Utenrikshandel . 144 Foreign trade.

- Page 180 and 181: Innenlandsk handel in. v. 146 Inter

- Page 182 and 183: Innenlandsk halidel no. v. 148 Inte

- Page 184 and 185: Si otransport. 150 Water transport.

- Page 186 and 187: Sjotransport. 152 Water transport.

- Page 188 and 189: • Sjotransport. 154 Water transpo

- Page 190 and 191: Siotransport. 156 Water transport.

- Page 192 and 193: Sjotransport. 15 8 W ater transport

- Page 194 and 195: Sjotransport. 160 Water transport.

- Page 196 and 197: Samferdsel. 162 Transport and commu

- Page 198 and 199: Samferdsel. 164 Transport and commu

- Page 200 and 201: Samferdsel. 1 66 Transport and comm

- Page 202 and 203: Samferdsel. 168 Transport and commu

- Page 204 and 205: Samferdsel. 1 7 0 Transport and com

- Page 206 and 207: Samferdsel. 1 72 Transport and comm

- Page 208 and 209: Sam ferdsel. 1 74 Transport and com

- Page 210 and 211: Finanser. 76 Public finance. ••

- Page 214 and 215: Finanser. 180 Public finance. Tabel

- Page 216 and 217: - - Offentlige finanser• 182 Publ

- Page 218 and 219: Offentlige finanser. 184 Public fin

- Page 220 and 221: - Offentlige finanser. 1 86 Public

- Page 222 and 223: Offentlige finanser. 188 Public fin

- Page 224 and 225: Offentlige finanser. 190 Public fin

- Page 226 and 227: Offentlige finanser. 192 Public fin

- Page 228 and 229: Offentlige finanser. 1 04 Public fi

- Page 230 and 231: Offentlige finanser. 196 Public fin

- Page 232 and 233: Offentlige finanser. 19 8 Public fi

- Page 234 and 235: • Offentlige finanser. 200 Public

- Page 236 and 237: Penger og kreditt. 202 Money and cr

- Page 238 and 239: Penger og kreditt. 204 Money and cr

- Page 240 and 241: Penger og kreditt. 206 Money and cr

- Page 242 and 243: Penger og kreditt. 208 Money and cr

- Page 244 and 245: Penger og kreditt. 210 Money and cr

- Page 246 and 247: Penger og kreditt. 212 Money and cr

- Page 248 and 249: Fenger og kreditt. 214 Money and cr

- Page 250 and 251: Penger og kreditt. 216 Money and cr

- Page 252 and 253: Penger og kreditt. 218 Money and cr

- Page 254 and 255: Penger og kreditt. 220 Money and cr

- Page 256 and 257: Penger og kreditt. 222 Money and cr

- Page 258 and 259: Fenger og kreditt. 224 Money and cr

- Page 260 and 261: Penger og kreditt. 220 Money and cr

- Page 262 and 263:

Penger og kreditt. 22 8 Money and c

- Page 264 and 265:

Penger og kreditt. 2 3 0 Money and

- Page 266 and 267:

Priser. Prices. 232 og maned Year a

- Page 268 and 269:

Priser. Prices. 234 Tabell 275. Pri

- Page 270 and 271:

Pricer. 236 Prices. Tahe11 279. Kon

- Page 272 and 273:

Lonninger. 238 Wages. Ar og kvartal

- Page 274 and 275:

• • Lonninger. 240 Wages. Tabel

- Page 276 and 277:

Lonninger. 242 Wages. Tabell 286. G

- Page 278 and 279:

Lonninger. 244 Wages. Tahell 2L9. M

- Page 280 and 281:

Lonninger. 24(1 Wages. Tabell 291.

- Page 282 and 283:

Sosiale forhold. 248 Social conditi

- Page 284 and 285:

Sosi ale forhold. 250 Social condit

- Page 286 and 287:

Sosiale forhold. 252 Social conditi

- Page 288 and 289:

Sosiale forhold. 254 Social conditi

- Page 290 and 291:

• • - $osiale forhold. Social c

- Page 292 and 293:

Sosiale forhold. Social conditions.

- Page 294 and 295:

Sosiale forhold. 260 Social conditi

- Page 296 and 297:

Rettsforhold. 262 Justice and crime

- Page 298 and 299:

Rettsforhold. 264 Justice and crime

- Page 300 and 301:

Rettsforhold. 266 Justice and crime

- Page 302 and 303:

Rettsforitold. 2 6 8 Justice and cr

- Page 304 and 305:

Undervisning m. v. 270 Education de

- Page 306 and 307:

Undervisning m. v. 272 Education et

- Page 308 and 309:

Undervisning m. v. 2 74 Education.

- Page 310 and 311:

Undervisning m. v. Education etc. T

- Page 312 and 313:

Under visning m. v. 97 Education et

- Page 314 and 315:

Undervisning m. v. 280 Education et

- Page 316 and 317:

Undervisning m. v. 2 8 • Educatio

- Page 318 and 319:

Undervisning m. v. 284 Education et

- Page 320 and 321:

Undervisning m. v. 2 8 6 Education

- Page 322 and 323:

• Vaig. Elections. 288 CC r. GC i

- Page 324 and 325:

V alg. Elections. 290 Nr. 2 3 4 5 6

- Page 326 and 327:

• ▪ • • • Valg. Elections

- Page 328 and 329:

Mid og vekt. 294 Measures and weigh

- Page 330 and 331:

Internasjonale oversikter. 96 Tabel

- Page 332 and 333:

Internasjonale oversikter. 298 Tabe

- Page 334 and 335:

Internasjonale oversikter. 300 Tabe

- Page 336 and 337:

Internasjonale oversikter. 302 Tabe

- Page 338 and 339:

Internasionale oversikter. 304 Tabe

- Page 340 and 341:

Internasjonale oversikter. 306 Tabe

- Page 342 and 343:

Internasjonale oversikter. 308 Tabe

- Page 344 and 345:

Internasjonale oversikter. 310 Tabe

- Page 346 and 347:

Internasjonale oversikter. 312 Nr.

- Page 348 and 349:

Internasjonale oversikter. 314 Tabe

- Page 350 and 351:

Internasjonale oversikter. 316 Tabe

- Page 352 and 353:

Internasjonale oversikter. 318 Tabe

- Page 354 and 355:

Interna3jonale oversikter. 320 Tabe

- Page 356 and 357:

Internasjonale oversikter. 39 2 Nr.

- Page 358 and 359:

, Internasjonale oversikter. 324 I

- Page 360 and 361:

Internasjonale oversikter. 326 Tabe

- Page 362 and 363:

Internasjonale oversikter. 328 Tabe

- Page 364 and 365:

Internasjonale oversikter. 330 Tabe

- Page 366 and 367:

Internasjonale oversikte r. 332 Tab

- Page 368 and 369:

Internasjonale oversikter. 334 Tabe

- Page 370 and 371:

Internasjonale oversikter. 336 Tabe

- Page 372 and 373:

Internasjonale oversikter. 338 Tabe

- Page 374 and 375:

Internasjonale oversikter. 340 Tabe

- Page 376 and 377:

Internasjonale oversikter. 342 Tabe

- Page 378 and 379:

Internasjonale oversikter. 344 Tabe

- Page 380 and 381:

Internasjonale oversikter. 346 Tabe

- Page 382 and 383:

Intemasjonale oversikter. 3 4 8 Lan

- Page 384 and 385:

Internasjonale oversikter. 350 Tabe

- Page 386 and 387:

Internasjonale oversikter. 352 Tabe

- Page 388 and 389:

Internasjonale oversikter. 354 Tabe

- Page 390 and 391:

Internasjonale oversikter. 356 Tabe

- Page 392 and 393:

Internasjonale oversikter. 358 Tabe

- Page 394 and 395:

Internasjonale oversikter. 360 Tabe

- Page 396 and 397:

Internasjonale oversikter. 362 Ar (

- Page 398 and 399:

Intemasjonale oversikter 364 Land A

- Page 400 and 401:

Tnternasjonale oversikter. 3 6 6 Ta

- Page 402 and 403:

Internasjonale oversikter. 3C8 Tabe

- Page 404 and 405:

Norges offisielle statistikk, rekke