You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I<br />

1954<br />

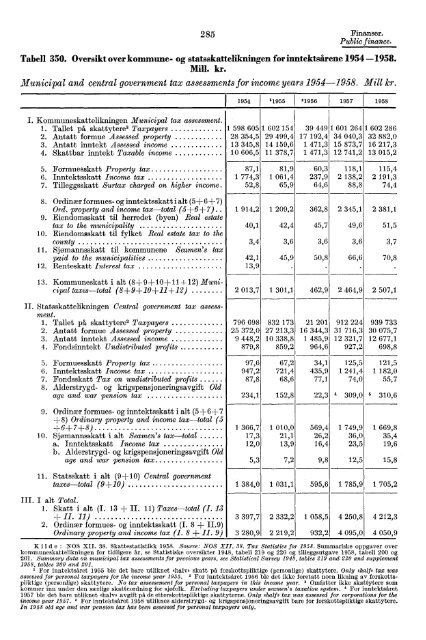

I. Kommuneskattelikningen Municipal tax assessment.<br />

1. Tallet på skattytere3 Taxpayers 1 598 605<br />

2. Antatt formue Assessed property 28 354,5<br />

3. Antatt inntekt Assessed income 13 345,8<br />

4. Skattbar inntekt Taxable income 10 606,5<br />

285 Finanser.<br />

Public finance.<br />

Tabell 350. Oversikt overkommune- og statsskattelikningen for inntektsårene 1954 -1958.<br />

Mill. kr.<br />

Municipal and central government tax assessments for income years 1954-1958. Mill kr.<br />

11955 21956 1957 1958<br />

1 602 154<br />

29 499,4<br />

14 159,6<br />

11 378,7<br />

39 449<br />

192,4<br />

471,3<br />

471,3<br />

17<br />

1<br />

1<br />

1 601 264<br />

34 040,3<br />

15 873,7<br />

12 741,2<br />

1 602 286<br />

32 882,0<br />

16 217,3<br />

13 015,2<br />

5. Formuesskatt Property tax 87,1<br />

6. Inntektsskatt Income tax 1 774,3<br />

7. Tilleggsskatt Surtax charged on higher income 52,8<br />

1<br />

81,9<br />

061,4<br />

65,9<br />

60,3<br />

237,9<br />

64,6<br />

118,1<br />

2 138,2<br />

88,8<br />

2<br />

115,4<br />

191,3<br />

74,4<br />

8. Ordinær formues - og inntektsskatt i alt (5+6+7)<br />

Ord. property and income tax-total (5+6+7 ) . . 1 914.2<br />

9. Eiendomsskatt til herredet (byen) Real estate<br />

tax to the municipality 40,1<br />

10. Eiendomsskatt til fylket Real estate tax to the<br />

county 3,4<br />

11. Sjømannsskatt til kommunene Seamen's tax<br />

paid to the municipalities 42,1<br />

12. Renteskatt Interest tax 13,9<br />

1 209,2<br />

42,4<br />

3,6<br />

45,9<br />

362,8<br />

45,7<br />

3,6<br />

50,8<br />

2 345,1<br />

49,6<br />

3,6<br />

66,6<br />

2 381,1<br />

51,5<br />

3,7<br />

70,8<br />

13. Kommuneskatt i alt (8+9+10+11+12) Municipal<br />

taxes-total (8+9+10+11+12) 2 013,7<br />

1 301,1 462,9 2 464,9 2 507,1<br />

Statsskattelikningen Central government tax assessment.<br />

1. Tallet på skattytere 3 Taxpayers 796 698<br />

2. Antatt formue Assessed property 25 372,0<br />

3. Antatt inntekt Assessed income 9 448,2<br />

4. Fondsinntekt Undistributed profits 879,8<br />

832 173 21 201 912 224 939 733<br />

27 213,3 16 344,3 31 716,3 30 075,7<br />

10 338,8 1 485,9 12 321,7 12 677,1<br />

859,2 964,6 927,2 698,8<br />

5. Formuesskatt Property tax 97,6<br />

6. Inntektsskatt Income tax 947,2<br />

7. Fondsskatt Tax on undistributed profits 87,8<br />

8. Alderstrygd- og krigspensjoneringsavgift Old<br />

age and war pension tax 234,1<br />

9. Ordinær formues- og inntektsskatt i alt (5+6+7<br />

+8) Ordinary property and income tax-total (5<br />

+6+7+8) 1 366,7<br />

10. Sjømannsskatt i alt Seamen's tax-total 17,3<br />

a. Inntektsskatt Income tax 12,0<br />

b. Alderstrygd- og krigspensjoneringsavgift Old<br />

age and war pension tax 5,3<br />

11. Statsskatt i alt (9+10) Central government<br />

taxes-total (9+10) 1 384,0<br />

III. I alt Total.<br />

1. Skatt i alt (I. 13 + II. 11) Taxes-total (I. 13<br />

+ II. 11) 3 397,7<br />

2. Ordinær formues- og inntektsskatt (I. 8 + 11.9)<br />

Ordinary property and income tax (I. 8 + II. 9) 3 280,9<br />

67,2 34,1 125,5 121,5<br />

721,4 435,9 1 241,4 1 182,0<br />

68,6 77,1 74,0 55,7<br />

152,8 22,3 4 309,0 5 310,6<br />

1 010,0 569,4 1 749,9 1 669,8<br />

21,1 26,2 36,0 35,4<br />

13,9 16,4 23,5 19,6<br />

7,2 9,8 12,5 15,8<br />

1 031,1 595,6 1 785,9 1 705,2<br />

2 332,2 1 058,5 4250,8 4 212,3<br />

2 219,2 932,2 4 095,0 4 050,9<br />

Kilde : NOS XII. 38. Skattestatistikk 1958. Source: NOS XII. 38. Tax Statistics for 1958. Summariske oppgaver over<br />

kommuneskattelikningen for tidligere år, se Statistiske oversikter 1948, tabell 219 og 220 og tilleggsutgave 1958, tabell 200 og<br />

201. Summary data on municipal tax assessments for previous years, see Statistical Survey 1948, tables 219 and 220 and supplement<br />

1958, tables 200 and 201.<br />

For inntektsåret 1955 ble det bare utliknet «halv» skatt på forskottspliktige (personlige) skattytere. Only «half» tax was<br />

assessed for personal taxpayers for the income year 1955. 2 For inntektsåret 1956 ble det ikke foretatt noen likning av forskottspliktige<br />

(personlige) skattytere. No tax assessement for personal taxpayers in this income year. 3 Omfatter ikke skattytere som<br />

kommer inn under den særlige skatteordning for sjøfolk. Excluding taxpayers under seamen's taxation system. For inntektsåret<br />

1957 ble det bare utliknet dIaly» avgift på de etterskottspliktige skattyterne. Only «half» tax was assessed for corporations for the<br />

income year 1957. 5 For inntektsåret 1958 utliknes alderstrygd- og krigspensjoneringsavgift bare for forskottspliktige skattytere.<br />

In 1958 old age and war pension tax has been assessed for personal taxpayers only.