Automotive Expotrs November 2022

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

100 billion liras loan package for tradesmen takes effect<br />

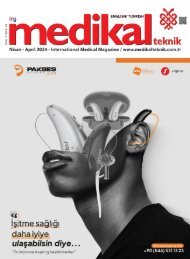

The government’s Treasury-supported<br />

loan package scheme for tradesmen and<br />

craftsmen has taken effect following a<br />

presidential decree, Treasury and Finance<br />

Minister Nureddin Nebati has announced.<br />

State lender Halkbank will provide a total<br />

of 100 billion Turkish Liras ($5.4 billion) to<br />

the businesses at an annual interest rate of<br />

7.5 percent to be paid back in 60 months,<br />

Nebati said.<br />

Under the scheme, the limit of loans with<br />

no interest to be made available to young<br />

entrepreneurs has been increased from<br />

100,000 liras to 300,000 liras, while the age<br />

limit to be eligible for those financing has<br />

been increased from 30 to 35, the minister<br />

added. Meanwhile, President Recep Tayyip<br />

Erdoğan said that interest rates in Türkiye<br />

are coming down toward single digits.<br />

“Hopefully, interest rates will fall to single<br />

digits, and we will save our investors and<br />

citizens from the oppression of interest<br />

rates,” Erdoğan said in a speech he delivered<br />

at a ceremony marking the inauguration of<br />

several facilities in the province of Malatya<br />

on Oct. 22.<br />

Private banks have also started to lower<br />

their interest rates, the president added.<br />

“We did this in the past, lowered [the rate]<br />

down to 4.6 percent and inflation then<br />

dropped to 5.6 percent. We will increase the<br />

income level of all people.”<br />

Erdoğan has been long advocating for<br />

lower interest rates to ignite the engine of<br />

economic growth.<br />

Earlier this month, he said that interest rates<br />

should come down to single digits by the<br />

end of the year. The Central Bank lowered<br />

its benchmark interest rate for the third<br />

month in a row. It slashed the one-week<br />

repo auction rate from 12 percent to 10.5<br />

percent but signaled that it may end the rate<br />

cut cycle.<br />

“The committee evaluated taking a similar<br />

step in the following meeting and ending the<br />

rate cut cycle,” the bank said in a statement<br />

released after the Monetary Policy<br />

Committee (MPC) meeting held on Oct. 20.<br />

<strong>November</strong> <strong>2022</strong> 118