Revizorski izvjestaj 2006 (pdf) - Montenegro berza

Revizorski izvjestaj 2006 (pdf) - Montenegro berza

Revizorski izvjestaj 2006 (pdf) - Montenegro berza

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

December 31, <strong>2006</strong><br />

CRNOGORSKA KOMERCIJALNA BANKA A.D., PODGORICA<br />

10. CASH AND BALANCES WITH THE CENTRAL BANK (Continued)<br />

The obligatory reserve is to be calculated by applying the aforementioned ratios on a weekly<br />

basis, two days prior to the expiration of the maintenance period.<br />

The Bank’s obligatory reserves represent the minimum deposits set aside into domestic accounts<br />

and/or into Central Bank of <strong>Montenegro</strong> (“CBM”) accounts abroad, which may contain up to 10%<br />

of the Bank’s obligatory reserve requirements by restricting the Treasury bills issued by the<br />

Government of the Republic of <strong>Montenegro</strong> (Note 11). The Central Bank pays interest to the<br />

banks on 40% of the obligatory reserve requirement deposited, at the annual rate of 1% up to the<br />

eighth day of the month for the preceding month. The obligatory reserve is held in euro amounts.<br />

11. TREASURY BILLS<br />

Treasury bills are debt securities issued by the Central Bank of <strong>Montenegro</strong> on the behalf of the<br />

Ministry of Finance of the Republic of <strong>Montenegro</strong> for a term of two months, three months and<br />

six months.<br />

Treasury bills stated at December 31, <strong>2006</strong> in the amount of EUR 1,461 thousand (2005: EUR<br />

3,831 thousand) represent a portion of the obligatory reserve held with the Central Bank of the<br />

Republic of <strong>Montenegro</strong> (Note 10) placed for a period of three to six months, at annual interest<br />

rates ranging from 0.99 to 2.99 percent.<br />

Treasury bills in which the bank invested funds during <strong>2006</strong> bear an annual interest rate of 0.49 to<br />

5.5. percent with a declining tendency.<br />

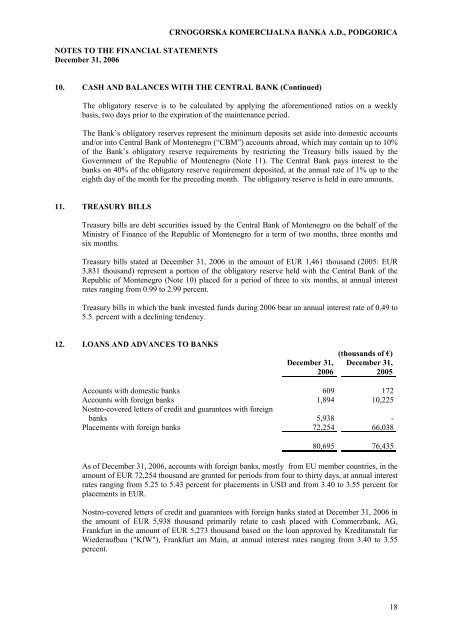

12. LOANS AND ADVANCES TO BANKS<br />

December 31,<br />

<strong>2006</strong><br />

(thousands of €)<br />

December 31,<br />

2005<br />

Accounts with domestic banks 609 172<br />

Accounts with foreign banks 1,894 10,225<br />

Nostro-covered letters of credit and guarantees with foreign<br />

banks 5,938 -<br />

Placements with foreign banks 72,254 66,038<br />

80,695 76,435<br />

As of December 31, <strong>2006</strong>, accounts with foreign banks, mostly from EU member countries, in the<br />

amount of EUR 72,254 thousand are granted for periods from four to thirty days, at annual interest<br />

rates ranging from 5.25 to 5.43 percent for placements in USD and from 3.40 to 3.55 percent for<br />

placements in EUR.<br />

Nostro-covered letters of credit and guarantees with foreign banks stated at December 31, <strong>2006</strong> in<br />

the amount of EUR 5,938 thousand primarily relate to cash placed with Commerzbank, AG,<br />

Frankfurt in the amount of EUR 5,273 thousand based on the loan approved by Kreditanstalt fur<br />

Wiederaufbau ("KfW"), Frankfurt am Main, at annual interest rates ranging from 3.40 to 3.55<br />

percent.<br />

18