An outline of the CCCTB (Common Consolidated Corporate Tax ...

An outline of the CCCTB (Common Consolidated Corporate Tax ...

An outline of the CCCTB (Common Consolidated Corporate Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

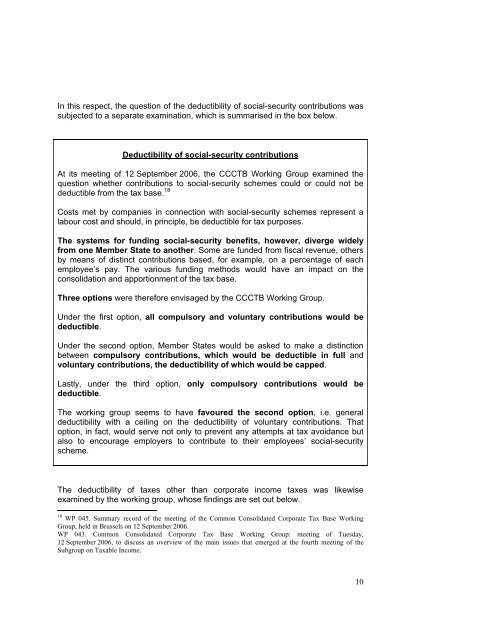

In this respect, <strong>the</strong> question <strong>of</strong> <strong>the</strong> deductibility <strong>of</strong> social-security contributions was<br />

subjected to a separate examination, which is summarised in <strong>the</strong> box below.<br />

Deductibility <strong>of</strong> social-security contributions<br />

At its meeting <strong>of</strong> 12 September 2006, <strong>the</strong> <strong>CCCTB</strong> Working Group examined <strong>the</strong><br />

question whe<strong>the</strong>r contributions to social-security schemes could or could not be<br />

deductible from <strong>the</strong> tax base. 18<br />

Costs met by companies in connection with social-security schemes represent a<br />

labour cost and should, in principle, be deductible for tax purposes.<br />

The systems for funding social-security benefits, however, diverge widely<br />

from one Member State to ano<strong>the</strong>r. Some are funded from fiscal revenue, o<strong>the</strong>rs<br />

by means <strong>of</strong> distinct contributions based, for example, on a percentage <strong>of</strong> each<br />

employee’s pay. The various funding methods would have an impact on <strong>the</strong><br />

consolidation and apportionment <strong>of</strong> <strong>the</strong> tax base.<br />

Three options were <strong>the</strong>refore envisaged by <strong>the</strong> <strong>CCCTB</strong> Working Group.<br />

Under <strong>the</strong> first option, all compulsory and voluntary contributions would be<br />

deductible.<br />

Under <strong>the</strong> second option, Member States would be asked to make a distinction<br />

between compulsory contributions, which would be deductible in full and<br />

voluntary contributions, <strong>the</strong> deductibility <strong>of</strong> which would be capped.<br />

Lastly, under <strong>the</strong> third option, only compulsory contributions would be<br />

deductible.<br />

The working group seems to have favoured <strong>the</strong> second option, i.e. general<br />

deductibility with a ceiling on <strong>the</strong> deductibility <strong>of</strong> voluntary contributions. That<br />

option, in fact, would serve not only to prevent any attempts at tax avoidance but<br />

also to encourage employers to contribute to <strong>the</strong>ir employees’ social-security<br />

scheme.<br />

The deductibility <strong>of</strong> taxes o<strong>the</strong>r than corporate income taxes was likewise<br />

examined by <strong>the</strong> working group, whose findings are set out below.<br />

18 WP 045. Summary record <strong>of</strong> <strong>the</strong> meeting <strong>of</strong> <strong>the</strong> <strong>Common</strong> <strong>Consolidated</strong> <strong>Corporate</strong> <strong>Tax</strong> Base Working<br />

Group, held in Brussels on 12 September 2006.<br />

WP 043. <strong>Common</strong> <strong>Consolidated</strong> <strong>Corporate</strong> <strong>Tax</strong> Base Working Group: meeting <strong>of</strong> Tuesday,<br />

12 September 2006, to discuss an overview <strong>of</strong> <strong>the</strong> main issues that emerged at <strong>the</strong> fourth meeting <strong>of</strong> <strong>the</strong><br />

Subgroup on <strong>Tax</strong>able Income.<br />

10