An outline of the CCCTB (Common Consolidated Corporate Tax ...

An outline of the CCCTB (Common Consolidated Corporate Tax ...

An outline of the CCCTB (Common Consolidated Corporate Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

When a group ceased to exist, unrelieved group losses would be attributed to <strong>the</strong><br />

taxpayers belonging to <strong>the</strong> group at <strong>the</strong> moment <strong>of</strong> termination on <strong>the</strong> basis <strong>of</strong> <strong>the</strong><br />

sharing-mechanism calculations for <strong>the</strong> date <strong>of</strong> termination.<br />

Intra-group transactions would have to be factored out: Companies belonging<br />

to a <strong>CCCTB</strong> group would be due to consolidate <strong>the</strong>ir tax bases since <strong>the</strong>y reach<br />

<strong>the</strong> 75% threshold, thus entailing to factor out intra-group transactions in order only<br />

transactions between <strong>the</strong> group and third parties enter into <strong>the</strong> consolidated tax<br />

base. The consolidated tax base would not include any pr<strong>of</strong>its or losses on intragroup<br />

transactions between members <strong>of</strong> <strong>the</strong> consolidated group. This would relate<br />

to any pr<strong>of</strong>its or losses on <strong>the</strong> disposal <strong>of</strong> stocks, fixed assets, shares in<br />

consolidated companies or o<strong>the</strong>r tangible or intangible assets. Nor would <strong>the</strong> tax<br />

base include intra-group provisions.<br />

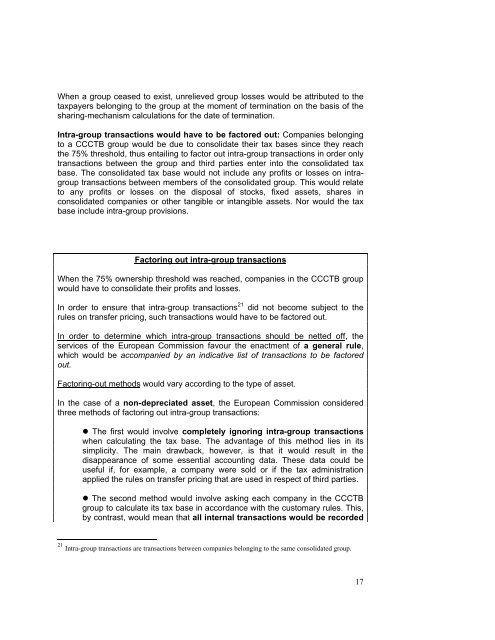

Factoring out intra-group transactions<br />

When <strong>the</strong> 75% ownership threshold was reached, companies in <strong>the</strong> <strong>CCCTB</strong> group<br />

would have to consolidate <strong>the</strong>ir pr<strong>of</strong>its and losses.<br />

In order to ensure that intra-group transactions 21 did not become subject to <strong>the</strong><br />

rules on transfer pricing, such transactions would have to be factored out.<br />

In order to determine which intra-group transactions should be netted <strong>of</strong>f, <strong>the</strong><br />

services <strong>of</strong> <strong>the</strong> European Commission favour <strong>the</strong> enactment <strong>of</strong> a general rule,<br />

which would be accompanied by an indicative list <strong>of</strong> transactions to be factored<br />

out.<br />

Factoring-out methods would vary according to <strong>the</strong> type <strong>of</strong> asset.<br />

In <strong>the</strong> case <strong>of</strong> a non-depreciated asset, <strong>the</strong> European Commission considered<br />

three methods <strong>of</strong> factoring out intra-group transactions:<br />

� The first would involve completely ignoring intra-group transactions<br />

when calculating <strong>the</strong> tax base. The advantage <strong>of</strong> this method lies in its<br />

simplicity. The main drawback, however, is that it would result in <strong>the</strong><br />

disappearance <strong>of</strong> some essential accounting data. These data could be<br />

useful if, for example, a company were sold or if <strong>the</strong> tax administration<br />

applied <strong>the</strong> rules on transfer pricing that are used in respect <strong>of</strong> third parties.<br />

� The second method would involve asking each company in <strong>the</strong> <strong>CCCTB</strong><br />

group to calculate its tax base in accordance with <strong>the</strong> customary rules. This,<br />

by contrast, would mean that all internal transactions would be recorded<br />

21 Intra-group transactions are transactions between companies belonging to <strong>the</strong> same consolidated group.<br />

17