An outline of the CCCTB (Common Consolidated Corporate Tax ...

An outline of the CCCTB (Common Consolidated Corporate Tax ...

An outline of the CCCTB (Common Consolidated Corporate Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

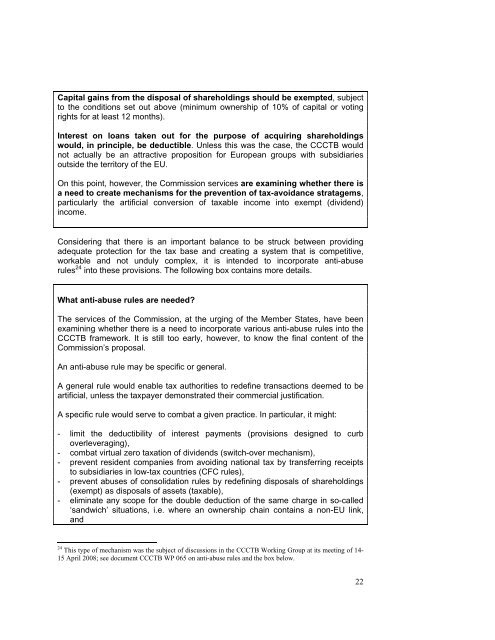

Capital gains from <strong>the</strong> disposal <strong>of</strong> shareholdings should be exempted, subject<br />

to <strong>the</strong> conditions set out above (minimum ownership <strong>of</strong> 10% <strong>of</strong> capital or voting<br />

rights for at least 12 months).<br />

Interest on loans taken out for <strong>the</strong> purpose <strong>of</strong> acquiring shareholdings<br />

would, in principle, be deductible. Unless this was <strong>the</strong> case, <strong>the</strong> <strong>CCCTB</strong> would<br />

not actually be an attractive proposition for European groups with subsidiaries<br />

outside <strong>the</strong> territory <strong>of</strong> <strong>the</strong> EU.<br />

On this point, however, <strong>the</strong> Commission services are examining whe<strong>the</strong>r <strong>the</strong>re is<br />

a need to create mechanisms for <strong>the</strong> prevention <strong>of</strong> tax-avoidance stratagems,<br />

particularly <strong>the</strong> artificial conversion <strong>of</strong> taxable income into exempt (dividend)<br />

income.<br />

Considering that <strong>the</strong>re is an important balance to be struck between providing<br />

adequate protection for <strong>the</strong> tax base and creating a system that is competitive,<br />

workable and not unduly complex, it is intended to incorporate anti-abuse<br />

rules 24 into <strong>the</strong>se provisions. The following box contains more details.<br />

What anti-abuse rules are needed?<br />

The services <strong>of</strong> <strong>the</strong> Commission, at <strong>the</strong> urging <strong>of</strong> <strong>the</strong> Member States, have been<br />

examining whe<strong>the</strong>r <strong>the</strong>re is a need to incorporate various anti-abuse rules into <strong>the</strong><br />

<strong>CCCTB</strong> framework. It is still too early, however, to know <strong>the</strong> final content <strong>of</strong> <strong>the</strong><br />

Commission’s proposal.<br />

<strong>An</strong> anti-abuse rule may be specific or general.<br />

A general rule would enable tax authorities to redefine transactions deemed to be<br />

artificial, unless <strong>the</strong> taxpayer demonstrated <strong>the</strong>ir commercial justification.<br />

A specific rule would serve to combat a given practice. In particular, it might:<br />

- limit <strong>the</strong> deductibility <strong>of</strong> interest payments (provisions designed to curb<br />

overleveraging),<br />

- combat virtual zero taxation <strong>of</strong> dividends (switch-over mechanism),<br />

- prevent resident companies from avoiding national tax by transferring receipts<br />

to subsidiaries in low-tax countries (CFC rules),<br />

- prevent abuses <strong>of</strong> consolidation rules by redefining disposals <strong>of</strong> shareholdings<br />

(exempt) as disposals <strong>of</strong> assets (taxable),<br />

- eliminate any scope for <strong>the</strong> double deduction <strong>of</strong> <strong>the</strong> same charge in so-called<br />

‘sandwich’ situations, i.e. where an ownership chain contains a non-EU link,<br />

and<br />

24 This type <strong>of</strong> mechanism was <strong>the</strong> subject <strong>of</strong> discussions in <strong>the</strong> <strong>CCCTB</strong> Working Group at its meeting <strong>of</strong> 14-<br />

15 April 2008; see document <strong>CCCTB</strong> WP 065 on anti-abuse rules and <strong>the</strong> box below.<br />

22