Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONDENSED INTERIM FINANCIAL REPORT (CONTINUED)<br />

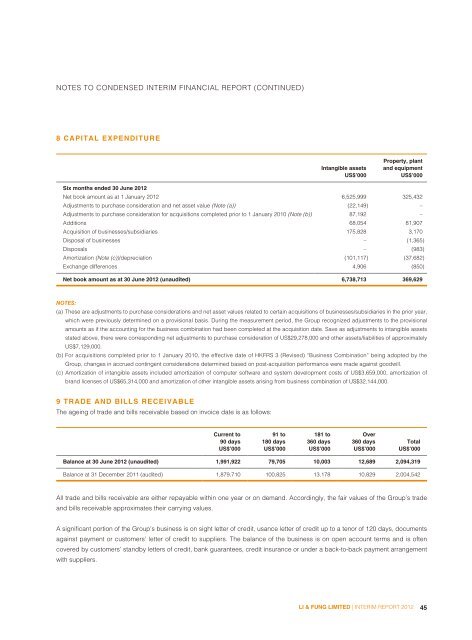

8 CAPITAL EXPENDITURE<br />

Intangible assets<br />

Property, plant<br />

and equipment<br />

US$’000 US$’000<br />

Six months ended 30 June 2012<br />

Net book amount as at 1 January 2012 6,525,999 325,432<br />

Adjustments to purchase consideration and net asset value (Note (a)) (22,149) –<br />

Adjustments to purchase consideration for acquisitions completed prior to 1 January 2010 (Note (b)) 87,192 –<br />

Additions 68,054 81,907<br />

Acquisition of businesses/subsidiaries 175,828 3,170<br />

Disposal of businesses – (1,365)<br />

Disposals – (983)<br />

Amortization (Note (c))/depreciation (101,117) (37,682)<br />

Exchange differences 4,906 (850)<br />

Net book amount as at 30 June 2012 (unaudited) 6,738,713 369,629<br />

NOTES:<br />

(a) These are adjustments to purchase considerations and net asset values related to certain acquisitions of businesses/subsidiaries in the prior year,<br />

which were previously determined on a provisional basis. During the measurement period, the Group recognized adjustments to the provisional<br />

amounts as if the accounting for the business combination had been completed at the acquisition date. Save as adjustments to intangible assets<br />

stated above, there were corresponding net adjustments to purchase consideration of US$29,278,000 and other assets/liabilities of approximately<br />

US$7,129,000.<br />

(b) For acquisitions completed prior to 1 January 2010, the effective date of HKFRS 3 (Revised) “Business Combination” being adopted by the<br />

Group, changes in accrued contingent considerations determined based on post-acquisition performance were made against goodwill.<br />

(c) Amortization of intangible assets included amortization of computer software and system development costs of US$3,659,000, amortization of<br />

brand licenses of US$65,314,000 and amortization of other intangible assets arising from business combination of US$32,144,000.<br />

9 TRADE AND BILLS RECEIVABLE<br />

The ageing of trade and bills receivable based on invoice date is as follows:<br />

Current to<br />

91 to<br />

181 to<br />

Over<br />

90 days 180 days 360 days 360 days Total<br />

US$’000 US$’000 US$’000 US$’000 US$’000<br />

Balance at 30 June 2012 (unaudited) 1,991,922 79,705 10,003 12,689 2,094,319<br />

Balance at 31 December 2011 (audited) 1,879,710 100,825 13,178 10,829 2,004,542<br />

All trade and bills receivable are either repayable within one year or on demand. Accordingly, the fair values of the Group’s trade<br />

and bills receivable approximates their carrying values.<br />

A significant portion of the Group’s business is on sight letter of credit, usance letter of credit up to a tenor of 120 days, documents<br />

against payment or customers’ letter of credit to suppliers. The balance of the business is on open account terms and is often<br />

covered by customers’ standby letters of credit, bank guarantees, credit insurance or under a back-to-back payment arrangement<br />

with suppliers.<br />

LI & FUNG LIMITED | INTERIM REPORT 2012<br />

45