Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

HIGHLIGHTS<br />

HALF YEAR RESULTS TO 30 JUNE 2012<br />

(US$ million) 2012 2011 Change<br />

Turnover 9,128 8,798 +4%<br />

Core Operating Profit 221 282 -22%<br />

As % of Turnover 2.43% 3.21%<br />

Profit attributable to shareholders<br />

of the Company<br />

312 236 +33%<br />

Earnings per Share – Basic 3.80 US cents 2.92 US cents +30%<br />

Dividend per Share 15 HK cents 19 HK cents -21%<br />

• Turnover increased by 4% to US$9,128 million, reflecting market share gains in USA and tough market conditions in Europe<br />

• The Company continued to make inroads in capturing growing Asian markets<br />

• Cross-selling momentum continued amongst all three Business Networks of Trading, Logistics and Distribution, but will be<br />

reflected in second half of 2012 and into 2013<br />

• Profit Attributable to Shareholders up 33% to US$312 million<br />

• Core Operating Profit was down by 22% to US$221 million, due to slower than expected turnaround of LF USA’s business and<br />

the investment into LF Asia’s Fashion & Home platform<br />

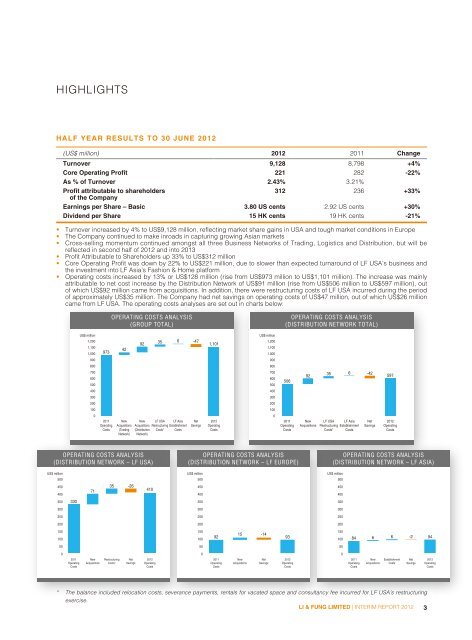

• Operating costs increased by 13% or US$128 million (rise from US$973 million to US$1,101 million). The increase was mainly<br />

attributable to net cost increase by the Distribution Network of US$91 million (rise from US$506 million to US$597 million), out<br />

of which US$92 million came from acquisitions. In addition, there were restructuring costs of LF USA incurred during the period<br />

of approximately US$35 million. The Company had net savings on operating costs of US$47 million, out of which US$26 million<br />

came from LF USA. The operating costs analyses are set out in in ccharts<br />

charts c below:<br />

US$ million<br />

1,200<br />

1,100<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

973<br />

2011<br />

Operating<br />

Costs<br />

OPERATING COSTS ANALYSIS<br />

(GROUP TOTAL)<br />

New<br />

Acquisitions<br />

(Trading<br />

Network)<br />

New<br />

Acquisitions<br />

(Distribution<br />

Network)<br />

OPERATING COSTS ANALYSIS<br />

(DISTRIBUTION NETWORK – LF USA)<br />

US$ million<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

330<br />

2011<br />

Operating<br />

Costs<br />

71<br />

New<br />

Acquisitions<br />

Restructuring<br />

Costs*<br />

42<br />

35 -26<br />

Net<br />

Savings<br />

92<br />

410<br />

2012<br />

Operating<br />

Costs<br />

35 6 -47<br />

LF USA<br />

Restructuring<br />

Costs*<br />

LF Asia<br />

Establishment<br />

Costs<br />

Net<br />

Savings<br />

1,101<br />

2012<br />

Operating<br />

Costs<br />

US$ million<br />

1,200<br />

1,100<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

OPERATING COSTS ANALYSIS<br />

(DISTRIBUTION NETWORK TOTAL)<br />

506<br />

2011<br />

Operating<br />

Costs<br />

OPERATING COSTS ANALYSIS<br />

(DISTRIBUTION NETWORK – LF EUROPE)<br />

US$ million<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

15 -14<br />

92 93<br />

2011<br />

Operating<br />

Costs<br />

New<br />

Acquisitions<br />

Net<br />

Savings<br />

2012<br />

Operating<br />

Costs<br />

92<br />

New<br />

Acquisitions<br />

35 6 -42<br />

LF USA<br />

Restructuring<br />

Costs*<br />

LF Asia<br />

Establishment<br />

Costs<br />

Net<br />

Savings<br />

597<br />

2012<br />

Operating<br />

Costs<br />

OPERATING COSTS ANALYSIS<br />

(DISTRIBUTION NETWORK – LF ASIA)<br />

US$ million<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

84<br />

2011<br />

Operating<br />

Costs<br />

6 6 -2<br />

* The balance included relocation costs, severance payments, rentals for vacated space and consultancy fee incurred for LF USA’s restructuring<br />

exercise.<br />

LI & FUNG LIMITED | INTERIM REPORT 2012 3<br />

New<br />

Acquisitions<br />

Establishment<br />

Costs<br />

Net<br />

Savings<br />

94<br />

2012<br />

Operating<br />

Costs