You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONDENSED INTERIM FINANCIAL REPORT (CONTINUED)<br />

9 TRADE AND BILLS RECEIVABLE (CONTINUED)<br />

There is no concentration of credit risk with respect to trade receivables, as the Group has a large number of customers<br />

internationally dispersed.<br />

Certain subsidiaries of the Group discounted bills receivable balances amounting to US$33,717,000 (31 December 2011:<br />

US$40,298,000) to banks in exchange for cash as at 30 June 2012. The transactions have been accounted for as collateralized<br />

bank advances.<br />

As at 30 June 2012, trade receivables of US$21,750,000 (31 December 2011: US$8,820,000) were pledged as security for the<br />

Group’s borrowings.<br />

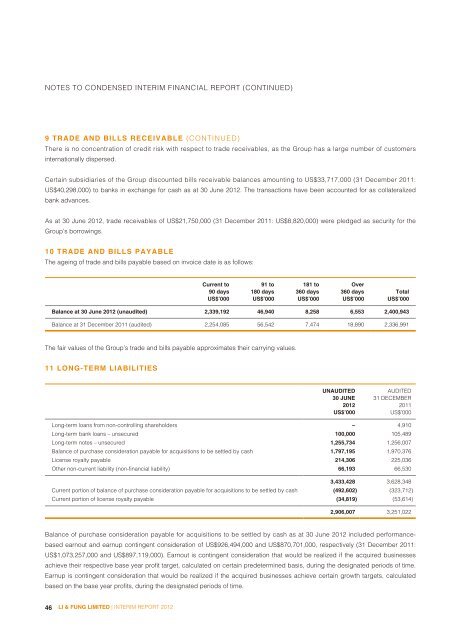

10 TRADE AND BILLS PAYABLE<br />

The ageing of trade and bills payable based on invoice date is as follows:<br />

46 LI & FUNG LIMITED | INTERIM REPORT 2012<br />

Current to<br />

91 to<br />

181 to<br />

Over<br />

90 days 180 days 360 days 360 days Total<br />

US$’000 US$’000 US$’000 US$’000 US$’000<br />

Balance at 30 June 2012 (unaudited) 2,339,192 46,940 8,258 6,553 2,400,943<br />

Balance at 31 December 2011 (audited) 2,254,085 56,542 7,474 18,890 2,336,991<br />

The fair values of the Group’s trade and bills payable approximates their carrying values.<br />

11 LONG-TERM LIABILITIES<br />

UNAUDITED<br />

30 JUNE<br />

2012<br />

AUDITED<br />

31 DECEMBER<br />

2011<br />

US$’000 US$’000<br />

Long-term loans from non-controlling shareholders – 4,910<br />

Long-term bank loans – unsecured 100,000 105,489<br />

Long-term notes – unsecured 1,255,734 1,256,007<br />

Balance of purchase consideration payable for acquisitions to be settled by cash 1,797,195 1,970,376<br />

<strong>Li</strong>cense royalty payable 214,306 225,036<br />

Other non-current liability (non-financial liability) 66,193 66,530<br />

3,433,428 3,628,348<br />

Current portion of balance of purchase consideration payable for acquisitions to be settled by cash (492,602) (323,712)<br />

Current portion of license royalty payable (34,819) (53,614)<br />

2,906,007 3,251,022<br />

Balance of purchase consideration payable for acquisitions to be settled by cash as at 30 June 2012 included performancebased<br />

earnout and earnup contingent consideration of US$926,494,000 and US$870,701,000, respectively (31 December 2011:<br />

US$1,073,257,000 and US$897,119,000). Earnout is contingent consideration that would be realized if the acquired businesses<br />

achieve their respective base year profit target, calculated on certain predetermined basis, during the designated periods of time.<br />

Earnup is contingent consideration that would be realized if the acquired businesses achieve certain growth targets, calculated<br />

based on the base year profits, during the designated periods of time.