EXCEL CROP CARE LIMITED C O N T E N T S - BSE

EXCEL CROP CARE LIMITED C O N T E N T S - BSE

EXCEL CROP CARE LIMITED C O N T E N T S - BSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

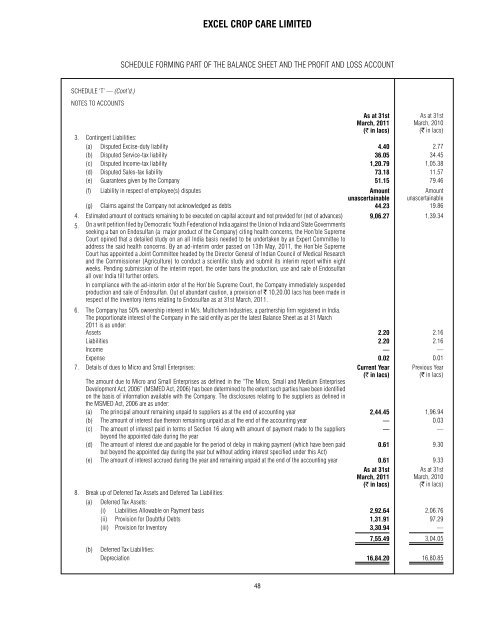

SCHEDULE ‘T’ — (Cont’d.)<br />

NOTES TO ACCOUNTS<br />

<strong>EXCEL</strong> <strong>CROP</strong> <strong>CARE</strong> <strong>LIMITED</strong><br />

SCHEDULE FORMING PART OF THE BALANCE SHEET AND THE PROFIT AND LOSS ACCOUNT<br />

48<br />

As at 31st<br />

March, 2011<br />

(` in lacs)<br />

As at 31st<br />

March, 2010<br />

(` in lacs)<br />

3. Contingent Liabilities:<br />

(a) Disputed Excise-duty liability 4.40 2.77<br />

(b) Disputed Service-tax liability 36.05 34.45<br />

(c) Disputed Income-tax liability 1,20.79 1,05.38<br />

(d) Disputed Sales-tax liability 73.18 11.57<br />

(e) Guarantees given by the Company 51.15 79.46<br />

(f) Liability in respect of employee(s) disputes Amount<br />

Amount<br />

unascertainable unascertainable<br />

(g) Claims against the Company not acknowledged as debts 44.23 19.86<br />

4. Estimated amount of contracts remaining to be executed on capital account and not provided for (net of advances) 9,06.27 1,39.34<br />

5. On a writ petition filed by Democratic Youth Federation of India against the Union of India and State Governments<br />

seeking a ban on Endosulfan (a major product of the Company) citing health concerns, the Hon’ble Supreme<br />

Court opined that a detailed study on an all India basis needed to be undertaken by an Expert Committee to<br />

address the said health concerns. By an ad-interim order passed on 13th May, 2011, the Hon’ble Supreme<br />

Court has appointed a Joint Committee headed by the Director General of Indian Council of Medical Research<br />

and the Commissioner (Agriculture) to conduct a scientific study and submit its interim report within eight<br />

weeks. Pending submission of the interim report, the order bans the production, use and sale of Endosulfan<br />

all over India till further orders.<br />

In compliance with the ad-interim order of the Hon’ble Supreme Court, the Company immediately suspended<br />

production and sale of Endosulfan. Out of abundant caution, a provision of ` 10,20.00 lacs has been made in<br />

respect of the inventory items relating to Endosulfan as at 31st March, 2011.<br />

6. The Company has 50% ownership interest in M/s. Multichem Industries, a partnership firm registered in India.<br />

The proportionate interest of the Company in the said entity as per the latest Balance Sheet as at 31 March<br />

2011 is as under:<br />

Assets 2.20 2.16<br />

Liabilities 2.20 2.16<br />

Income — —<br />

Expense 0.02 0.01<br />

7. Details of dues to Micro and Small Enterprises: Current Year Previous Year<br />

The amount due to Micro and Small Enterprises as defined in the “The Micro, Small and Medium Enterprises<br />

Development Act, 2006” (MSMED Act, 2006) has been determined to the extent such parties have been identified<br />

on the basis of information available with the Company. The disclosures relating to the suppliers as defined in<br />

the MSMED Act, 2006 are as under:<br />

(` in lacs) (` in lacs)<br />

(a) The principal amount remaining unpaid to suppliers as at the end of accounting year 2,44.45 1,96.94<br />

(b) The amount of interest due thereon remaining unpaid as at the end of the accounting year — 0.03<br />

(c) The amount of interest paid in terms of Section 16 along with amount of payment made to the suppliers<br />

beyond the appointed date during the year<br />

— —<br />

(d) The amount of interest due and payable for the period of delay in making payment (which have been paid<br />

but beyond the appointed day during the year but without adding interest specified under this Act)<br />

0.61 9.30<br />

(e) The amount of interest accrued during the year and remaining unpaid at the end of the accounting year 0.61 9.33<br />

As at 31st<br />

As at 31st<br />

March, 2011 March, 2010<br />

(` in lacs) (` in lacs)<br />

8. Break up of Deferred Tax Assets and Deferred Tax Liabilities:<br />

(a) Deferred Tax Assets:<br />

(i) Liabilities Allowable on Payment basis 2,92.64 2,06.76<br />

(ii) Provision for Doubtful Debts 1,31.91 97.29<br />

(iii) Provision for Inventory 3,30.94 —<br />

7,55.49 3,04.05<br />

(b) Deferred Tax Liabilities:<br />

Depreciation 16,84.20 16,80.85