EXCEL CROP CARE LIMITED C O N T E N T S - BSE

EXCEL CROP CARE LIMITED C O N T E N T S - BSE

EXCEL CROP CARE LIMITED C O N T E N T S - BSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EXCEL</strong> <strong>CROP</strong> <strong>CARE</strong> <strong>LIMITED</strong><br />

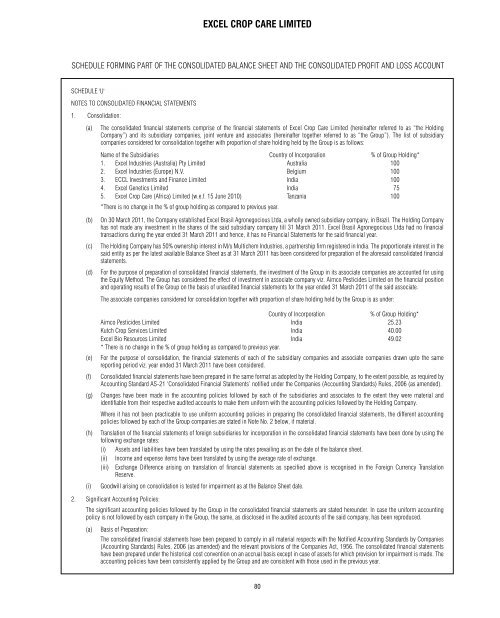

SCHEDULE FORMING PART OF THE CONSOLIDATED BALANCE SHEET AND THE CONSOLIDATED PROFIT AND LOSS ACCOUNT<br />

SCHEDULE 'U' (Contd.)<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

1. Consolidation:<br />

(a) The consolidated financial statements comprise of the financial statements of Excel Crop Care Limited (hereinafter referred to as “the Holding<br />

Company”) and its subsidiary companies, joint venture and associates (hereinafter together referred to as “the Group”). The list of subsidiary<br />

companies considered for consolidation together with proportion of share holding held by the Group is as follows:<br />

Name of the Subsidiaries Country of Incorporation % of Group Holding*<br />

1. Excel Industries (Australia) Pty Limited Australia 100<br />

2. Excel Industries (Europe) N.V. Belgium 100<br />

3. ECCL Investments and Finance Limited India 100<br />

4. Excel Genetics Limited India 75<br />

5. Excel Crop Care (Africa) Limited (w.e.f. 15 June 2010) Tanzania 100<br />

*There is no change in the % of group holding as compared to previous year.<br />

(b) On 30 March 2011, the Company established Excel Brasil Agronegocious Ltda, a wholly owned subsidiary company, in Brazil. The Holding Company<br />

has not made any investment in the shares of the said subsidiary company till 31 March 2011. Excel Brasil Agronegocious Ltda had no financial<br />

transactions during the year ended 31 March 2011 and hence, it has no Financial Statements for the said financial year.<br />

(c) The Holding Company has 50% ownership interest in M/s Multichem Industries, a partnership firm registered in India. The proportionate interest in the<br />

said entity as per the latest available Balance Sheet as at 31 March 2011 has been considered for preparation of the aforesaid consolidated financial<br />

statements.<br />

(d) For the purpose of preparation of consolidated financial statements, the investment of the Group in its associate companies are accounted for using<br />

the Equity Method. The Group has considered the effect of investment in associate company viz. Aimco Pesticides Limited on the financial position<br />

and operating results of the Group on the basis of unaudited financial statements for the year ended 31 March 2011 of the said associate.<br />

The associate companies considered for consolidation together with proportion of share holding held by the Group is as under:<br />

Country of Incorporation % of Group Holding*<br />

Aimco Pesticides Limited India 25.23<br />

Kutch Crop Services Limited India 40.00<br />

Excel Bio Resources Limited India 49.02<br />

(e)<br />

* There is no change in the % of group holding as compared to previous year.<br />

For the purpose of consolidation, the financial statements of each of the subsidiary companies and associate companies drawn upto the same<br />

reporting period viz. year ended 31 March 2011 have been considered.<br />

(f) Consolidated financial statements have been prepared in the same format as adopted by the Holding Company, to the extent possible, as required by<br />

Accounting Standard AS-21 ‘Consolidated Financial Statements’ notified under the Companies (Accounting Standards) Rules, 2006 (as amended).<br />

(g) Changes have been made in the accounting policies followed by each of the subsidiaries and associates to the extent they were material and<br />

identifiable from their respective audited accounts to make them uniform with the accounting policies followed by the Holding Company.<br />

Where it has not been practicable to use uniform accounting policies in preparing the consolidated financial statements, the different accounting<br />

policies followed by each of the Group companies are stated in Note No. 2 below, if material.<br />

(h) Translation of the financial statements of foreign subsidiaries for incorporation in the consolidated financial statements have been done by using the<br />

following exchange rates:<br />

(i) Assets and liabilities have been translated by using the rates prevailing as on the date of the balance sheet.<br />

(ii) Income and expense items have been translated by using the average rate of exchange.<br />

(i)<br />

(iii) Exchange Difference arising on translation of financial statements as specified above is recognised in the Foreign Currency Translation<br />

Reserve.<br />

Goodwill arising on consolidation is tested for impairment as at the Balance Sheet date.<br />

2. Significant Accounting Policies:<br />

The significant accounting policies followed by the Group in the consolidated financial statements are stated hereunder. In case the uniform accounting<br />

policy is not followed by each company in the Group, the same, as disclosed in the audited accounts of the said company, has been reproduced.<br />

(a) Basis of Preparation:<br />

The consolidated financial statements have been prepared to comply in all material respects with the Notified Accounting Standards by Companies<br />

(Accounting Standards) Rules, 2006 (as amended) and the relevant provisions of the Companies Act, 1956. The consolidated financial statements<br />

have been prepared under the historical cost convention on an accrual basis except in case of assets for which provision for impairment is made. The<br />

accounting policies have been consistently applied by the Group and are consistent with those used in the previous year.<br />

80