IN WESTERN AUSTRALIA - Department of Mines and Petroleum

IN WESTERN AUSTRALIA - Department of Mines and Petroleum

IN WESTERN AUSTRALIA - Department of Mines and Petroleum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

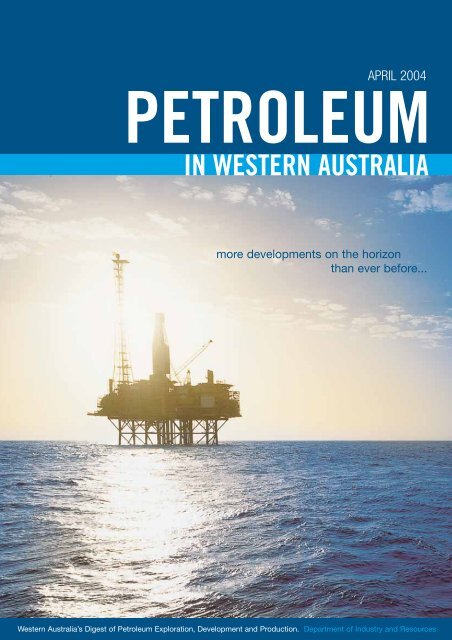

APRIL 2004<br />

PETROLEUM<br />

<strong>IN</strong> <strong>WESTERN</strong> <strong>AUSTRALIA</strong><br />

more developments on the horizon<br />

than ever before...<br />

Western Australia’s Digest <strong>of</strong> <strong>Petroleum</strong> Exploration, Development <strong>and</strong> Production. <strong>Department</strong> <strong>of</strong> Industry <strong>and</strong> Resources

april 2004<br />

<strong>Petroleum</strong> <strong>and</strong> Royalties Division - Mineral House<br />

100 Plain Street, East Perth, Western Australia 6004<br />

Tel +61 8 9222 3273 Fax +61 8 9222 3799<br />

www.doir.wa.gov.au<br />

Publisher - RIU Resource Information Unit<br />

Tel +61 8 9382 3955 Fax +61 8 9388 1025<br />

www.riu.com.au<br />

Design & Artwork - Triton Corporate<br />

Tel +61 8 9325 1644 Fax +61 8 9325 1644<br />

www.tritoncorporate.com.au<br />

Editor - Darren Ferdin<strong>and</strong>o<br />

Email darren.ferdin<strong>and</strong>o@doir.wa.gov.au<br />

Cover Photo:<br />

Goldwyn ‘A’ Platform<br />

(Photo Courtesy <strong>of</strong> Woodside Energy).<br />

All expressions <strong>of</strong> opinion are published here on the basis that they are not<br />

to be regarded as expressing the <strong>of</strong>ficial views <strong>of</strong> the <strong>Department</strong> <strong>of</strong><br />

Industry <strong>and</strong> Resources. The <strong>Department</strong> accepts no responsibility for the<br />

accuracy <strong>of</strong> any <strong>of</strong> the opinions or information contained herein <strong>and</strong> readers<br />

should rely on their own enquiries in making any decisions touching<br />

upon their own interests.<br />

Contents<br />

PWA April Edition - Contents<br />

International Contacts 2<br />

Minister’s Message 3<br />

Director’s Comment 5<br />

Review <strong>of</strong> 2003 - Exploration, Production <strong>and</strong> Development Activities in Western Australia 7<br />

Resource Branch’s Recent Activities 22<br />

Magnetotelluric Surveys for <strong>Petroleum</strong> Exploration in Western Australia 24<br />

State Acreage Release March 2004 28<br />

Diving Regulations 32<br />

Coal Seam Methane - what’s the gas? 34<br />

International Risk Consultancy - Company Focus 37<br />

Table 1. Reserves as at 31 December 2003 - Developed Fields 39<br />

Table 2. Reserves as at 31 December 2003 - Undeveloped Fields 39<br />

Table 3. Unbooked Resources as at 31 December 2003 40<br />

Table 4. Cumulative Production to 2003 40<br />

Table 5. Production by Field to 2003 41<br />

Table 6. Seismic Surveys in Western Australia 2003 Calendar Year 42<br />

Table 7. <strong>Petroleum</strong> Wells in Western Australia 2003 Calendar Year 42<br />

Table 8. Seismic Surveys in Western Australia Operating 2003 Calendar Year 43<br />

Table 9. <strong>Petroleum</strong> Wells in Western Australia Operating 2003 Calendar Year 44<br />

Table 10. Western Australia list <strong>of</strong> <strong>Petroleum</strong> Titles <strong>and</strong> Holders as at 15 April 2004 45<br />

<strong>Department</strong> <strong>of</strong> Industry <strong>and</strong> Resources - Key Contacts 57<br />

<strong>Department</strong> <strong>of</strong><br />

Industry <strong>and</strong> Resources<br />

Western Australia’s Digest <strong>of</strong> <strong>Petroleum</strong> Exploration, Development <strong>and</strong> Production.<br />

<strong>Department</strong> <strong>of</strong> Industry <strong>and</strong> Resources.<br />

1

2<br />

PWA April Edition - International Contacts<br />

International<br />

Contacts<br />

CH<strong>IN</strong>A - Shanghai<br />

Mr BJ Zhuang, Regional Director<br />

Western Australian Trade & Investment Promotion<br />

Shanghai Representative Office<br />

Room 2208 CITIC Square<br />

1168 Nanjing Road West<br />

SHANGHAI 200041<br />

PEOPLES REPUBLIC OF CH<strong>IN</strong>A<br />

Tel: +86 21 5292 5899<br />

Mobile: +86 1390 175 8192 (for BJ Zhuang)<br />

Fax: +86 21 5292 5889<br />

E-mail: bj.zhuang@doir.wa.gov.au<br />

CH<strong>IN</strong>A - Hangzhou<br />

Ms Stella Bu, Manager<br />

Western Australian Trade & Investment Promotion<br />

Hangzhou Representative Office<br />

Room 910, World Trade Office Plaza<br />

Zhejiang World Trade Centre<br />

15 Shuguang Road<br />

HANGZHOU 310007<br />

PEOPLES REPUBLIC OF CH<strong>IN</strong>A<br />

Tel: +86 571 8795 0296<br />

Fax: +86 571 8795 0295<br />

E-mail: stella.bu@doir.wa.gov.au<br />

EUROPE - London<br />

Mr Robert Fisher, Agent General<br />

Government <strong>of</strong> West. Aust. - European Office<br />

5th Floor, Australia Centre<br />

Corner <strong>of</strong> Str<strong>and</strong> & Melbourne Place<br />

LONDON WC2B 4LG<br />

UNITED K<strong>IN</strong>GDOM<br />

Tel: +44 20 7240 2881<br />

Fax: +44 20 7240 6637<br />

E-mail: agent_general@wago.co.uk<br />

Website: www.wago.co.uk<br />

<strong>IN</strong>DIA - Mumbai<br />

Ms Sonia Grinceri, Regional Director<br />

Western Australian Trade Office<br />

93, Jolly Maker Chambers No2<br />

9th Floor, Nariman Point<br />

MUMBAI 400 021<br />

<strong>IN</strong>DIA<br />

Tel: +91 22 5630 3973/74 & 78<br />

Fax +91 22 5630 3977<br />

E-mail: sonia.grinceri@doir.wa.gov.au<br />

<strong>IN</strong>DIA - Chennai (Madras)<br />

Mr K.V. Rajan Senior Trade Advisor<br />

1 Doshi Regency<br />

876 Poonamallee High Road Kilpauk<br />

CHENNAI 600 084 <strong>IN</strong>DIA<br />

Tel: +91 44 2640 0407<br />

Tel/Fax: +91 44 2643 0064<br />

Mobile: +91 098 410 4364<br />

E-mail: KVV.RAJAN@doir.wa.gov.au<br />

<strong>IN</strong>DONESIA - Jakarta<br />

Mr Trevor Boughton, Regional Director<br />

Western Australia Trade Office<br />

Australian Trade Commission<br />

Australian Embassy<br />

Jl H R Rasuna Said Kav C15-16<br />

Kuningan JAKARTA 12940 <strong>IN</strong>DONESIA<br />

Tel: +6221 2550 5331<br />

Fax: +6221 522 7103<br />

Mobile: +62 81 2301 4891<br />

Email: trevor.boughton@austrade.gov.au<br />

<strong>IN</strong>DONESIA - Surabaya<br />

Ms Lydia Agam, Manager<br />

Western Australia Trade Office<br />

Graha Pena, 17th Floor<br />

Jl. Ahmad Yani 88<br />

SURABAYA 60234 <strong>IN</strong>DONESIA<br />

Tel: +6231 829 9979<br />

Fax: +6231 829 9975<br />

Mobile: 62 81 2301 4892<br />

Email: lydia.agam@doir.wa.gov.au<br />

JAPAN - Tokyo<br />

Mr Craig Peacock, Official Representative<br />

North Asia<br />

Government <strong>of</strong> Western Australia Office<br />

Australian Business Centre<br />

28th Floor, New Otani Garden Court<br />

4-1 Kioicho, Chiyoda-Ku<br />

TOKYO 102-0094 JAPAN<br />

Tel: +81 3 5214 0791<br />

Fax: +81 3 5214 0796<br />

Email: tokyo@wajapan.net<br />

Web: www.wajapan.net<br />

JAPAN - Kobe<br />

Ms Noriko Hirata, Manager<br />

Government <strong>of</strong> Western Australia Office<br />

6th Floor Golden Sun Building<br />

3-6 Nakayamate-dori<br />

4-Chome Chuo-Ku<br />

KOBE 650-0004 JAPAN<br />

Tel: +81 78 242 7705<br />

Fax: +81 78 242 7707<br />

Email: kobe@wajapan.net<br />

MALAYSIA<br />

Ms Elaine Yong, Regional Director<br />

Western Australian Trade Office<br />

4th Floor, UBN Tower<br />

10 Jalan P Ramlee<br />

KUALA LUMPUR 50250 MALAYSIA<br />

Tel: +603 2031 8175/6<br />

Fax: +603 2031 8177<br />

Mobile: 012 2388 174<br />

E-mail: elaine.yong@doir.wa.gov.au<br />

MIDDLE EAST - Dubai<br />

Mr Chris Heysen, Regional Director<br />

Western Australian Trade Office<br />

Suite 106, Emarat Atrium Blg.<br />

PO Box 58007 DUBAI<br />

UNITED ARAB EMIRATES<br />

Tel: +971 4 343 3226<br />

Fax: +971 4 343 3238<br />

Mobile: +971 50 4567 448<br />

E-mail: chris.heysen@wato.ae<br />

TAIWAN- Taipei<br />

Mr Nicholas McKay,<br />

WA Business Development Manager<br />

Australian Commerce & Industry Office<br />

Australian Business Centre<br />

Suite 2606, International Trade Building<br />

#333 Keelung Road Section 1<br />

TAIPEI 110 TAIWAN R.O.C.<br />

Tel: +886 2 8725 4280<br />

Fax: +886 2 2757 6707<br />

Mobile: +886 937 455 431<br />

E-Mail: nicholas.mckay@austrade.gov.au<br />

THAILAND - Bangkok<br />

Mr Siraphop Apilertvorakorn, WA Business<br />

Development Manager<br />

Australian Trade Commission<br />

Australian Embassy<br />

37 South Sathorn Road<br />

BANGKOK 10120 THAILAND<br />

Tel: +662 287 2680 Ext 3307<br />

Fax: +662 287 2589 or<br />

+662 679 2090<br />

E-mail: siraphop@austrade.gov.au<br />

<strong>Department</strong> <strong>of</strong><br />

Industry <strong>and</strong> Resources<br />

PETROLEUM AND ROYALTIES DIVISION<br />

Mineral House<br />

100 Plain Street, East Perth<br />

Western Australia 6004<br />

Telephone +61 8 9222 3333<br />

Facsimile +61 9222 3430<br />

www.doir.wa.gov.au

The oil <strong>and</strong> gas industry is a significant contributor<br />

to the economic development <strong>of</strong> Western Australia<br />

<strong>and</strong> is the State’s largest resource sector, with total<br />

petroleum sales in 2002–03 <strong>of</strong> more than $10<br />

billion, or 37 per cent <strong>of</strong> the total value <strong>of</strong> the<br />

State’s mineral <strong>and</strong> petroleum sales, <strong>and</strong> annual<br />

exports <strong>of</strong> $7.8 billion in 2002–03 (Figure 1).<br />

The industry directly employs over 13,000 people in<br />

Australia. Around 900 Western Australian service<br />

<strong>and</strong> contracting companies are involved in the<br />

industry.<br />

The oil <strong>and</strong> gas industry has enormous potential,<br />

with increasing dem<strong>and</strong> for LNG in the USA, China,<br />

Korea <strong>and</strong> Japan, as well as opportunities for<br />

further downstream processing in WA. Gas is also a<br />

major source <strong>of</strong> energy for the State in electricity<br />

generation, minerals processing <strong>and</strong> service<br />

provision.<br />

Gold<br />

12%<br />

Iron ore<br />

20%<br />

Alumina<br />

11%<br />

Nickel<br />

9%<br />

Others<br />

11%<br />

<strong>Petroleum</strong><br />

37%<br />

Minister’s Message<br />

Western Australia is increasingly becoming a major<br />

player in the global oil <strong>and</strong> gas industry. This<br />

position is predicated on a number <strong>of</strong> strategic<br />

advantages.<br />

First, WA has significant petroleum reserves, with<br />

our already world-class natural gas reserves<br />

expected to increase substantially with further<br />

exploration <strong>and</strong> advances in technology.<br />

Second, WA has a strong record <strong>of</strong> meeting supply<br />

commitments, led by Woodside’s faultless record in<br />

the export <strong>of</strong> LNG to Japan over the last two<br />

decades. This record contributes to Western<br />

Australia’s reputation as a low sovereign risk<br />

environment.<br />

Third, WA is proximate to many <strong>of</strong> the world’s<br />

fastest growing economies, making us ideally<br />

placed to both meet their energy needs <strong>and</strong> assist<br />

them in developing their own oil <strong>and</strong> gas industries.<br />

Crude Oil<br />

41%<br />

Natural Gas<br />

6%<br />

Condensate<br />

19%<br />

LPG - Butane<br />

2%<br />

LNG<br />

30%<br />

LPG - Propane<br />

2%<br />

Figure 1. Western Australia Resources Sales 2002-03 - $A27.9 billion (Graphic source: DoIR)<br />

PWA April Edition - Minister’s Message<br />

Hon. Clive Brown,<br />

Minister for State Development Western Australia<br />

Fourth, WA has a high quality <strong>and</strong> diverse skills<br />

base, with our traditional trades skills<br />

complemented by growing expertise in engineering<br />

design, engineering construction <strong>and</strong> fabrication.<br />

Fifth, WA is a wonderful place in which to live <strong>and</strong><br />

do business. We have a high <strong>and</strong> affordable<br />

st<strong>and</strong>ard <strong>of</strong> living <strong>and</strong> a warm <strong>and</strong> welcoming<br />

society.<br />

The challenge for WA is to take advantage <strong>of</strong> these<br />

strategic advantages <strong>and</strong> continue to become a<br />

major player in all levels <strong>of</strong> the oil <strong>and</strong> gas industry.<br />

We have to utilise WA’s strategic advantages <strong>and</strong><br />

the current boom in projects to develop local service<br />

<strong>and</strong> supply capabilities. It is for this reason that I<br />

organised the Summit on Maximising Western<br />

Australian Business <strong>and</strong> Employment Opportunities,<br />

which was held on Friday 27 February 2004 in the<br />

Legislative Assembly <strong>of</strong> the Western Australian<br />

Parliament.<br />

My vision is for a local support industry that will be<br />

able to provide competitively priced services <strong>and</strong><br />

supplies not only to our local Western Australia<br />

projects but also to the Asia Pacific region.<br />

Over 60 representatives <strong>of</strong> Industry, Government<br />

<strong>and</strong> the Unions attended the Summit to discuss<br />

ways to maximise the benefits to Western<br />

Australians from the State’s major oil <strong>and</strong> gas<br />

projects. It was a common view <strong>of</strong> those who<br />

attended that all parties should work together to<br />

maximise the business <strong>and</strong> employment<br />

opportunities. It was also a common view that<br />

ongoing communication <strong>and</strong> the building <strong>of</strong> trust<br />

between the key stakeholders were essential if<br />

progress was to continue.<br />

The major outcome <strong>of</strong> the Summit was the<br />

establishment <strong>of</strong> a new Coordinating Council which I<br />

3

4<br />

PWA April Edition - Minister’s Message<br />

will chair. The Tripartite Council will consist <strong>of</strong><br />

Industry, Government <strong>and</strong> Union movement leaders<br />

<strong>and</strong> will, for the first time, facilitate ongoing<br />

communication between the oil <strong>and</strong> gas industry’s<br />

major stakeholders.<br />

Early focus is to be on strategies to:<br />

• address barriers <strong>and</strong> impediments to accessing<br />

resources;<br />

• address <strong>and</strong> overcome barriers <strong>and</strong><br />

impediments to the successful participation <strong>of</strong><br />

local companies in the oil <strong>and</strong> gas industry;<br />

• urgently address current <strong>and</strong> future skill<br />

requirements in the industry <strong>and</strong> develop <strong>and</strong><br />

coordinate an oil <strong>and</strong> gas industry <strong>and</strong><br />

associated service industries training plan.<br />

I look forward to working with the new<br />

Coordinating Council to maximise business <strong>and</strong><br />

employment opportunities throughout the State. DoIR<br />

Linda oilfield’s jacket <strong>and</strong> deck, which were fabricated at the Australian Marine Complex.

2004 - It’s going to be a busy year<br />

<strong>Petroleum</strong> exploration in Western Australia has<br />

recovered to 2001 levels <strong>and</strong> there are more<br />

upstream developments on the horizon than we<br />

have ever had. About $11 billion in upstream oil<br />

<strong>and</strong> gas developments are either committed to or<br />

being evaluated prior to final commitment. The<br />

<strong>Petroleum</strong> <strong>and</strong> Royalties Division has a higher<br />

than ever base workload. In addition to this<br />

increased base load activity, the Division is<br />

implementing change on a number <strong>of</strong> fronts:<br />

NOPSA Transition<br />

The National Offshore <strong>Petroleum</strong> Safety Authority<br />

(NOPSA) is to start operation on the 1st <strong>of</strong> January<br />

2005. Western Australia has to prepare for the<br />

transfer <strong>of</strong> responsibility through amending State<br />

legislation <strong>and</strong> providing a seamless h<strong>and</strong>over. The<br />

State is unique in being the only State/Territory with<br />

Safety Offshore<br />

State<br />

7%<br />

PETROLEUM DIVISION WORK FUNCTIONS<br />

Onshore Pipelines<br />

Safety Onshore<br />

State<br />

Safety Offshore<br />

Cwlth<br />

15%<br />

5%<br />

5%<br />

Environment<br />

10%<br />

* 22% to NOPSA 1-1-05<br />

* Prior to Royalties joining the Division<br />

*<br />

*<br />

significant oil <strong>and</strong> gas operations <strong>of</strong>fshore in State<br />

waters <strong>and</strong> this has complicated arrangements.<br />

Detailed transition plans are being developed to<br />

identify interfaces between the continuing role <strong>of</strong><br />

the <strong>Department</strong> <strong>of</strong> Industry <strong>and</strong> Resources (DoIR) as<br />

the Designated Authority (DA) <strong>and</strong> NOPSA. DoIR will<br />

continue to provide regulatory services both <strong>of</strong>fshore<br />

<strong>and</strong> onshore for petroleum titles, resource<br />

management, <strong>and</strong> environment. Additionally, DoIR<br />

will provide regulatory services for onshore safety<br />

including drilling <strong>and</strong> production <strong>and</strong> pipelines as<br />

well as for some <strong>of</strong>fshore activities. An estimated<br />

split <strong>of</strong> resources necessary for these functions is<br />

shown in Figure 1. DoIR will effectively h<strong>and</strong> over<br />

22% <strong>of</strong> its responsibilities to NOPSA. A seminar is<br />

planned for later in the year (sponsored by NOPSA,<br />

DoIR, APPEA <strong>and</strong> the ACTU) to broadcast<br />

arrangements for the transition.<br />

Titles<br />

22%<br />

Admin/Exec<br />

10%<br />

Figure 1. Split <strong>of</strong> resources between DoIR <strong>and</strong> NOPSA<br />

Resources<br />

26%<br />

PWA April Edition - Director’s Comment<br />

Bill Tinapple,<br />

Director, <strong>Petroleum</strong> <strong>and</strong> Royalties Division<br />

Legislation Amendments<br />

There are currently two petroleum legislation<br />

amendment bills <strong>of</strong> major significance being<br />

drafted:<br />

• NOPSA Amendments:<br />

These amendments to the WA petroleum<br />

legislation (<strong>Petroleum</strong> (Submerged L<strong>and</strong>s) Act<br />

1982, <strong>Petroleum</strong> Act 1967, <strong>and</strong> <strong>Petroleum</strong><br />

Pipelines Act 1969) will enable NOPSA to<br />

regulate safety in all the State’s coastal waters<br />

<strong>and</strong> under certain circumstances onshore, for<br />

example, where a pipeline development extends<br />

from <strong>of</strong>fshore to onshore. On those occasions,<br />

NOPSA will be contracted by way <strong>of</strong> a service<br />

level agreement. This package will also include<br />

the consequential amendments to the State’s<br />

submerged l<strong>and</strong>s legislation to allow for the<br />

Commonwealth’s plain English rewrite <strong>of</strong> the<br />

<strong>Petroleum</strong> (Submerged L<strong>and</strong>s) Act 1967.<br />

• Common Mining Code/Gorgon CO 2<br />

sequestration/Environmental<br />

Regulations/National Competition Policy<br />

Amendments:<br />

These amendments provide for the common<br />

mining code changes since 1994, changes to<br />

the <strong>Petroleum</strong> Act 1967 <strong>and</strong> the <strong>Petroleum</strong><br />

Pipelines Act 1969 to provide coverage <strong>of</strong> CO 2<br />

sequestration in the State’s onshore petroleum<br />

legislation to cater for the Gorgon gas<br />

development on Barrow Isl<strong>and</strong>, provision for the<br />

drafting <strong>of</strong> environmental regulations in all State<br />

petroleum legislation <strong>and</strong> minor National<br />

Competition Policy amendments.<br />

Workshop Outcomes<br />

Following the successful feedback received from the<br />

three breakfast workshops held by DoIR late in<br />

5

6<br />

PWA April Edition - Director’s Comment<br />

2003, the <strong>Department</strong> is following up to implement<br />

the recommendations made at the workshops.<br />

Topics presented <strong>and</strong> recommended actions were<br />

as follows.<br />

• Simplifying the <strong>Petroleum</strong> Act<br />

The <strong>Department</strong> is continuing to refine<br />

amendments. A discussion paper is being<br />

developed. Further consultation will be<br />

organised.<br />

• Greenfield/Frontier Exploration<br />

The APPEA Exploration Subcommittee proposals<br />

for a cascade title gazettal system to determine<br />

which acreage should be classified as frontier<br />

acreage has now been endorsed by the APPEA<br />

Council <strong>and</strong> is being evaluated by Government.<br />

An Exploration Working Group has been<br />

established by the Upstream <strong>Petroleum</strong><br />

Subcommittee.<br />

• Early Access to Data<br />

Industry placed a high priority on gaining early<br />

access to basic data <strong>and</strong> requested that<br />

Government endeavour to get more information<br />

out sooner. Data transcription <strong>and</strong> reprocessing <strong>of</strong><br />

seismic data is being given a high priority by DoIR.<br />

• Aquifer Depletion Studies<br />

DoIR has carried out aquifer depletion studies<br />

for the Barrow <strong>and</strong> Dampier Sub-basins, which<br />

indicated significant resources are potentially<br />

being lost. The <strong>Department</strong> is proposing that a<br />

national government <strong>and</strong> industry working group<br />

be established under the auspices <strong>of</strong> the<br />

Ministerial Council on Mineral <strong>and</strong> <strong>Petroleum</strong><br />

Resources to assess the implications <strong>of</strong> the<br />

issue <strong>and</strong> develop policies to address prevention<br />

<strong>and</strong> corrective measures.<br />

WA Acreage Releases<br />

In a continuing effort to maintain exploration,<br />

acreage releases are planned as follows:<br />

• WA State release opens on 30 March 2004 <strong>and</strong><br />

bids close 23 September 2004 with 3 blocks in<br />

State Waters in the Northern Carnarvon Basin, 2<br />

blocks onshore in the Perth Basin, <strong>and</strong> 1 block<br />

in the Officer Basin; <strong>and</strong><br />

• Commonwealth acreage release 2004 to be<br />

announced 29 March 2004, with the 1st round<br />

closing 30 September 2004. This round has 3<br />

blocks in the outer northern Rankin Platform, 3<br />

blocks in the Barrow Sub-basin <strong>and</strong> Rankin<br />

Platform, 3 blocks in the Exmouth <strong>and</strong> Barrow<br />

Sub-basins <strong>and</strong> 1 block in the Vlaming Subbasin,<br />

Perth Basin. The 2nd round, closing 31<br />

March 2005, has 1 block in the Bonaparte<br />

Basin, 4 blocks in the Exmouth Plateau <strong>and</strong> 2<br />

blocks in the Houtman Sub-basin, Perth Basin.<br />

A re-release <strong>of</strong> the 2003 areas not taken up is<br />

planned for both the Commonwealth <strong>and</strong> State<br />

areas.<br />

Electronic <strong>Petroleum</strong> Register<br />

The Electronic <strong>Petroleum</strong> Register (EPR) upgrade<br />

from an old database system to a modern webbased<br />

system is reaching completion. In conjunction<br />

with this will be the pro<strong>of</strong> <strong>of</strong> concept testing <strong>of</strong> Eforms,<br />

which is the electronic update <strong>of</strong> information<br />

on the register from forms forwarded from<br />

companies electronically to the <strong>Petroleum</strong> <strong>and</strong><br />

Royalties Division.<br />

2004 Direction<br />

Whale investigating the Legendre Production Facility (image courtesy <strong>of</strong> Woodside)<br />

The <strong>Department</strong> is committed to completing these<br />

activities in an effective manner, which will maintain<br />

the emphasis on stakeholder satisfaction that we<br />

have set as a benchmark. DoIR

Review <strong>of</strong> 2003<br />

Exploration, Production <strong>and</strong> Development Activities in Western Australia<br />

During the 2003 calendar year, 77 petroleum<br />

wells were drilled in Western Australia;<br />

comprising 14 development wells, 21 extension<br />

wells, <strong>and</strong> 42 new field wildcat wells. This level <strong>of</strong><br />

activity marks a significant increase on the<br />

previous year, where 51 wells were drilled. This<br />

has brought the State back to the high level <strong>of</strong><br />

drilling activity seen in 2000 <strong>and</strong> 2001 where 75<br />

wells were drilled in each <strong>of</strong> those years. The<br />

current level <strong>of</strong> activity is partly attributable to the<br />

continuing high oil price <strong>and</strong> improvements in the<br />

gas sales market. On a national level, Western<br />

Australia has attracted over 70% <strong>of</strong> Australia’s<br />

petroleum exploration expenditure during the<br />

year, indicating the State remains the most<br />

prospective area <strong>of</strong> Australia for new petroleum<br />

finds (Figure 1).<br />

Activity in the Perth Basin, particularly the northern<br />

portion <strong>of</strong> the basin, remains high, buoyed by the<br />

Cliff Head, Hovea <strong>and</strong> Jingemia discoveries in 2002<br />

(Figure 2). During 2003, three onshore <strong>and</strong> three<br />

<strong>of</strong>fshore exploration wells were drilled, along with<br />

10 development <strong>and</strong> extension wells drilled onshore<br />

<strong>and</strong> two extension wells drilled <strong>of</strong>fshore as part <strong>of</strong><br />

the Cliff Head project. Of the onshore exploration<br />

wells, Eremia 1 proved to be a success for ARC<br />

Energy just to the northwest <strong>of</strong> their Hovea<br />

discovery, while Eclipse 1 <strong>and</strong> Leafcutter 1 had<br />

some interesting gas shows, but were ab<strong>and</strong>oned<br />

as non-economic. The Northern Carnarvon Basin<br />

continues to be the centre <strong>of</strong> exploration <strong>and</strong><br />

development activity, with 31 <strong>of</strong> the 42 wildcat wells<br />

drilled in 2003 located in that basin, <strong>and</strong> 22<br />

development <strong>and</strong> extension wells spudded in the<br />

basin. A number <strong>of</strong> significant discoveries were<br />

made, including oil pools discovered by the BHP<br />

Billiton <strong>Petroleum</strong> (BHPBP) wells Stybarrow 1,<br />

Ravensworth 1 <strong>and</strong> Crosby 1 (Figure 3). Four<br />

exploration wells were spudded in the Browse<br />

Basin, two <strong>of</strong> these discovering gas in Inpex’s<br />

WA-285-P permit, with the Ichthys 2 extension well<br />

drilled in November to assess the gas discovery<br />

made by Ichthys 1 in June. The sole exploration well<br />

in the <strong>of</strong>fshore Bonaparte Basin, Woodside’s Weasel<br />

1, was plugged <strong>and</strong> ab<strong>and</strong>oned as a dry hole.<br />

The wave <strong>of</strong> drilling predicted last year in response<br />

to higher oil prices <strong>and</strong> an increase in gas contract<br />

availability appears to be occurring, with a mix <strong>of</strong><br />

exploration in both brownfields <strong>and</strong> greenfields<br />

areas. While some <strong>of</strong> the greenfields exploration<br />

results have been disappointing, for example the<br />

Maginnis <strong>and</strong> Strumbo wells in the Browse Basin,<br />

there is still a large amount <strong>of</strong> prospective acreage<br />

that is largely unexplored by modern techniques <strong>and</strong><br />

play concepts. Perhaps the most exciting <strong>of</strong> the<br />

upcoming greenfields exploration is the drilling <strong>of</strong><br />

the Sally May prospect (formerly known as the<br />

WA Exploration Expenditure ($ million)<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

136.3<br />

141.7<br />

119.7<br />

82<br />

85.3<br />

PWA April Edition - 2003 Review<br />

Darren Ferdin<strong>and</strong>o<br />

Research Geologist, Resources Branch<br />

Cetus prospect) in the central Canning Basin by<br />

Kingsway Resources 2001 later this year. If<br />

successful, this prospect has the potential to<br />

completely rewrite current thinking on the Canning<br />

Basin <strong>and</strong> introduce a number <strong>of</strong> new play targets<br />

to the region. In the coming year a number <strong>of</strong><br />

critical wells are also planned for the onshore<br />

northern Perth Basin, <strong>and</strong> success with these will<br />

help push the boundary <strong>of</strong> the region deemed<br />

prospective for liquid hydrocarbons further south.<br />

This, in turn will help spur on further exploration in<br />

the central Perth Basin region.<br />

The Whicher Range 5 well, drilled in the southern<br />

Perth Basin during the second half <strong>of</strong> the year,<br />

proved to be a mixed result for Amity Oil. While<br />

there is no question that there is a large gas<br />

resource in the Whicher Range field, the extraction<br />

<strong>of</strong> the gas from tight s<strong>and</strong>stone units affected by<br />

170.2<br />

191.5<br />

151.3<br />

177.9<br />

Sep-01 Dec-01 Mar-02 Jun-02 Sep-02 Dec-02 Mar-03 Jun-03 Sep-03<br />

Figure 1. <strong>Petroleum</strong> exploration expenditure in WA <strong>and</strong> % <strong>of</strong> total exploration expenditure in Australia.<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

7<br />

Percentage <strong>of</strong> Australian Exploration Expenditure

8<br />

PWA April Edition - 2003 Review<br />

swelling clays is proving to be a technological<br />

challenge. Work is currently being undertaken by<br />

Amity Oil to look at stimulating the reservoir so that<br />

commercial quantities <strong>of</strong> gas may be obtained from<br />

the field. As the Whicher Range field is situated at the<br />

southern end <strong>of</strong> the Dampier to Bunbury gas pipeline,<br />

it is strategically located to provide gas to a large<br />

number <strong>of</strong> electricity-intensive industries in the South<br />

West, such as the Alcoa aluminium operations.<br />

Looking at other greenfields locations likely to be<br />

explored in the coming year, the <strong>of</strong>fshore northern<br />

Perth Basin will again see significant activity.<br />

Despite the disappointment associated with the<br />

drilling <strong>of</strong> Twin Lions, Vindara <strong>and</strong> Mentelle in<br />

February 2003 <strong>and</strong> Morangie in 2002, some<br />

interesting results were obtained. Residual oil<br />

columns were recorded in a number <strong>of</strong> these wells<br />

in Late <strong>and</strong> Early Permian s<strong>and</strong>stones, with followup<br />

drilling expected to occur soon in the Apache<br />

Energy <strong>and</strong> ROC Oil operated permits between<br />

Dongara <strong>and</strong> the Abrolhos Isl<strong>and</strong>s.<br />

Continued exploration in the Exmouth Sub-basin on<br />

targets found using the 2D <strong>and</strong> 3D seismic<br />

coverage acquired over the last few years paid<br />

dividends this year for BHPBP. The play fairway they<br />

modelled in the centre <strong>of</strong> the sub-basin came up<br />

trumps for Stybarrow with 18.6 m <strong>of</strong> net oil pay <strong>and</strong><br />

this was followed-up by successful drilling <strong>of</strong> the<br />

Ravensworth prospect, with the well encountering a<br />

37 m oil column overlain by a 7 m gas cap. Even<br />

the Eskdale prospect, which appears to be<br />

subcommercial, was a technical success for BHPBP<br />

with oil shows in tight s<strong>and</strong>stone confirming the<br />

presence <strong>of</strong> a valid trap <strong>and</strong> oil migration. BHPBP<br />

were not as successful in the Browse Basin<br />

however, with their first well in the region, Maginnis<br />

1, penetrating a thick pile <strong>of</strong> volcanic sediment <strong>and</strong><br />

basalt in what was interpreted to be Plover<br />

S<strong>and</strong>stone. While this is a set-back for BHPBP <strong>and</strong><br />

its Joint Venture partners in these permits, the size<br />

<strong>of</strong> some <strong>of</strong> the possible traps <strong>and</strong> the presence <strong>of</strong><br />

source <strong>and</strong> migration to the east <strong>and</strong> possibly the<br />

west, mean that work here will continue. BHPBP are<br />

currently re-evaluating their data on the region so<br />

the extent <strong>and</strong> impact <strong>of</strong> Jurassic volcanic activity<br />

on the petroleum prospectivity is fully understood.<br />

Exploration activity in the Barrow Sub-basin was<br />

once again dominated by Apache Energy operated<br />

Joint Ventures, assisted by Tap Oil <strong>and</strong> Woodside<br />

Energy operated Joint Ventures. While no significant<br />

new discoveries were made in the sub-basin, a<br />

number <strong>of</strong> small discoveries were made in permits<br />

under Apache operatorship, which are likely to be<br />

put into production in the near future. The Apache<br />

philosophy <strong>of</strong> drilling many, low-cost wells over<br />

relatively small prospects in an area where it has a<br />

strong underst<strong>and</strong>ing <strong>of</strong> the petroleum system,<br />

instead <strong>of</strong> focussing on finding high-risk, highreward<br />

targets, appears to be paying <strong>of</strong>f. The<br />

Blackdragon prospect, which will be drilled early in<br />

2004, is perhaps the exception to this, but all<br />

indications from Apache are that this prospect looks<br />

extremely good.<br />

The level <strong>of</strong> exploration activity seen in Western<br />

Australia at present appears to be sustainable over<br />

the medium term based on the number <strong>of</strong> wells that<br />

are to be drilled as part <strong>of</strong> permit commitments for<br />

the next 5 years. The acreage in both<br />

Commonwealth <strong>and</strong> State areas that was released<br />

over the last two years have now in almost all cases<br />

either successfully negotiated Native Title<br />

Agreements or are in the final stages <strong>of</strong> reaching<br />

Native Agreement <strong>and</strong> exploration will soon<br />

commence. Future release areas, with<br />

accompanying pre-competitive prospectivity<br />

packages <strong>and</strong> data, are underway with acreage in<br />

the Northern Carnarvon, Perth <strong>and</strong> Officer Basins<br />

<strong>and</strong> a future release <strong>of</strong> further Canning Basin areas<br />

in the planning stage. While the farmin market at<br />

present is sluggish, it is hoped that as interest in<br />

the exploration ‘hot spots’ <strong>of</strong> the Perth <strong>and</strong> Northern<br />

Carnarvon Basins increases, a number <strong>of</strong><br />

multinational <strong>and</strong> larger Australian ‘junior’ explorers<br />

will take the opportunity to invest in the prospective<br />

Western Australian acreage that will be on <strong>of</strong>fer in<br />

the coming year.<br />

On the production <strong>and</strong> development side, further<br />

development at the Hovea <strong>and</strong> Eremia oilfields,<br />

including drilling <strong>of</strong> water injector wells to assist in<br />

maintaining pressure support for the field continued<br />

with 4 development wells drilled there during 2003.<br />

Testing <strong>of</strong> the Jingemia oilfield in preparation for<br />

submission <strong>of</strong> a field development plan in 2004<br />

continued during the second half <strong>of</strong> 2003. In the<br />

<strong>of</strong>fshore Perth Basin, the Cliff Head oilfield was<br />

declared commercial by the Joint Venture <strong>and</strong> they<br />

have commenced front-end engineering <strong>and</strong> design<br />

studies <strong>and</strong> submitted a field development plan to<br />

DoIR. It is expected that first oil will come from the<br />

field in late 2005. Apache Energy drilled a number<br />

<strong>of</strong> development <strong>and</strong> appraisal wells, with two fields<br />

brought online as one or two well producers: Hoover<br />

<strong>and</strong> North Pedirka. The Enfield development, due to<br />

commence production in 2006, gained<br />

environmental approvals for the development <strong>and</strong><br />

were in the final stages <strong>of</strong> obtaining approval for<br />

their field development plan from the State <strong>and</strong><br />

Commonwealth upstream petroleum regulators.<br />

DoIR granted a retention lease over the Blacktip<br />

gasfield in late 2003 as one <strong>of</strong> the initial steps in<br />

bringing the field on-stream to supply gas to the<br />

Alcan aluminium refinery in Gove. During the year<br />

approval was also granted in principle by the State<br />

Government for the Gorgon gasfield development to<br />

commence, including the use <strong>of</strong> l<strong>and</strong> on Barrow<br />

Isl<strong>and</strong> (an ‘A’ class nature reserve) to house gas<br />

processing facilities.<br />

ACTIVITY BY BAS<strong>IN</strong><br />

Perth Basin<br />

Within the Perth Basin, three onshore <strong>and</strong> three<br />

<strong>of</strong>fshore exploration wells were drilled. The <strong>of</strong>fshore<br />

wells were follow-up wells to the Cliff Head<br />

discovery <strong>and</strong> all were plugged <strong>and</strong> ab<strong>and</strong>oned,<br />

with Twin Lions 1 <strong>and</strong> Vindara 1 classified as dry<br />

<strong>and</strong> Mentelle 1 having indications <strong>of</strong> a 50 m<br />

residual oil column. Of the onshore wells, Leafcutter<br />

1 intersected some interesting residual oil<br />

indications <strong>and</strong> Eclipse 1, drilled in the central Perth<br />

Basin, penetrated some minor oil shows in the<br />

Cattamarra Coal Measures. In October the OD&E<br />

Rig 28, brought in from SE Asia, spudded the<br />

Whicher Range 5 well. The well has been<br />

suspended after air-drilling operations failed to go<br />

as planned after water break-through. While<br />

elevated gas shows were recorded, further study is<br />

being undertaken by Amity Oil to assess whether a<br />

commercial flow can be obtained through a ‘dry’<br />

fracc process.<br />

The major success for 2003 in the Perth Basin was<br />

Eremia 1, drilled to the northwest <strong>of</strong> the Hovea<br />

oilfield. Development drilling for the Cliff Head<br />

oilfield saw Cliff Head 3 <strong>and</strong> 4 drilled early in 2003,<br />

<strong>and</strong> development <strong>of</strong> the Hovea oilfield saw Hovea<br />

wells 4 through to 10 drilled in 2003, with Hovea<br />

10 drilled as a water injector well to maintain<br />

pressure support for the Hovea field.<br />

Eremia 1<br />

ARC Energy drilled Eremia 1 in their L1 production<br />

permit, roughly 2 km to the north-northwest <strong>of</strong> the<br />

Hovea oilfield in a similar style <strong>of</strong> fault-bounded trap<br />

to that found in Hovea. The well intersected a 15 m<br />

oil column in the Upper Permian Dongara<br />

S<strong>and</strong>stone. The field has been production tested<br />

<strong>and</strong> is currently online <strong>and</strong> producing into the Hovea<br />

facility at a rate <strong>of</strong> 238 kL/d (1500 bbl/d). A followup<br />

horizontal well, Eremia 2 was drilled in November<br />

<strong>and</strong> completed as a producer.<br />

Northern Carnarvon Basin<br />

During the 2003 calendar year, 33 exploration <strong>and</strong><br />

22 development/extension wells were drilled in the<br />

Northern Carnarvon Basin. A number <strong>of</strong> oil <strong>and</strong> gas<br />

discoveries were made, the most significant <strong>of</strong><br />

which are Stybarrow, Ravensworth <strong>and</strong> Crosby.<br />

North Perdirka 1<br />

The North Perdirka oilfield is located approximately<br />

15 km east <strong>of</strong> Barrow Isl<strong>and</strong> in Apache operated<br />

licence TL/6. The well intersected an 8 m oil column<br />

in the Flag S<strong>and</strong>stone <strong>and</strong> was brought into<br />

production immediately through the Victoria Platform.<br />

Stybarrow 1<br />

The Stybarrow oilfield, operated by BHP Billiton<br />

<strong>Petroleum</strong> is located in WA-255-P. Stybarrow 1<br />

intersected a 23 m gross (18.6 m net) oil column in<br />

the top Macedon Member.<br />

Cyrano 1<br />

Cyrano 1 targeted a rollover anticline in the Tap Oil<br />

operated permit EP 364 (R1), 4 km to the southwest<br />

<strong>of</strong> the Nasutus oilfield. The well intersected a 29 m<br />

gross hydrocarbon column comprising a 19 m gas<br />

column in the Lower Cretaceous Mardie Greens<strong>and</strong>

GASCOYNE<br />

SIGNIFICANT<br />

HYDROCARBON DISCOVERIES<br />

CUVIER<br />

ABYSSAL<br />

PLA<strong>IN</strong><br />

<strong>IN</strong>DIAN<br />

ABYSSAL<br />

OCEAN<br />

Refer to Figure 3<br />

EXMOUTH<br />

PLATEAU<br />

CARNARVON<br />

PERTH<br />

NATURALISTE<br />

PLATEAU<br />

in <strong>WESTERN</strong> <strong>AUSTRALIA</strong><br />

ABYSSAL<br />

PLA<strong>IN</strong><br />

PLA<strong>IN</strong><br />

Oil<br />

GERALDTON<br />

ONSLOW<br />

EXMOUTH<br />

FREMANTLE<br />

ARGO ABYSSAL PLA<strong>IN</strong><br />

0 100 400<br />

<strong>Department</strong> <strong>of</strong><br />

Industry <strong>and</strong> Resources<br />

112^<br />

as at February 2004<br />

114^<br />

Gas<br />

Oil <strong>and</strong> Gas<br />

Kilometres<br />

DAMPIER - BUNBURY NATURAL GAS PIPEL<strong>IN</strong>E<br />

PARMELIA PIPEL<strong>IN</strong>E<br />

DAMPIER<br />

PORT HEDLAND<br />

KARRATHA ROEBOURNE<br />

PERTH<br />

BUNBURY<br />

BUSSELTON<br />

NORTH<br />

MEEKATHARRA<br />

Whicher Range<br />

116^<br />

MIDWEST PIPEL<strong>IN</strong>E<br />

See Enlargement<br />

Gingin<br />

ALBANY<br />

118^<br />

WEST<br />

Sumba<br />

NEWMAN<br />

<strong>IN</strong>DIAN<br />

OCEAN<br />

SCOTT<br />

PLATEAU<br />

SHELF<br />

Sawu<br />

Scott Reef<br />

Brecknock<br />

Brecknock South<br />

GOLDFIELDS<br />

NATURAL GAS<br />

SOUTHERN<br />

120^<br />

PIPEL<strong>IN</strong>E<br />

BROOME<br />

Roti<br />

Dinichthys<br />

Point Torment<br />

KALGOORLIE<br />

DERBY<br />

ESPERANCE<br />

Timor<br />

Territory <strong>of</strong> Ashmore<br />

<strong>and</strong><br />

Cartier Isl<strong>and</strong>s (N.T.)<br />

Titanichthys<br />

Ichthys<br />

Gorgonichthys<br />

Yulleroo<br />

Cudalgarra<br />

OCEAN<br />

Figure 2. Significant Hydrocarbon discoveries in Western Australia.<br />

122^<br />

Pictor<br />

124^<br />

PWA April Edition - 2003 Review 9<br />

Laminaria<br />

Saratoga<br />

Prometheus<br />

Cornea<br />

Lennard Shelf<br />

Oilfields<br />

Looma<br />

Joint <strong>Petroleum</strong><br />

Development Area<br />

Buffalo<br />

Proposed Bayu-Undan<br />

Pipeline<br />

Petrel<br />

Tern<br />

Blacktip<br />

Waggon Creek<br />

WYNDHAM<br />

St George Range<br />

GERALDTON<br />

Dongara<br />

Jingemia<br />

Cliff Head<br />

Beharra<br />

Springs<br />

Woodada<br />

126^<br />

MIDWEST PIPEL<strong>IN</strong>E<br />

Mt Horner<br />

Eremia<br />

Hovea<br />

Beharra<br />

Springs<br />

PARMELIA PIPEL<strong>IN</strong>E<br />

North<br />

GEOCENTRIC DATUM <strong>of</strong> <strong>AUSTRALIA</strong><br />

NTv2 GRID FILE TRANSFORMATION<br />

128^<br />

-12^<br />

-14^<br />

-16^<br />

-18^<br />

-20^<br />

-22^<br />

-24^<br />

-26^<br />

-28^<br />

-30^<br />

-32^<br />

-34^<br />

pwawellsGDA_Jan03.lat

10<br />

PWA April Edition - 2003 Review<br />

114^ 116^<br />

<strong>Department</strong> <strong>of</strong><br />

Industry <strong>and</strong> Resources<br />

Norfolk<br />

Pitcairn<br />

Mutineer<br />

Exeter<br />

Egret<br />

Talisman<br />

Lambert/Hermes<br />

Angel<br />

Cossack<br />

Eaglehawk<br />

Athena<br />

Capella<br />

Perseus<br />

Significant North West Shelf<br />

Hydrocarbon Discoveries<br />

Legendre<br />

Legendre South<br />

Wanaea<br />

North<br />

Rankin<br />

Goodwyn<br />

Gaea<br />

Echo/Yodel<br />

Keast<br />

Tidepole<br />

Rankin Dockrell<br />

West Dixon Dixon<br />

HYDROCARBON DISCOVERIES<br />

Urania<br />

Io<br />

FEBRUARY 2004<br />

Gas<br />

Oil<br />

Oil & Gas<br />

Jansz<br />

Scarborough<br />

Sage<br />

Iago<br />

Geryon<br />

PRODUCTION FACILITIES<br />

20^<br />

Reindeer/Caribou<br />

Wilcox<br />

Dionysus<br />

Orthrus<br />

A<br />

W<strong>and</strong>oo<br />

Corvus<br />

Maenad<br />

B<br />

Chrysaor<br />

West Tryal Rocks<br />

Stag<br />

Commonwealth Jurisdiction<br />

State Jurisdiction<br />

Burrup Peninsula<br />

KARRATHA<br />

North Gorgon<br />

Central Gorgon<br />

Gorgon<br />

C<br />

Spar<br />

Barrow Isl<strong>and</strong><br />

B<br />

Montebello Isl<strong>and</strong>s<br />

Thomas Bright John Brookes<br />

Campbell<br />

Wonnich Linda Sinbad<br />

Montgomery<br />

Bambra Rose/Lee<br />

Maitl<strong>and</strong><br />

Harriet A Gipsy/North Gipsy<br />

Agincourt<br />

Monty<br />

Rosette<br />

Josephine/Baker<br />

East Spar Little S<strong>and</strong>y/Pedirka Alkimos/Tanami/Simpson<br />

Double Isl<strong>and</strong> Varanus Isl<strong>and</strong><br />

Gibson/South Plato<br />

Barrow Isl<strong>and</strong><br />

Victoria<br />

Woollybutt<br />

Pasco<br />

<strong>IN</strong>DIAN<br />

DAMPIER<br />

OCEAN<br />

Conventional platform<br />

Mini platform<br />

Jack-up rig<br />

Monopod/Minipod<br />

Subsea completion, well<br />

Navigation, Comm<strong>and</strong>,<br />

<strong>and</strong> Control Buoy<br />

Floating Production Storage<br />

<strong>and</strong> Offloading vessel<br />

LNG carrier<br />

Oil carrier<br />

Pipeline, possible pipeline route<br />

ROEBOURNE<br />

LNG storage tanks<br />

Oil storage tanks<br />

Onshore production facility<br />

Under construction<br />

Proposed development<br />

South Pepper<br />

North Herald<br />

Chinook/Scindian<br />

Griffin<br />

Chervil<br />

Coniston Airlie Isl<strong>and</strong><br />

Novara<br />

Skiddaw Vincent<br />

Crest<br />

Thevenard Isl<strong>and</strong><br />

A<br />

Stybarrow<br />

Ravensworth<br />

B Saladin<br />

Enfield Crosby<br />

Corowa Yammaderry<br />

C<br />

Macedon/<br />

Cowle<br />

Laverda<br />

Scafell Pyrenees<br />

Roller Skate<br />

A<br />

C<br />

B ONSLOW<br />

Figure 3. North West Shelf production facilities <strong>and</strong> significant hydrocarbon discoveries.<br />

Ab<strong>and</strong>oned field<br />

Onslow<br />

Tubridgi<br />

EXMOUTH<br />

Rivoli<br />

22^<br />

22^<br />

Yardie East<br />

Cape Range<br />

LOCALITY<br />

MAP<br />

Rough Range<br />

Parrot Hill<br />

<strong>WESTERN</strong><br />

50 km<br />

<strong>AUSTRALIA</strong><br />

Map produced by <strong>Petroleum</strong> Division, <strong>Department</strong> <strong>of</strong> Industry <strong>and</strong> Resources WA.<br />

Maritime boundary data supplied by Geoscience Australia <strong>and</strong> is AMBIS 2001 data.<br />

116^<br />

114^

underlain by a 10 m gross oil column at the top <strong>of</strong><br />

the Birdrong S<strong>and</strong>stone.<br />

Crosby 1<br />

The Crosby field, located in WA-12-R <strong>and</strong> operated<br />

by BHP Billiton <strong>Petroleum</strong>, is situated 106 km westnorthwest<br />

<strong>of</strong> Onslow. Crosby 1 penetrated 7 m <strong>of</strong><br />

gas overlying 36 m <strong>of</strong> oil in the Pyrenees Member<br />

<strong>of</strong> the Lower Barrow Group in a complex structural<br />

trap between the Scafell Trend <strong>and</strong> the Novara Arch<br />

in the Exmouth Sub-basin.<br />

Ravensworth 1<br />

Ravensworth 1 was drilled in WA-155-P,<br />

approximately 108 km west-northwest <strong>of</strong> Onslow.<br />

The well encountered a 44 m gross hydrocarbon<br />

column consisting <strong>of</strong> 7 m <strong>of</strong> gas <strong>and</strong> 37 m <strong>of</strong> oil in<br />

the Pyrenees Member s<strong>and</strong>s.<br />

Browse Basin<br />

Within the Browse Basin, four exploration wells were<br />

drilled: Ichthys 1, Ichthys Deep 1, Maginnis 1 <strong>and</strong><br />

Strumbo 1, with Ichthys <strong>and</strong> Ichthys Deep both<br />

intersecting thick zones <strong>of</strong> gas pay. Neither<br />

Maginnis nor Strumbo intersected any<br />

hydrocarbons. An appraisal well, Ichthys 2, was<br />

drilled to assist in determining the extent <strong>of</strong> the<br />

Ichthys gasfield.<br />

Ichthys 1 <strong>and</strong> Ichthys Deep 1<br />

These wells were drilled by Inpex in their 100%<br />

owned permit WA-285-P. The wells encountered<br />

excellent gas shows in their target horizons <strong>and</strong><br />

follow-up gas discoveries at Gorgonichthys,<br />

Dinichthys <strong>and</strong> Titanichthys made in 2002.<br />

Bonaparte Basin<br />

The only well drilled in the Bonaparte Basin was<br />

Weasel 1 by Woodside Energy in WA-279-P. The<br />

well did not intersect any hydrocarbons <strong>and</strong> was<br />

plugged <strong>and</strong> ab<strong>and</strong>oned.<br />

PETROLEUM RESERVES AND RESOURCES<br />

<strong>Petroleum</strong> reserves in Western Australia have been<br />

compiled under two main headings – ‘developed<br />

fields’ <strong>and</strong> ‘undeveloped fields’. Developed fields are<br />

those currently producing fields that are located<br />

either <strong>of</strong>fshore in Commonwealth or State Waters or<br />

onshore within Western Australia. The reserves<br />

quoted are remaining reserves as at 31 December<br />

2003. Undeveloped fields have reserves associated<br />

with the static petroleum resources that may be<br />

developed in the future.<br />

In all <strong>of</strong> the above categories, reserves or resources<br />

have been quoted at the 90% <strong>and</strong> 50% probability<br />

<strong>of</strong> recovery levels (P90 <strong>and</strong> P50).<br />

The reserves for undeveloped fields are the<br />

reserves associated with the static petroleum<br />

resources that may be developed in the future.<br />

Undeveloped fields have been subdivided into three<br />

categories as follows:<br />

• Category 1, Potential for early development<br />

• Category 2, Expected medium to long term<br />

development<br />

• Category 3, Not currently viable; subject to<br />

Retention Lease<br />

The overall reserves <strong>and</strong> production figures for<br />

Western Australia up to 31 December are listed<br />

in Table 1.<br />

EXPLORATION ACTIVITY<br />

(Compiled from data provided by companies; where<br />

there is no report for a company, it is due to them<br />

not submitting a report)<br />

Apache Energy<br />

In the calendar year 2003, Apache operated 18<br />

exploration wells, 11 appraisal wells <strong>and</strong> 4<br />

development wells. Three field discoveries were<br />

confirmed <strong>and</strong> all appraisal wells but two <strong>and</strong> all<br />

development wells were successful.<br />

Taunton 3 <strong>and</strong> 3ST (TL/2) were to confirm the<br />

easterly extent <strong>of</strong> the field. Both wells encountered<br />

oil-bearing reservoir section <strong>of</strong> similar thickness <strong>and</strong><br />

quality to the discovery well, Taunton 1 drilled in<br />

1991.<br />

Thomas Bright 1 <strong>and</strong> 2 (WA-214-P) were drilled to<br />

establish the presence <strong>of</strong> gas-bearing s<strong>and</strong>s over<br />

the southern portion <strong>of</strong> the John Brookes-Tryal<br />

Rocks Anticline. Both wells encountered the main<br />

pay section seen at John Brookes 1 <strong>and</strong> both were<br />

gas bearing. Deeper gas-bearing s<strong>and</strong>s were also<br />

encountered at Thomas Bright 1. The outcome <strong>of</strong><br />

these wells in combination with John Brookes 1 has<br />

led the WA-214-P participants to proceed with the<br />

development <strong>of</strong> the field.<br />

North Pedirka 1 (TL/1) was drilled from the Victoria<br />

Platform <strong>and</strong> encountered an 8 m gross oil column<br />

in the massive Flag S<strong>and</strong>stone. The well was<br />

immediately completed <strong>and</strong> brought on production.<br />

Ginger 1 well was drilled to evaluate a Biggada<br />

prospect identified by bright seismic amplitudes.<br />

Table 1. 2003 Production <strong>and</strong> reserves for Western Australia<br />

PWA April Edition - 2003 Review 11<br />

The well encountered a 21 m gross gas column<br />

within a tight s<strong>and</strong>stone reservoir. No gas/water<br />

contact was encountered. The commercial viability<br />

<strong>of</strong> Ginger remains uncertain pending the analysis <strong>of</strong><br />

reprocessed seismic data.<br />

Apache expects to drill more than 35 wells during<br />

2004. Exploration activities will comprise more than<br />

20 wells <strong>and</strong> be mainly concentrated in the Varanus<br />

Isl<strong>and</strong> <strong>and</strong> Dampier areas. A highlight <strong>of</strong> the year will<br />

be Blackdragon 1 in the Exmouth Sub-basin (WA-<br />

335-P). This well is situated in over 1400 m <strong>of</strong> water<br />

<strong>and</strong> is Apache’s first deep water well in Australia.<br />

Arc Energy<br />

ARC Energy participated in the drilling <strong>of</strong> 14 <strong>of</strong> the<br />

77 wells drilled in Western Australia in 2003 <strong>and</strong><br />

operated seven <strong>of</strong> these.<br />

2003 Exploration Highlights<br />

Exploration drilling at Eremia 1, in the onshore<br />

resulted in a commercial oil discovery at Eremia.<br />

Offshore, the Twin Lions 1, Mentelle 1 <strong>and</strong> Vindara<br />

1 wells were unsuccessful.<br />

The Hibbertia 3D seismic survey identified a number<br />

<strong>of</strong> gas prospects east <strong>of</strong> the Hovea oilfield <strong>and</strong> north<br />

<strong>of</strong> the Beharra Springs gasfield that will be drilled in<br />

2004. Preparations are underway for the acquisition<br />

<strong>of</strong> the Denison 3D seismic survey over the eastern<br />

oil fairway in L1/L2, <strong>and</strong> l<strong>and</strong> gravity data has<br />

already been acquired over this oil fairway.<br />

BHP Billiton <strong>Petroleum</strong><br />

Outer Browse Area<br />

BHP Billiton regards the deep water Outer Browse<br />

Basin as a frontier basin with high potential <strong>and</strong><br />

little prior exploration.<br />

In 2000, the company was awarded five blocks:<br />

WA-301-P, WA-302-P, WA-303-P, WA-304-P <strong>and</strong><br />

WA-305-P. These blocks comprise around<br />

25 000 km 2 <strong>and</strong> lie in water depths ranging from<br />

1000 to 3000 metres.<br />

Category Oil (GL) Condensate (GL) Gas (Gm 3 )<br />

Developed Fields<br />

2003 Production 14.054 6.606 27.435<br />

Remaining Reserves P90 33.449 51.968 462.253<br />

P50 60.015 75.757 592.933<br />

Undeveloped Reserves<br />

Category 1 P90 36.681 38.295 214.656<br />

P50 54.057 55.871 304.145<br />

Category 2 P90 8.900 3.400 31.750<br />

P50 13.300 7.500 62.190<br />

Category 3 P90 4.980 87.509 1530.892<br />

P50 8.660 141.275 2385.666

12<br />

In 2002, a major remote sensing programme<br />

including a geotechnical piston core survey was<br />

undertaken in the five blocks to help underst<strong>and</strong> the<br />

likelihood <strong>of</strong> a working petroleum system.<br />

Early in 2003, BHP Billiton drilled the Maginnis 1<br />

well in WA-302-P. Maginnis 1 was located in<br />

approximately 1300 m <strong>of</strong> water <strong>and</strong> was drilled by<br />

the Jack Ryan dynamically positioned drill ship. BHP<br />

Billiton, on behalf <strong>of</strong> the respective Joint Venture<br />

partners, also acquired a combined 510 km 2 <strong>of</strong> 3D<br />

seismic data over permits WA-303-P <strong>and</strong> WA-304-P.<br />

The focus has been to incorporate the Maginnis 1<br />

results <strong>and</strong> data <strong>and</strong> interpret the seismic data.<br />

BHP Billiton is the operator in all five blocks. The<br />

ownership interests are:<br />

• WA-301-P, Kerr McGee, 50%; BHP Billiton, 50%<br />

• WA-302-P, Texaco, 33%; Kerr McGee, 33%;<br />

BHP Billiton, 33%<br />

• WA-303-P, Texaco, 33%; Kerr McGee, 33%;<br />

BHP Billiton, 33%<br />

• WA-304-P, Kerr McGee, 50%; BHP Billiton, 50%<br />

• WA-305-P, Texaco, 33%; Kerr McGee, 33%;<br />

BHP Billiton, 33%.<br />

Carnarvon Basin<br />

PWA April Edition - 2003 Review<br />

BHP Billiton <strong>Petroleum</strong> is the operator <strong>of</strong> exploration<br />

permits WA-255-P, WA-155-P(1) as well as<br />

retention lease WA-12-R (Macedon-Pyrenees fields)<br />

<strong>and</strong> production licences WA-10-L <strong>and</strong> WA-12-L<br />

(Griffin-Chinook-Scindian complex), all located<br />

within the <strong>of</strong>fshore Carnarvon Basin, Western<br />

Australia.<br />

During the second half <strong>of</strong> 2003, our Western<br />

Australian exploration focus was on the Exmouth<br />

Sub-basin <strong>of</strong> the Carnarvon Basin, with drilling<br />

activity in permits WA-155-P(1) <strong>and</strong> WA-12-R, <strong>and</strong><br />

exploration studies following an active drilling<br />

programme in WA-255-P.<br />

In WA-255-P (BHP Billiton 50%, operator), data<br />

gathered from a 4-well programme undertaken from<br />

February to June 2003 were analysed <strong>and</strong> results<br />

interpreted in preparation for a renewed drilling<br />

campaign proposed for the first half <strong>of</strong> 2004.<br />

Our exploration activity in WA-155-P(1) (BHP Billiton<br />

39.999%, operator) focused on extension <strong>of</strong> the<br />

Pyrenees-Vincent heavy oil play. An exploration well,<br />

Ravensworth 1, was drilled in July 2003 using the<br />

Sedco 703, approximately 10 km southeast <strong>of</strong> the<br />

Vincent oil <strong>and</strong> gas field. The well encountered a 37<br />

m oil column with a 7 m gas cap in high quality<br />

s<strong>and</strong>stones <strong>and</strong> after sidetracking to acquire core<br />

across the reservoir, Ravensworth 1 was plugged<br />

<strong>and</strong> ab<strong>and</strong>oned, as planned.<br />

The Ravensworth discovery was followed up in<br />

ChevronTexaco’s Greater Gorgon Area (Image courtesy <strong>of</strong> ChevronTexeco)<br />

October 2003 by an exploration well on the<br />

adjacent Crosby feature in WA-12-R. Ravensworth<br />

<strong>and</strong> Crosby are currently being evaluated, along<br />

with several undrilled prospects in WA-12-R inbetween<br />

Crosby 1 <strong>and</strong> West Muiron 5.<br />

The Van Gogh 1ST well was drilled in WA-155-P(1)<br />

to test the northern part <strong>of</strong> the Vincent field,<br />

discovered by Vincent 1 (Woodside, 1999). The<br />

results <strong>of</strong> BHP Billiton <strong>Petroleum</strong>’s Van Gogh 1ST<br />

<strong>and</strong> Woodside’s Vincent 1 <strong>and</strong> 2 wells are currently<br />

being evaluated.<br />

ChevronTexaco<br />

Barrow Isl<strong>and</strong> / Thevenard Isl<strong>and</strong> Licences<br />

ChevronTexaco continued to develop its exploration<br />

portfolio within the exploration <strong>and</strong> production<br />

licences <strong>of</strong> the Barrow <strong>and</strong> Thevenard areas.<br />

Exploration focus was on oil plays close to existing<br />

production facilities. No exploration drilling was<br />

undertaken in the Barrow <strong>and</strong> Thevenard Isl<strong>and</strong><br />

regions during 2003.<br />

The renewal <strong>of</strong> Barrow Isl<strong>and</strong> onshore exploration<br />

permits EP61 <strong>and</strong> EP62 was granted in 2003.<br />

Exploration permit TP/2 is currently subsisting<br />

awaiting formal renewal approval.<br />

In the Thevenard area, the only activity was the<br />

assignment <strong>of</strong> ChevronTexaco Australia’s interest in<br />

exploration permit TP/3 to Santos.<br />

There are no planned exploration activities for 2004<br />

in the Barrow Isl<strong>and</strong> or Thevenard Isl<strong>and</strong> regions.<br />

Greater Gorgon Area Gas Assets<br />

There were no exploration drilling activities in 2003<br />

within the Greater Gorgon Area exploration permits in<br />

the area including <strong>and</strong> to the west <strong>of</strong> the Gorgon field.<br />

Activities during the last twelve months in the<br />

Greater Gorgon Area were focused on retaining the<br />

recently discovered gas in WA-267-P <strong>and</strong> WA-25-P<br />

<strong>and</strong> extensions <strong>of</strong> these resources into WA-253-P.<br />

Ten retention leases have been awarded to<br />

ChevronTexaco Australia <strong>and</strong> their partners during<br />

the last two years covering the Iago, Geryon,<br />

Orthrus-Maenad, Urania, Io-South, <strong>and</strong> Io-Eurytion<br />

gasfields (from WA-25-P, WA-267-P, <strong>and</strong> WA-253-<br />

P). The remaining WA-267-P <strong>and</strong> WA-25-P<br />

graticular blocks were surrendered during 2003.<br />

In addition, <strong>and</strong> concurrent to this, marketing efforts<br />

for the sale <strong>of</strong> the Gorgon Area gas (which includes<br />

Spar, West Tryal Rocks <strong>and</strong> the Gorgon gasfields) was<br />

the main focus for ChevronTexaco Australia Pty Ltd<br />

during 2003. These three Gorgon Area gasfields were<br />

renewed for a further five years in August 2003.<br />

Seismic acquisition was undertaken in WA-253-P<br />

(Wheatstone 2D MSS), WA-268-P (Champagne 2D<br />

MSS) <strong>and</strong> WA-205-P (Acme 3D MSS) to fulfil their<br />

respective work commitments. Wheatstone 2D MSS<br />

comprised 625 line km while Champagne 2D MSS<br />

2430 line km <strong>and</strong> Acme 3D MSS 220 km 2 . The

acquisition had incident free operations.<br />

Texaco Australia Pty Ltd participated in the drilling <strong>of</strong><br />

the Mobil operated Jansz 3 well. The well was<br />

successfully production tested, with a peak rate <strong>of</strong> 2<br />

Mm 3 /d (72.6 MMcf/d).<br />

A major event during 2003 was the announcement<br />

<strong>of</strong> the ratification <strong>of</strong> the State legislation that will<br />

allow Gorgon limited access to Barrow Isl<strong>and</strong> for the<br />

construction <strong>of</strong> a gas processing plant. Many other<br />

approvals are required before Gorgon can start<br />

construction <strong>of</strong> the plant notwithst<strong>and</strong>ing the<br />

stringent environmental approvals.<br />

Two large seismic programs have been planned for<br />

2004 in the Greater Gorgon Area. The Ch<strong>and</strong>on 3D<br />

MSS will focus on the Ch<strong>and</strong>on Prospect in WA-<br />

268-P <strong>and</strong> the Io-Jansz 3D MSS will further<br />

delineate the large gas resource discovered by the<br />

Io <strong>and</strong> Jansz wells over the last several years.<br />

Acquisition is scheduled to start in February 2004.<br />

The major focus in 2004 for the Gorgon Area Gas<br />

Team will be the continued commercialisation effort<br />

for the Gorgon gas. To this, numerous positions<br />

have been advertised in the national newspapers<br />

looking for engineers <strong>and</strong> other project experienced<br />

personnel.<br />

Eni Australia<br />

In 2003, Eni Australia was actively involved in 11<br />

exploration permits in <strong>of</strong>fshore Australian waters<br />

<strong>and</strong> eight <strong>of</strong> these were in Western Australian<br />

waters. As operator, Eni acquired 5300 km <strong>of</strong> 2D<br />

seismic in the Houtman Sub-basin <strong>and</strong> reprocessed<br />

a further 5000 km <strong>of</strong> 2D seismic. As non-operator,<br />

Eni participated in two exploration wells, Wigmore 1<br />

<strong>and</strong> Weasel 1.<br />

Activity planned for 2004 as operator includes the<br />

acquisition <strong>of</strong> 600 km 2 <strong>of</strong> 3D seismic <strong>and</strong> the<br />

drilling <strong>of</strong> one exploration well on the Woollybutt<br />

production licence. The company also intends to<br />

participate in at least two other exploration wells<br />

during the year.<br />

Kimberley Oil<br />

Due to the forthcoming granting <strong>of</strong> Application Area<br />

2/96-7, which contains the oil <strong>and</strong> gas-bearing<br />

Pictor anticline, the company commissioned an<br />

engineering appraisal <strong>of</strong> the economic viability <strong>of</strong><br />

horizontal drilling into the oil <strong>and</strong> gas-bearing zone.<br />

The study concluded that horizontal drilling into the<br />

Pictor Anticline is likely to achieve economic oil<br />

production rates <strong>and</strong> that estimated recoverable oil<br />

reserves total 6.4 GL (40 MMbbl).<br />

Kimberley Oil will be seeking a farm-in into the<br />

exploration permit, subsequent to the granting <strong>of</strong><br />

Application Area 2/96-7, so that a horizontal well is<br />

drilled into the Pictor Anticline.<br />

A commitment exploration well is due in EP129, <strong>and</strong><br />

the company is seeking a farm-in partner for the<br />

drilling <strong>of</strong> Boundary Southeast 1. A commitment<br />

exploration well is due in EP391, <strong>and</strong> the company<br />

is seeking a farm-in partner for the drilling <strong>of</strong> a test<br />

well on the crest <strong>of</strong> the Yulleroo Anticline.<br />

Nexen Energy<br />

On the exploration front, Nexen had been seeking<br />

partners to participate in the exploration <strong>of</strong> WA-239-<br />

P, in the Browse Basin, <strong>of</strong>fshore Western Australia.<br />

The block is situated on the Yampi Shelf on the<br />

eastern margin <strong>of</strong> the basin, approximately 730 km<br />

southwest <strong>of</strong> Darwin. It has an area <strong>of</strong><br />

approximately 4700 km 2 <strong>and</strong> only two wells have<br />

been drilled in the permit. However, the farm-out<br />

efforts were unsuccessful <strong>and</strong> Nexen surrendered<br />

the permit.<br />

Roc Oil<br />

Permit Interests<br />

As at 31 December 2003, Roc Oil (WA) Pty Ltd<br />

(ROC) is the operator <strong>of</strong> four permits in the Perth<br />

Basin <strong>and</strong> participates in another permit, as detailed<br />

in Table 2. Effective 1 April 2003, ROC acquired Arc<br />

Nexen’s Buffalo oilfield (Image courtesy <strong>of</strong> Nexen Energy)<br />

Table 2: ROC’s W.A. Permit Interests as at 31 December 2003<br />

PWA April Edition - 2003 Review 13<br />

Energy’s 7.5% interest in WA-286-P (which<br />

includes the Cliff Head oilfield). ROC farmed into<br />

EP413 effective 1 April 2003, by acquiring Victoria<br />

<strong>Petroleum</strong>’s 0.25% equity in the permit, which<br />

contains the Jingemia oilfield. In mid-2003, ROC<br />

acquired an option to acquire Norwest Energy’s<br />

7.5% equity in WA-226-P. This option may be<br />

exercised pending the review <strong>of</strong> Macallan 3D<br />

seismic data.<br />

In addition, ROC announced on 18 December 2003<br />

that it will exercise an option with Voyager Energy<br />

Limited to acquire a 50% interest in, <strong>and</strong><br />

operatorship <strong>of</strong>, the gazettal block WO3-14, which<br />

is contiguous with three licences in which ROC<br />

already hold interests, <strong>and</strong> is on the same<br />

geological trend as the Cliff Head oilfield.<br />

Drilling Activity<br />

In 2003, ROC participated in three exploration <strong>and</strong><br />

four appraisal wells in the Perth Basin. The<br />

exploration wells did not encounter significant<br />

hydrocarbons, while all appraisal wells were<br />

successful.<br />

Permit Basin ROC Interest Operator<br />

WA-286-P Perth (Offshore) 37.5% Roc Oil (WA) Pty Ltd<br />

TP/15 Perth (Offshore) 20.0% Roc Oil (WA) Pty Ltd<br />

WA-325-P Perth (Offshore) 37.5% Roc Oil (WA) Pty Ltd<br />

WA-327-P Perth (Offshore) 37.5% Roc Oil (WA) Pty Ltd<br />

EP413 Perth (Onshore) 0.25% Origin Energy<br />

Developments Pty Ltd<br />

WA-226-P (Option to acquire) Perth (Offshore) 7.5% Origin Energy<br />

Developments Pty Ltd

14<br />

Two wildcat wells in WA-286-P (Mentelle 1 <strong>and</strong><br />

Vindara 1) encountered minor oil shows in sidewall<br />

cores, but were assessed to be non-commercial<br />

<strong>and</strong> were plugged <strong>and</strong> ab<strong>and</strong>oned. The Twin Lions 1<br />

wildcat in TP/15 encountered good quality<br />

reservoirs, which were water-wet, <strong>and</strong> the well was<br />

plugged <strong>and</strong> ab<strong>and</strong>oned.<br />

Seismic Activity<br />

PWA April Edition - 2003 Review<br />

During 2003, ROC as operator recorded four marine<br />

seismic surveys; 687 km 2 <strong>of</strong> 3D data <strong>and</strong> 1554 km<br />

<strong>of</strong> 2D data.<br />

The Veritas Pacific Sword completed the Cliff Head<br />

3D seismic survey <strong>of</strong> 30.4 km 2 over the Cliff Head<br />

oil discovery in WA-286-P on 1 November 2003.<br />

The survey was designed to support development<br />

planning, in particular optimisation <strong>of</strong> development<br />

well design.<br />

This was followed by acquisition <strong>of</strong> the Lilian 2D<br />

seismic survey <strong>of</strong> 729 km (644 km in WA-286-P<br />

<strong>and</strong> 85 km in TP/15), completed on 11 November.<br />

The Pacific Sword then acquired the MaryAnn 2D<br />

seismic survey (825 km) in WA-325-P. In the WA-<br />

327-P <strong>and</strong> WA-325-P permits, the Nordic Explorer<br />

acquired the 657 km 2 Vicki/Angela 3D seismic<br />

survey in late November–December 2003.<br />