Annual Report 2009 (1 MB, pdf) - Vasco

Annual Report 2009 (1 MB, pdf) - Vasco

Annual Report 2009 (1 MB, pdf) - Vasco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

to a maximum of 5,000 Euros. Borrowing under the line of credit may be denominated in Euros, U.S. Dollars or<br />

Swiss Francs. If the borrowings are denominated in Euros, we are obligated to pay interest at the monthly<br />

average of the EONIA (Euro Over Night Index Average) plus 2.5% per year. If the borrowings are denominated<br />

in U.S. Dollars, we are obligated to pay interest at the U.S. Dollar Fed Fund Rate plus 2.5% per year. If the<br />

borrowings are denominated in Swiss Francs, we are obligated to pay interest at the Swiss National Bank Repo<br />

rate plus 2.5% per year. Either party can terminate the credit line with 14 days notice without penalty. If<br />

terminated, all borrowings under the line then outstanding would be due and payable. The bank can also<br />

terminate the credit line immediately if VASCO fails to observe the specific terms of the credit line, becomes<br />

insolvent, ceases operation or experiences a change in control. We had no borrowings under the credit line at<br />

December 31, <strong>2009</strong>.<br />

The net effect of <strong>2009</strong> activity resulted in an increase in net cash of $9,887 and a net cash balance of<br />

$67,601 at December 31, <strong>2009</strong>, compared to $57,714 at the end of 2008. Our working capital at December 31,<br />

<strong>2009</strong> was $87,632, an increase of $11,702 or 15% from $75,930 at December 31, 2008. The change is primarily<br />

attributable to the generation of positive cash flow from operations in <strong>2009</strong>. Our current ratio was 4.8 to 1.0 at<br />

December 31, <strong>2009</strong>. We believe that our current cash balances, credit available under our existing overdraft<br />

agreement and the anticipated cash generated from operations, including deposits received on orders of<br />

DIGIPASS to be delivered in 2010, will be sufficient to meet our anticipated cash needs for the next 12 months.<br />

The net effect of 2008 activity resulted in an increase in net cash of $18,881 and a net cash balance of<br />

$57,714 at December 31, 2008, compared to $38,833 at the end of 2007. Our working capital at December 31,<br />

2008 was $75,930, an increase of $23,492 or 45% from $52,438 at December 31, 2007. The change was<br />

primarily attributable to the generation of positive cash flow from operations in 2008. Our current ratio was 3.5<br />

to 1.0 at December 31, 2008.<br />

While we believe that our financial resources and current borrowing arrangements are adequate to meet<br />

our operating needs over the next twelve months, we anticipate that the difficult current economic conditions that<br />

exist on a worldwide basis today may require us to modify our business plans. In the current economic<br />

environment there is an increased risk that customers may delay their orders until the economic conditions<br />

stabilize or improve. If a significant number of orders are delayed for an indefinite period of time, our revenue<br />

and cash receipts may not be sufficient to meet the operating needs of the business. If this is the case, we may<br />

need to borrow against our credit line, significantly reduce our workforce, sell certain of our assets, enter into<br />

strategic relationships or business combinations, discontinue some or all of our operations, or take other similar<br />

restructuring actions. While we expect that these actions would result in a reduction of recurring costs, they also<br />

may result in a reduction of recurring revenue and cash receipts. It is also likely that we would incur substantial<br />

non-recurring costs to implement one or more of these restructuring actions. See our “Risks Related to Our<br />

Business” in Item 1A, Risk Factors.<br />

Off-Balance Sheet Arrangements<br />

The company has no off-balance sheet arrangements.<br />

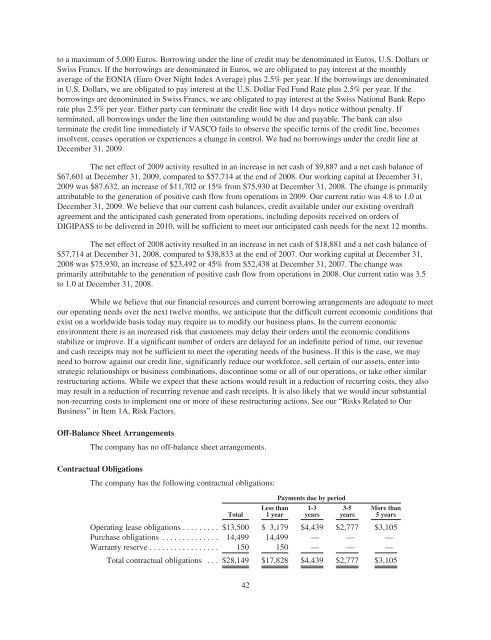

Contractual Obligations<br />

The company has the following contractual obligations:<br />

Total<br />

Less than<br />

1 year<br />

Payments due by period<br />

1-3<br />

years<br />

3-5<br />

years<br />

More than<br />

5 years<br />

Operating lease obligations ......... $13,500 $ 3,179 $4,439 $2,777 $3,105<br />

Purchase obligations .............. 14,499 14,499 — — —<br />

Warranty reserve ................. 150 150 — — —<br />

Total contractual obligations . . . $28,149 $17,828 $4,439 $2,777 $3,105<br />

42

![KB [100006] - Vasco](https://img.yumpu.com/12539350/1/184x260/kb-100006-vasco.jpg?quality=85)