Annual Report 2009 (1 MB, pdf) - Vasco

Annual Report 2009 (1 MB, pdf) - Vasco

Annual Report 2009 (1 MB, pdf) - Vasco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

VASCO DATA SECURITY INTERNATIONAL, INC.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)<br />

(amounts in thousands, except per share data)<br />

estimated using the Black-Scholes option pricing model, with the expected life adjusted to reflect the effect of<br />

post-vesting restrictions. The assumptions used for the Black-Scholes model are listed in Note 9. This<br />

compensation expense is recorded on a straight-line basis over the vesting period of the options.<br />

Warranty<br />

Warranties are provided on the sale of certain of our products and an accrual for estimated future claims is<br />

recorded at the time revenue is recognized. Warranty reserves are based on past claims experience, sales history<br />

and other considerations. Our standard practice is to provide a warranty on our hardware products for either a one<br />

or two year period after the date of purchase. Customers may purchase extended warranties covering periods<br />

from one to four years after the standard warranty period. We defer the revenue associated with the extended<br />

warranty and recognize it into income on a straight-line basis over the extended warranty period. We have<br />

historically experienced minimal actual claims over the warranty period.<br />

Reclassifications<br />

Certain prior year amounts in the Consolidated Statement of Cash Flows have been reclassified to conform<br />

to the <strong>2009</strong> presentation, to present the details of the changes in assets and liabilities on a consistent basis.<br />

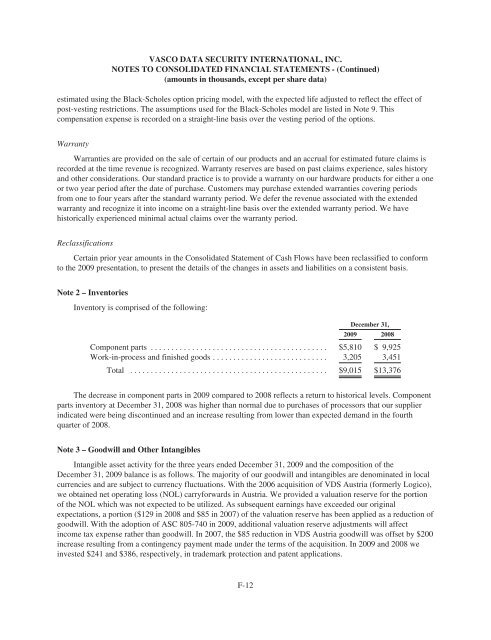

Note 2 – Inventories<br />

Inventory is comprised of the following:<br />

December 31,<br />

<strong>2009</strong> 2008<br />

Component parts ........................................... $5,810 $ 9,925<br />

Work-in-process and finished goods ............................ 3,205 3,451<br />

Total ................................................ $9,015 $13,376<br />

The decrease in component parts in <strong>2009</strong> compared to 2008 reflects a return to historical levels. Component<br />

parts inventory at December 31, 2008 was higher than normal due to purchases of processors that our supplier<br />

indicated were being discontinued and an increase resulting from lower than expected demand in the fourth<br />

quarter of 2008.<br />

Note 3 – Goodwill and Other Intangibles<br />

Intangible asset activity for the three years ended December 31, <strong>2009</strong> and the composition of the<br />

December 31, <strong>2009</strong> balance is as follows. The majority of our goodwill and intangibles are denominated in local<br />

currencies and are subject to currency fluctuations. With the 2006 acquisition of VDS Austria (formerly Logico),<br />

we obtained net operating loss (NOL) carryforwards in Austria. We provided a valuation reserve for the portion<br />

of the NOL which was not expected to be utilized. As subsequent earnings have exceeded our original<br />

expectations, a portion ($129 in 2008 and $85 in 2007) of the valuation reserve has been applied as a reduction of<br />

goodwill. With the adoption of ASC 805-740 in <strong>2009</strong>, additional valuation reserve adjustments will affect<br />

income tax expense rather than goodwill. In 2007, the $85 reduction in VDS Austria goodwill was offset by $200<br />

increase resulting from a contingency payment made under the terms of the acquisition. In <strong>2009</strong> and 2008 we<br />

invested $241 and $386, respectively, in trademark protection and patent applications.<br />

F-12

![KB [100006] - Vasco](https://img.yumpu.com/12539350/1/184x260/kb-100006-vasco.jpg?quality=85)