Annual Report 2009 (1 MB, pdf) - Vasco

Annual Report 2009 (1 MB, pdf) - Vasco

Annual Report 2009 (1 MB, pdf) - Vasco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VASCO DATA SECURITY INTERNATIONAL, INC.<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued)<br />

(amounts in thousands, except per share data)<br />

was 83 in <strong>2009</strong> and 29 in 2008, which represents the number of shares that will be received if the Company<br />

achieves 100% of the performance goal. The shares received for performance at a level between stated<br />

performance percentages will be interpolated. The performance targets are established by the Board of Directors.<br />

Compensation expense equal to the market value of the stock on the grant date is recorded on a straight-line<br />

basis over the vesting period if the performance condition is deemed to be probable, as required by ASC 718-10.<br />

Compensation expense in <strong>2009</strong> includes a benefit of $650 for the reversal of 2007 and 2008 award accruals and<br />

expense of $231 for the <strong>2009</strong> awards. The unamortized future compensation expense for the performance-based<br />

restricted stock was $477 at December 31, <strong>2009</strong>.<br />

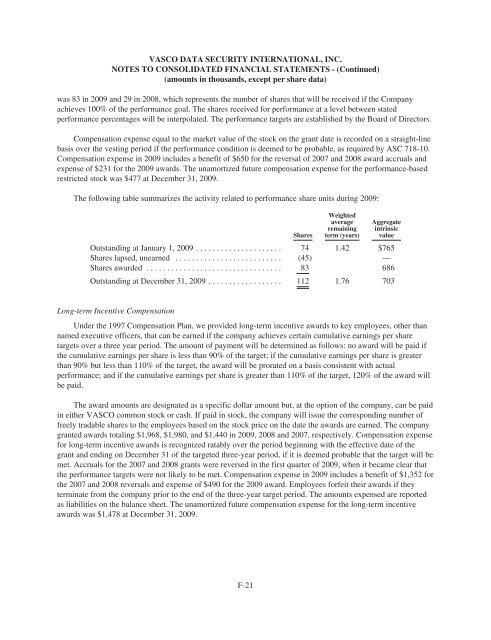

The following table summarizes the activity related to performance share units during <strong>2009</strong>:<br />

Shares<br />

Weighted<br />

average<br />

remaining<br />

term (years)<br />

Aggregate<br />

intrinsic<br />

value<br />

Outstanding at January 1, <strong>2009</strong> ..................... 74 1.42 $765<br />

Shares lapsed, unearned .......................... (45) —<br />

Shares awarded ................................. 83 686<br />

Outstanding at December 31, <strong>2009</strong> .................. 112 1.76 703<br />

Long-term Incentive Compensation<br />

Under the 1997 Compensation Plan, we provided long-term incentive awards to key employees, other than<br />

named executive officers, that can be earned if the company achieves certain cumulative earnings per share<br />

targets over a three year period. The amount of payment will be determined as follows: no award will be paid if<br />

the cumulative earnings per share is less than 90% of the target; if the cumulative earnings per share is greater<br />

than 90% but less than 110% of the target, the award will be prorated on a basis consistent with actual<br />

performance; and if the cumulative earnings per share is greater than 110% of the target, 120% of the award will<br />

be paid.<br />

The award amounts are designated as a specific dollar amount but, at the option of the company, can be paid<br />

in either VASCO common stock or cash. If paid in stock, the company will issue the corresponding number of<br />

freely tradable shares to the employees based on the stock price on the date the awards are earned. The company<br />

granted awards totaling $1,968, $1,980, and $1,440 in <strong>2009</strong>, 2008 and 2007, respectively. Compensation expense<br />

for long-term incentive awards is recognized ratably over the period beginning with the effective date of the<br />

grant and ending on December 31 of the targeted three-year period, if it is deemed probable that the target will be<br />

met. Accruals for the 2007 and 2008 grants were reversed in the first quarter of <strong>2009</strong>, when it became clear that<br />

the performance targets were not likely to be met. Compensation expense in <strong>2009</strong> includes a benefit of $1,352 for<br />

the 2007 and 2008 reversals and expense of $490 for the <strong>2009</strong> award. Employees forfeit their awards if they<br />

terminate from the company prior to the end of the three-year target period. The amounts expensed are reported<br />

as liabilities on the balance sheet. The unamortized future compensation expense for the long-term incentive<br />

awards was $1,478 at December 31, <strong>2009</strong>.<br />

F-21

![KB [100006] - Vasco](https://img.yumpu.com/12539350/1/184x260/kb-100006-vasco.jpg?quality=85)