top 10 most valuable banking brands in the world - Brand Finance

top 10 most valuable banking brands in the world - Brand Finance

top 10 most valuable banking brands in the world - Brand Finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

USA<br />

At <strong>the</strong> end of 2009, America’s Federal Deposit<br />

Insurance Corporation (FDIC) reported that<br />

American banks as a whole reported earn<strong>in</strong>gs<br />

only “slightly above breakeven”. While that<br />

passed for good news at <strong>the</strong> time, it seems<br />

that <strong>the</strong> headl<strong>in</strong>es <strong>in</strong> its September 20<strong>10</strong> report<br />

were positively gush<strong>in</strong>g: 1 :<br />

• Year-Over-Year Earn<strong>in</strong>gs Improve for Fifth<br />

Consecutive Year<br />

• Asset Quality Trends Cont<strong>in</strong>ued to<br />

Improve<br />

• Industry Assets Increase by $163 Billion<br />

From a time before <strong>the</strong> first of <strong>the</strong>se reports<br />

and <strong>the</strong> recent one, a dizzy<strong>in</strong>g level of public<br />

discussion has transpired regard<strong>in</strong>g what<br />

should be done regard<strong>in</strong>g <strong>the</strong> restoration<br />

of <strong>bank<strong>in</strong>g</strong> <strong>in</strong> <strong>the</strong> United States, <strong>in</strong>clud<strong>in</strong>g<br />

reversion to <strong>the</strong> separation between depository<br />

and <strong>in</strong>vestment <strong>bank<strong>in</strong>g</strong> per <strong>the</strong> Glass Steagall<br />

Act of 1933, <strong>the</strong> break<strong>in</strong>g up of <strong>in</strong>stitutions<br />

“too big to fail”, enact<strong>in</strong>g early warn<strong>in</strong>gs to<br />

detect systematic risks, limit<strong>in</strong>g executive pay,<br />

<strong>in</strong>creas<strong>in</strong>g <strong>bank<strong>in</strong>g</strong> reserve requirements,<br />

<strong>in</strong>creas<strong>in</strong>g regulatory authority for Federal<br />

Reserve over banks, severely reduc<strong>in</strong>g banks’<br />

rights to engage <strong>in</strong> proprietary trad<strong>in</strong>g among<br />

many, many o<strong>the</strong>r suggestions.<br />

Some of <strong>the</strong>se suggestions were enacted<br />

<strong>in</strong> <strong>the</strong> Dodd-Frank Wall Street Reform and<br />

Consumer Protection Act <strong>in</strong> July 20<strong>10</strong>,<br />

though some criticized this law s<strong>in</strong>ce it did<br />

little to address what many feel was a major<br />

contributor to <strong>bank<strong>in</strong>g</strong> difficulties and hence <strong>the</strong><br />

underm<strong>in</strong><strong>in</strong>g of many <strong>bank<strong>in</strong>g</strong> <strong>brands</strong>, namely<br />

<strong>the</strong> role of Freddie Mac and Fannie Mae -- <strong>the</strong><br />

government sponsored companies formed to<br />

trade <strong>in</strong> secondary mortgage obligations and<br />

<strong>the</strong>refore expand <strong>the</strong> pool of funds available as<br />

mortgages.<br />

1 FDIC Quarterly Bank<strong>in</strong>g Profile, September, 20<strong>10</strong><br />

Country Focus<br />

Only time will tell who is right, but for now <strong>the</strong>re<br />

is no question that <strong>the</strong> <strong>bank<strong>in</strong>g</strong> <strong>in</strong>dustry <strong>in</strong> <strong>the</strong><br />

United States is improv<strong>in</strong>g and <strong>the</strong> American<br />

<strong>bank<strong>in</strong>g</strong> <strong>brands</strong> on this year’s <strong>in</strong>dex are no<br />

exception, issues rema<strong>in</strong>.<br />

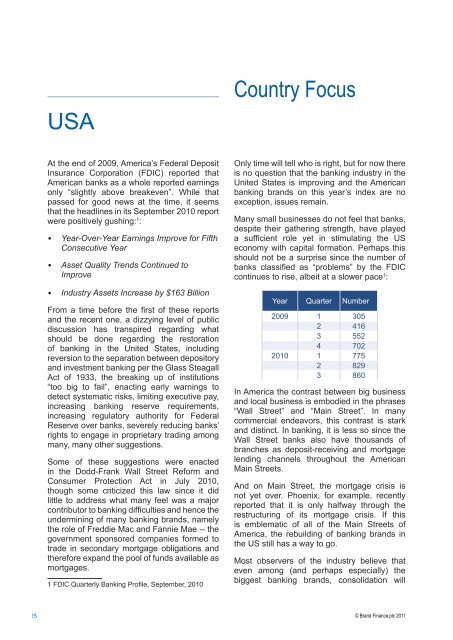

Many small bus<strong>in</strong>esses do not feel that banks,<br />

despite <strong>the</strong>ir ga<strong>the</strong>r<strong>in</strong>g strength, have played<br />

a sufficient role yet <strong>in</strong> stimulat<strong>in</strong>g <strong>the</strong> US<br />

economy with capital formation. Perhaps this<br />

should not be a surprise s<strong>in</strong>ce <strong>the</strong> number of<br />

banks classified as “problems” by <strong>the</strong> FDIC<br />

cont<strong>in</strong>ues to rise, albeit at a slower pace 1 :<br />

Year Quarter Number<br />

2009 1 305<br />

2 416<br />

3 552<br />

4 702<br />

20<strong>10</strong> 1 775<br />

2 829<br />

3 860<br />

In America <strong>the</strong> contrast between big bus<strong>in</strong>ess<br />

and local bus<strong>in</strong>ess is embodied <strong>in</strong> <strong>the</strong> phrases<br />

“Wall Street” and “Ma<strong>in</strong> Street”. In many<br />

commercial endeavors, this contrast is stark<br />

and dist<strong>in</strong>ct. In <strong>bank<strong>in</strong>g</strong>, it is less so s<strong>in</strong>ce <strong>the</strong><br />

Wall Street banks also have thousands of<br />

branches as deposit-receiv<strong>in</strong>g and mortgage<br />

lend<strong>in</strong>g channels throughout <strong>the</strong> American<br />

Ma<strong>in</strong> Streets.<br />

And on Ma<strong>in</strong> Street, <strong>the</strong> mortgage crisis is<br />

not yet over. Phoenix, for example, recently<br />

reported that it is only halfway through <strong>the</strong><br />

restructur<strong>in</strong>g of its mortgage crisis. If this<br />

is emblematic of all of <strong>the</strong> Ma<strong>in</strong> Streets of<br />

America, <strong>the</strong> rebuild<strong>in</strong>g of <strong>bank<strong>in</strong>g</strong> <strong>brands</strong> <strong>in</strong><br />

<strong>the</strong> US still has a way to go.<br />

Most observers of <strong>the</strong> <strong>in</strong>dustry believe that<br />

even among (and perhaps especially) <strong>the</strong><br />

biggest <strong>bank<strong>in</strong>g</strong> <strong>brands</strong>, consolidation will<br />

15 © <strong>Brand</strong> F<strong>in</strong>ance plc 2011