top 10 most valuable banking brands in the world - Brand Finance

top 10 most valuable banking brands in the world - Brand Finance

top 10 most valuable banking brands in the world - Brand Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

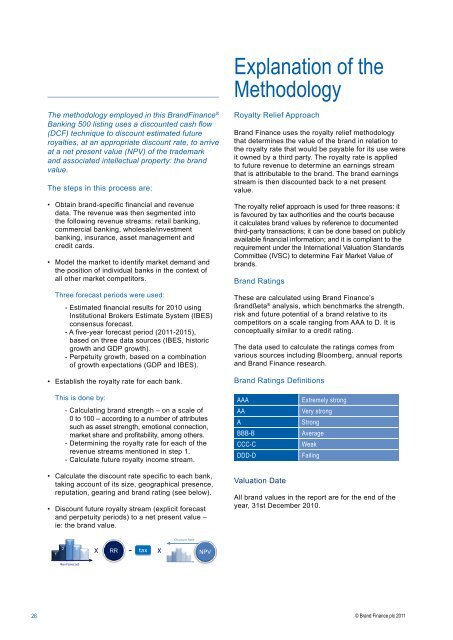

The methodology employed <strong>in</strong> this <strong>Brand</strong>F<strong>in</strong>ance ®<br />

Bank<strong>in</strong>g 500 list<strong>in</strong>g uses a discounted cash flow<br />

(DCF) technique to discount estimated future<br />

royalties, at an appropriate discount rate, to arrive<br />

at a net present value (NPV) of <strong>the</strong> trademark<br />

and associated <strong>in</strong>tellectual property: <strong>the</strong> brand<br />

value.<br />

The steps <strong>in</strong> this process are:<br />

• Obta<strong>in</strong> brand-specific f<strong>in</strong>ancial and revenue<br />

data. The revenue was <strong>the</strong>n segmented <strong>in</strong>to<br />

<strong>the</strong> follow<strong>in</strong>g revenue streams: retail <strong>bank<strong>in</strong>g</strong>,<br />

commercial <strong>bank<strong>in</strong>g</strong>, wholesale/<strong>in</strong>vestment<br />

<strong>bank<strong>in</strong>g</strong>, <strong>in</strong>surance, asset management and<br />

credit cards.<br />

• Model <strong>the</strong> market to identify market demand and<br />

<strong>the</strong> position of <strong>in</strong>dividual banks <strong>in</strong> <strong>the</strong> context of<br />

all o<strong>the</strong>r market competitors.<br />

Three forecast periods were used:<br />

- Estimated f<strong>in</strong>ancial results for 20<strong>10</strong> us<strong>in</strong>g<br />

Institutional Brokers Estimate System (IBES)<br />

consensus forecast.<br />

- A five-year forecast period (2011-2015),<br />

based on three data sources (IBES, historic<br />

growth and GDP growth).<br />

- Perpetuity growth, based on a comb<strong>in</strong>ation<br />

of growth expectations (GDP and IBES).<br />

• Establish <strong>the</strong> royalty rate for each bank.<br />

This is done by:<br />

- Calculat<strong>in</strong>g brand strength – on a scale of<br />

0 to <strong>10</strong>0 – accord<strong>in</strong>g to a number of attributes<br />

such as asset strength, emotional connection,<br />

market share and profitability, among o<strong>the</strong>rs.<br />

- Determ<strong>in</strong><strong>in</strong>g <strong>the</strong> royalty rate for each of <strong>the</strong><br />

revenue streams mentioned <strong>in</strong> step 1.<br />

- Calculate future royalty <strong>in</strong>come stream.<br />

• Calculate <strong>the</strong> discount rate specific to each bank,<br />

tak<strong>in</strong>g account of its size, geographical presence,<br />

reputation, gear<strong>in</strong>g and brand rat<strong>in</strong>g (see below).<br />

• Discount future royalty stream (explicit forecast<br />

and perpetuity periods) to a net present value –<br />

ie: <strong>the</strong> brand value.<br />

1<br />

2<br />

3<br />

4<br />

Rev Forecast<br />

5<br />

- X<br />

X RR tax<br />

Discount Rate<br />

NPV<br />

Explanation of <strong>the</strong><br />

Methodology<br />

Royalty Relief Approach<br />

<strong>Brand</strong> F<strong>in</strong>ance uses <strong>the</strong> royalty relief methodology<br />

that determ<strong>in</strong>es <strong>the</strong> value of <strong>the</strong> brand <strong>in</strong> relation to<br />

<strong>the</strong> royalty rate that would be payable for its use were<br />

it owned by a third party. The royalty rate is applied<br />

to future revenue to determ<strong>in</strong>e an earn<strong>in</strong>gs stream<br />

that is attributable to <strong>the</strong> brand. The brand earn<strong>in</strong>gs<br />

stream is <strong>the</strong>n discounted back to a net present<br />

value.<br />

The royalty relief approach is used for three reasons: it<br />

is favoured by tax authorities and <strong>the</strong> courts because<br />

it calculates brand values by reference to documented<br />

third-party transactions; it can be done based on publicly<br />

available f<strong>in</strong>ancial <strong>in</strong>formation; and it is compliant to <strong>the</strong><br />

requirement under <strong>the</strong> International Valuation Standards<br />

Committee (IVSC) to determ<strong>in</strong>e Fair Market Value of<br />

<strong>brands</strong>.<br />

<strong>Brand</strong> Rat<strong>in</strong>gs<br />

These are calculated us<strong>in</strong>g <strong>Brand</strong> F<strong>in</strong>ance’s<br />

ßrandßeta ® analysis, which benchmarks <strong>the</strong> strength,<br />

risk and future potential of a brand relative to its<br />

competitors on a scale rang<strong>in</strong>g from AAA to D. It is<br />

conceptually similar to a credit rat<strong>in</strong>g.<br />

The data used to calculate <strong>the</strong> rat<strong>in</strong>gs comes from<br />

various sources <strong>in</strong>clud<strong>in</strong>g Bloomberg, annual reports<br />

and <strong>Brand</strong> F<strong>in</strong>ance research.<br />

<strong>Brand</strong> Rat<strong>in</strong>gs Def<strong>in</strong>itions<br />

AAA Extremely strong<br />

AA Very strong<br />

A Strong<br />

BBB-B Average<br />

CCC-C Weak<br />

DDD-D Fail<strong>in</strong>g<br />

Valuation Date<br />

All brand values <strong>in</strong> <strong>the</strong> report are for <strong>the</strong> end of <strong>the</strong><br />

year, 31st December 20<strong>10</strong>.<br />

26 © <strong>Brand</strong> F<strong>in</strong>ance plc 2011