top 10 most valuable banking brands in the world - Brand Finance

top 10 most valuable banking brands in the world - Brand Finance

top 10 most valuable banking brands in the world - Brand Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

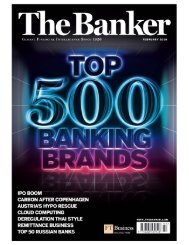

<strong>Brand</strong><br />

A brand is a trademark and associated Intellectual<br />

Property<br />

ßrandßeta ®<br />

<strong>Brand</strong> F<strong>in</strong>ance’s proprietary method for adjust<strong>in</strong>g<br />

a weighted average cost of capital (WACC) to arrive<br />

at a specific discount rate for each brand (based<br />

on its <strong>Brand</strong> Rat<strong>in</strong>g)<br />

<strong>Brand</strong>ed bus<strong>in</strong>ess<br />

The whole bus<strong>in</strong>ess trad<strong>in</strong>g under particular <strong>brands</strong>,<br />

<strong>the</strong> associated goodwill and all <strong>the</strong> o<strong>the</strong>r tangible and<br />

<strong>in</strong>tangible elements at work with<strong>in</strong> <strong>the</strong> bus<strong>in</strong>ess<br />

<strong>Brand</strong> rat<strong>in</strong>g<br />

A summary op<strong>in</strong>ion, similar to a credit rat<strong>in</strong>g,<br />

on a brand based on its strength as measured<br />

by <strong>Brand</strong> F<strong>in</strong>ance’s ßrandßeta ® analysis<br />

<strong>Brand</strong> value<br />

The net present value of <strong>the</strong> estimated future<br />

cash flows attributable to <strong>the</strong> brand (see Explanation<br />

of Methodology for more detail)<br />

Compound Annual Growth Rate (CAGR)<br />

The year-over-year growth rate of an <strong>in</strong>vestment over<br />

a specified period of time<br />

Discounted cash flow (DCF)<br />

A method of evaluat<strong>in</strong>g an asset value by estimat<strong>in</strong>g<br />

future cash flows and tak<strong>in</strong>g <strong>in</strong>to consideration <strong>the</strong><br />

time value of money and risk attributed to <strong>the</strong> future<br />

cash flows<br />

Discount rate<br />

The <strong>in</strong>terest rate used <strong>in</strong> discount<strong>in</strong>g future<br />

cash flows<br />

Disclosed Intangibles<br />

This represents <strong>the</strong> value of acquired <strong>in</strong>tangible<br />

assets as reported <strong>in</strong> a group’s f<strong>in</strong>ancial statements<br />

Enterprise value<br />

The comb<strong>in</strong>ed market value of <strong>the</strong> equity and debt of<br />

a bus<strong>in</strong>ess less cash and cash equivalents<br />

Fair market value (FMV)<br />

The price at which a bus<strong>in</strong>ess or assets would<br />

change hands between a will<strong>in</strong>g buyer and a will<strong>in</strong>g<br />

seller, nei<strong>the</strong>r of whom are under compulsion to buy<br />

or sell and both hav<strong>in</strong>g reasonable knowledge of all<br />

relevant facts at <strong>the</strong> time<br />

Global Intangible F<strong>in</strong>ance Tracker (GIFT)<br />

The <strong>Brand</strong> F<strong>in</strong>ance ‘Global Intangible F<strong>in</strong>ance<br />

Tracker is <strong>the</strong> <strong>most</strong> extensive report ever compiled<br />

<strong>in</strong>to <strong>in</strong>tangible assets and covers over 5,000<br />

companies <strong>in</strong> 25 countries<br />

Glossary of Terms<br />

Hold<strong>in</strong>g company<br />

A company controll<strong>in</strong>g management and operations <strong>in</strong><br />

ano<strong>the</strong>r company or group of o<strong>the</strong>r companies<br />

Institutional Brokers Estimate System (IBES)<br />

A system that ga<strong>the</strong>rs and compiles <strong>the</strong> different<br />

estimates made by stock analysts on <strong>the</strong> future<br />

earn<strong>in</strong>gs for <strong>most</strong> of <strong>the</strong> major publicly traded<br />

companies<br />

Intangible asset<br />

An identifiable non-monetary asset without physical<br />

substance<br />

Net present value (NPV)<br />

The present value of an asset’s net cash flows (m<strong>in</strong>us<br />

any <strong>in</strong>itial <strong>in</strong>vestment)<br />

Market Capitalisation (Market Cap)<br />

Current price per share multiplied by <strong>the</strong> number<br />

of shares <strong>in</strong> issue<br />

Perpetuity Growth<br />

Is <strong>the</strong> stable growth rate assumed to be effective <strong>in</strong><br />

perpetuity follow<strong>in</strong>g <strong>the</strong> last explicit forecast period<br />

Royalty Rate<br />

The rate at which usage-based payments are made<br />

by one party (<strong>the</strong> licensee) to ano<strong>the</strong>r (<strong>the</strong> licensor)<br />

for ongo<strong>in</strong>g use of <strong>the</strong> licensor’s asset, sometimes<br />

an <strong>in</strong>tellectual property right<br />

Royalty Relief Method<br />

Please see methodology section<br />

Tangible Net Assets<br />

Calculated as <strong>the</strong> total assets of a company, m<strong>in</strong>us<br />

any <strong>in</strong>tangible assets such as goodwill, patents and<br />

trademarks, less all liabilities and <strong>the</strong> par value of<br />

preferred stock<br />

Tangible Value<br />

The fair market value of <strong>the</strong> monetary and physical<br />

assets of a bus<strong>in</strong>ess<br />

Undisclosed Intangible Value<br />

This represents <strong>the</strong> value of <strong>the</strong> <strong>in</strong>tangible assets<br />

which are not separately reported <strong>in</strong> a group’s<br />

f<strong>in</strong>ancial statements (e.g. Goodwill, patents)<br />

Weighted average cost of capital (WACC)<br />

An average represent<strong>in</strong>g <strong>the</strong> expected return on all<br />

of a company’s securities. Each source of capital,<br />

such as stocks, bonds, and o<strong>the</strong>r debt, is assigned a<br />

required rate of return, and <strong>the</strong>n <strong>the</strong>se required rates<br />

of return are weighted <strong>in</strong> proportion to <strong>the</strong> share each<br />

source of capital contributes to <strong>the</strong> company’s capital<br />

structure<br />

33 © <strong>Brand</strong> F<strong>in</strong>ance plc 2011