Annual Report 2012 pdf (5 MB) - Deutsche Post DHL

Annual Report 2012 pdf (5 MB) - Deutsche Post DHL

Annual Report 2012 pdf (5 MB) - Deutsche Post DHL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

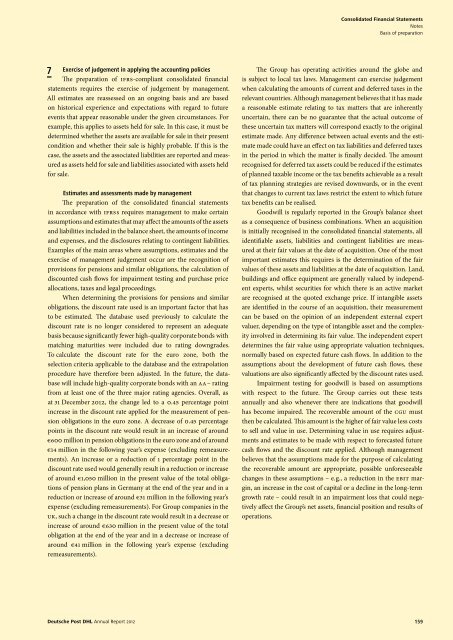

7<br />

Exercise of judgement in applying the accounting policies<br />

The preparation of IFRS-compliant consolidated financial<br />

statements requires the exercise of judgement by management.<br />

All estimates are reassessed on an ongoing basis and are based<br />

on historical experience and expectations with regard to future<br />

events that appear reasonable under the given circumstances. For<br />

example, this applies to assets held for sale. In this case, it must be<br />

determined whether the assets are available for sale in their present<br />

condition and whether their sale is highly probable. If this is the<br />

case, the assets and the associated liabilities are reported and measured<br />

as assets held for sale and liabilities associated with assets held<br />

for sale.<br />

Estimates and assessments made by management<br />

The preparation of the consolidated financial statements<br />

in accordance with IFRS s requires management to make certain<br />

assumptions and estimates that may affect the amounts of the assets<br />

and liabilities included in the balance sheet, the amounts of income<br />

and expenses, and the disclosures relating to contingent liabilities.<br />

Examples of the main areas where assumptions, estimates and the<br />

exercise of management judgement occur are the recognition of<br />

provisions for pensions and similar obligations, the calculation of<br />

discounted cash flows for impairment testing and purchase price<br />

allocations, taxes and legal proceedings.<br />

When determining the provisions for pensions and similar<br />

obligations, the discount rate used is an important factor that has<br />

to be estimated. The database used previously to calculate the<br />

discount rate is no longer considered to represent an adequate<br />

basis because significantly fewer high-quality corporate bonds with<br />

matching maturities were included due to rating downgrades.<br />

To calculate the discount rate for the euro zone, both the<br />

selection criteria applicable to the database and the extrapolation<br />

procedure have therefore been adjusted. In the future, the database<br />

will include high-quality corporate bonds with an AA – rating<br />

from at least one of the three major rating agencies. Overall, as<br />

at 31 December <strong>2012</strong>, the change led to a 0.45 percentage point<br />

increase in the discount rate applied for the measurement of pension<br />

obligations in the euro zone. A decrease of 0.45 percentage<br />

points in the discount rate would result in an increase of around<br />

€600 million in pension obligations in the euro zone and of around<br />

€14 million in the following year’s expense (excluding remeasurements).<br />

An increase or a reduction of 1 percentage point in the<br />

discount rate used would generally result in a reduction or increase<br />

of around €1,050 million in the present value of the total obligations<br />

of pension plans in Germany at the end of the year and in a<br />

reduction or increase of around €31 million in the following year’s<br />

expense (excluding remeasurements). For Group companies in the<br />

UK, such a change in the discount rate would result in a decrease or<br />

increase of around €630 million in the pres ent value of the total<br />

obligation at the end of the year and in a decrease or increase of<br />

around €41 million in the following year’s expense (excluding<br />

remeasurements).<br />

<strong>Deutsche</strong> <strong>Post</strong> <strong>DHL</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Consolidated Financial Statements<br />

Notes<br />

Basis of preparation<br />

The Group has operating activities around the globe and<br />

is subject to local tax laws. Management can exercise judgement<br />

when calculating the amounts of current and deferred taxes in the<br />

relevant countries. Although management believes that it has made<br />

a reasonable estimate relating to tax matters that are inherently<br />

uncertain, there can be no guarantee that the actual outcome of<br />

these uncertain tax matters will correspond exactly to the original<br />

estimate made. Any difference between actual events and the estimate<br />

made could have an effect on tax liabilities and deferred taxes<br />

in the period in which the matter is finally decided. The amount<br />

recognised for deferred tax assets could be reduced if the estimates<br />

of planned taxable income or the tax benefits achievable as a result<br />

of tax planning strategies are revised downwards, or in the event<br />

that changes to current tax laws restrict the extent to which future<br />

tax benefits can be realised.<br />

Goodwill is regularly reported in the Group’s balance sheet<br />

as a consequence of business combinations. When an acquisition<br />

is initially recognised in the consolidated financial statements, all<br />

identifiable assets, liabilities and contingent liabilities are measured<br />

at their fair values at the date of acquisition. One of the most<br />

important estimates this requires is the determination of the fair<br />

values of these assets and liabilities at the date of acquisition. Land,<br />

buildings and office equipment are generally valued by independent<br />

experts, whilst securities for which there is an active market<br />

are recognised at the quoted exchange price. If intangible assets<br />

are identified in the course of an acquisition, their measurement<br />

can be based on the opinion of an independent external expert<br />

valuer, depending on the type of intangible asset and the complexity<br />

involved in determining its fair value. The independent expert<br />

determines the fair value using appropriate valuation techniques,<br />

normally based on expected future cash flows. In addition to the<br />

assumptions about the development of future cash flows, these<br />

valuations are also significantly affected by the discount rates used.<br />

Impairment testing for goodwill is based on assumptions<br />

with respect to the future. The Group carries out these tests<br />

annually and also whenever there are indications that goodwill<br />

has become impaired. The recoverable amount of the CGU must<br />

then be calculated. This amount is the higher of fair value less costs<br />

to sell and value in use. Determining value in use requires adjustments<br />

and estimates to be made with respect to forecasted future<br />

cash flows and the discount rate applied. Although management<br />

believes that the assumptions made for the purpose of calculating<br />

the recoverable amount are appropriate, possible unforeseeable<br />

changes in these assumptions – e. g., a reduction in the EBIT margin,<br />

an increase in the cost of capital or a decline in the long-term<br />

growth rate – could result in an impairment loss that could negatively<br />

affect the Group’s net assets, financial position and results of<br />

operations.<br />

159