Annual Report 2012 pdf (5 MB) - Deutsche Post DHL

Annual Report 2012 pdf (5 MB) - Deutsche Post DHL

Annual Report 2012 pdf (5 MB) - Deutsche Post DHL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

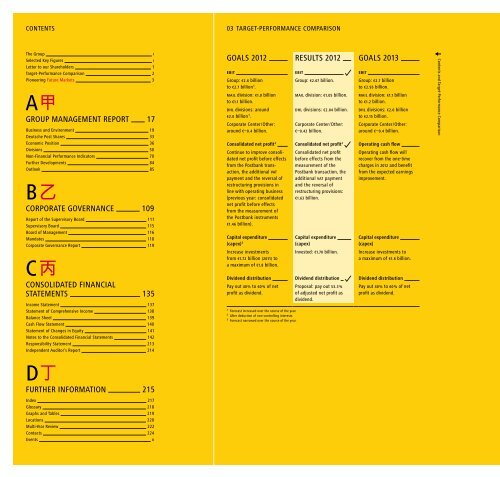

Contents<br />

the group I<br />

selected Key Figures I<br />

letter to our shareholders 1<br />

target-Performance Comparison 2<br />

Pioneering Future Markets 3<br />

a 甲<br />

grouP ManageMent rePort 17<br />

business and environment 19<br />

<strong>Deutsche</strong> <strong>Post</strong> shares 33<br />

economic Position 36<br />

Divisions 50<br />

non-Financial Performance indicators 70<br />

Further Developments 84<br />

outlook 85<br />

b乙<br />

CorPorate goVernanCe 109<br />

report of the supervisory board 111<br />

supervisory board 115<br />

board of Management 116<br />

Mandates 118<br />

Corporate governance report 119<br />

C 丙<br />

ConsoliDateD FinanCial<br />

stateMents 135<br />

income statement 137<br />

statement of Comprehensive income 138<br />

balance sheet 139<br />

Cash Flow statement 140<br />

statement of Changes in equity 141<br />

notes to the Consolidated Financial statements 142<br />

responsibility statement 213<br />

independent auditor’s report 214<br />

D丁<br />

FurtHer inForMation 215<br />

index 217<br />

glossary 218<br />

graphs and tables 219<br />

locations 220<br />

Multi-Year review 222<br />

Contacts 224<br />

events II<br />

03 target-PerForManCe CoMParison<br />

goals <strong>2012</strong> results <strong>2012</strong> goals 2013<br />

EBIT<br />

group: €2.6 billion<br />

to €2.7 billion 1 .<br />

MAIL division: €1.0 billion<br />

to €1.1 billion.<br />

<strong>DHL</strong> divisions: around<br />

€2.0 billion 1 .<br />

Corporate Center / other:<br />

around €–0.4 billion.<br />

Consolidated net profi t 2<br />

Continue to improve consolidated<br />

net profi t before effects<br />

from the <strong>Post</strong>bank transaction,<br />

the additional VAT<br />

payment and the reversal of<br />

restructuring provisions in<br />

line with operating business<br />

(previous year: consolidated<br />

net profit before effects<br />

from the measurement of<br />

the <strong>Post</strong>bank instruments<br />

€1.46 billion).<br />

Capital expenditure<br />

(capex) 3<br />

increase investments<br />

from €1.72 billion (2011) to<br />

a maximum of €1.8 billion.<br />

Dividend distribution<br />

Pay out 40 % to 60 % of net<br />

profi t as dividend.<br />

1 Forecast increased over the course of the year.<br />

2 after deduction of non-controlling interests.<br />

3 Forecast narrowed over the course of the year.<br />

EBIT<br />

group: €2.67 billion.<br />

MAIL division: €1.05 billion.<br />

<strong>DHL</strong> divisions: €2.04 billion.<br />

Corporate Center / other:<br />

€–0.42 billion.<br />

Consolidated net profi t 2<br />

Consolidated net profi t<br />

before effects from the<br />

measurement of the<br />

<strong>Post</strong>bank transaction, the<br />

additional VAT payment<br />

and the reversal of<br />

restructuring provisions:<br />

€1.63 billion.<br />

Capital expenditure<br />

(capex)<br />

invested: €1.70 billion.<br />

Dividend distribution<br />

Proposal: pay out 53.3 %<br />

of adjusted net profi t as<br />

dividend.<br />

EBIT<br />

group: €2.7 billion<br />

to €2.95 billion.<br />

MAIL division: €1.1 billion<br />

to €1.2 billion.<br />

<strong>DHL</strong> divisions: €2.0 billion<br />

to €2.15 billion.<br />

Corporate Center / other:<br />

around €–0.4 billion.<br />

Operating cash fl ow<br />

operating cash fl ow will<br />

recover from the one-time<br />

charges in <strong>2012</strong> and benefi t<br />

from the expected earnings<br />

improvement.<br />

Capital expenditure<br />

(capex)<br />

increase investments to<br />

a maximum of €1.8 billion.<br />

Dividend distribution<br />

Pay out 40 % to 60 % of net<br />

profi t as dividend.<br />

Contents and target-Performance Comparison