MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIReCtoRs’ <strong>RepoRt</strong><br />

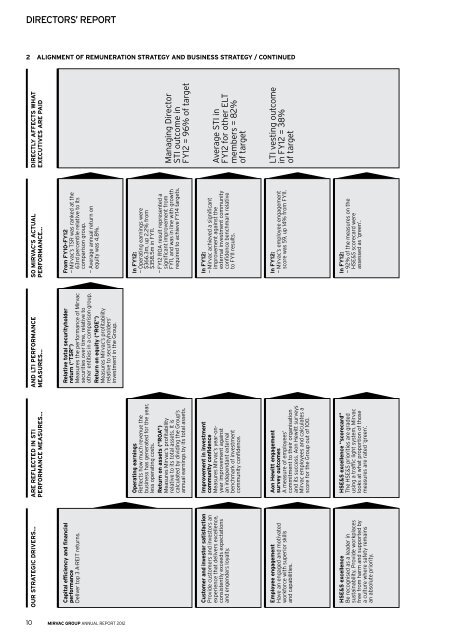

2 AlignMent of ReMuneRAtion stRAtegy AnD business stRAtegy / continueD<br />

DiRectly Affects whAt<br />

eXecutives ARe pAiD<br />

so MiRvAc’s ActuAl<br />

peRfoRMAnce…<br />

AnD lti peRfoRMAnce<br />

MeAsuRes…<br />

ouR stRAtegic DRiveRs… ARe ReflecteD in sti<br />

peRfoRMAnce MeAsuRes…<br />

from fy10-fy12<br />

— <strong>Mirvac</strong>’s TSR was ranked at the<br />

63rd percentile relative to its<br />

comparison group.<br />

— Average annual return on<br />

equity was 4.8%.<br />

Relative total securityholder<br />

return (“tsR”)<br />

Measures the performance of <strong>Mirvac</strong><br />

securities over time, relative to<br />

other entities in a comparison group.<br />

Return on equity (“Roe”)<br />

Measures <strong>Mirvac</strong>’s profitability<br />

relative to securityholders’<br />

investment in the <strong>Group</strong>.<br />

capital efficiency and financial<br />

performance<br />

Deliver top 3 A-ReIT returns.<br />

10 mirvac group annual report <strong>2012</strong><br />

Managing Director<br />

STI outcome in<br />

Fy12 = 96% of target<br />

in fy12:<br />

— operating earnings were<br />

$366.3m, up 2.2% from<br />

$358.5m in Fy11.<br />

— Fy12 RoA result represented a<br />

significant improvement from<br />

Fy11, and was in line with growth<br />

required to achieve Fy14 targets.<br />

operating earnings<br />

Reflects how much revenue the<br />

business has generated for the year,<br />

less operating costs.<br />

Return on assets (“RoA”)<br />

Measures <strong>Mirvac</strong>’s profitability<br />

relative to its total assets. It is<br />

calculated by dividing the <strong>Group</strong>’s<br />

annual earnings by its total assets.<br />

Average STI in<br />

Fy12 for other eLT<br />

members = 82%<br />

of target<br />

in fy12:<br />

— <strong>Mirvac</strong> achieved a significant<br />

improvement against the<br />

external investment community<br />

confidence benchmark relative<br />

to Fy11 results.<br />

improvement in investment<br />

community confidence<br />

Measures <strong>Mirvac</strong>’s year-onyear<br />

improvement against<br />

an independant external<br />

benchmark of investment<br />

community confidence.<br />

customer and investor satisfaction<br />

Provide customers and investors an<br />

experience that delivers excellence,<br />

consistently exceeds expectations<br />

and engenders loyalty.<br />

LTI vesting outcome<br />

in Fy12 = 38%<br />

of target<br />

in fy12:<br />

— <strong>Mirvac</strong>’s employee engagement<br />

score was 59, up 14% from Fy11.<br />

Aon hewitt engagement<br />

survey outcomes<br />

A measure of employees’<br />

commitment to their organisation<br />

and its success. Aon hewitt surveys<br />

<strong>Mirvac</strong> employees and calculates a<br />

score for the <strong>Group</strong> out of 100.<br />

employee engagement<br />

have an engaged and motivated<br />

workforce with superior skills<br />

and capabilities.<br />

in fy12:<br />

— 92% of the measures on the<br />

hSe&S scorecard were<br />

assessed as ‘green’.<br />

hse&s excellence “scorecard”<br />

The hSe&S priorities are graded<br />

using a traffic light system. <strong>Mirvac</strong><br />

looks at what proportion of those<br />

measures are rated ‘green’.<br />

hse&s excellence<br />

Be recognised as a leader in<br />

sustainability. Provide workplaces<br />

free from harm and supported by<br />

a culture where safety remains<br />

an absolute priority.