MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIReCtoRs’ <strong>RepoRt</strong><br />

3 ouR AppRoAch to eXecutive ReMuneRAtion<br />

Design / continueD<br />

c) Market positioning<br />

Consistent with the principles outlined above, <strong>Mirvac</strong> has<br />

adopted a market positioning strategy designed to attract<br />

and retain talented employees, and to reward them for<br />

delivering strong performance. The market positioning<br />

strategy also supports fair and equitable outcomes<br />

between employees.<br />

Definition of market<br />

when determining the relevant market for each role, <strong>Mirvac</strong><br />

considers the companies from which it sources talent, and<br />

to whom it could potentially lose talent. A distinction is made<br />

between the market for business roles and the market for<br />

corporate roles.<br />

For business roles:<br />

— the primary comparison group is the Australian Real estate<br />

Investment Trust (“A-ReIT”) sector, plus Lend Lease, FKP<br />

Property <strong>Group</strong> and Australand Property <strong>Group</strong>; and<br />

— the secondary comparison group is a general industry<br />

comparison group with a similar market capitalisation<br />

(50-200 per cent of <strong>Mirvac</strong>’s 12 month average market<br />

capitalisation).<br />

For corporate roles:<br />

— the primary comparison group is a general industry<br />

comparison group with a similar market capitalisation<br />

(50-200 per cent of <strong>Mirvac</strong>’s 12 month average market<br />

capitalisation) to reflect the greater transferability of skills.<br />

where disclosed data is unavailable, <strong>Mirvac</strong> relies on<br />

published remuneration surveys covering relevant industries<br />

and the broader market.<br />

targeted market positioning<br />

Fixed remuneration at <strong>Mirvac</strong> is positioned at the median<br />

(50th percentile), with the ability to work within a range<br />

around the median based on criteria such as:<br />

— the criticality of the role to successful execution of the<br />

business strategy;<br />

— assessment of employee performance/potential; and<br />

— the employee’s experience level.<br />

Target total remuneration at <strong>Mirvac</strong> is positioned at the<br />

median (50th percentile) with the opportunity to earn total<br />

remuneration up to the upper quartile (75th percentile) in<br />

the event that both the individual and the business achieve<br />

stretch targets.<br />

d) Remuneration mix<br />

<strong>Mirvac</strong>’s remuneration structures strive to fairly and<br />

responsibly reward employees, while complying with all<br />

relevant regulatory requirements.<br />

A significant portion of total remuneration for executives<br />

is variable or at risk if applicable performance criteria are<br />

not met or exceeded each year.<br />

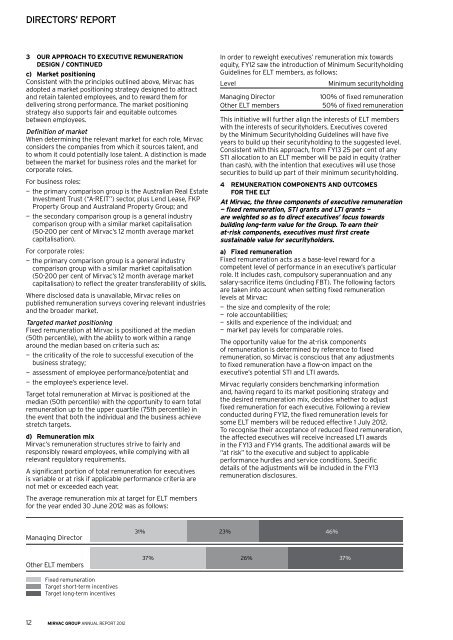

The average remuneration mix at target for eLT members<br />

for the year ended 30 June <strong>2012</strong> was as follows:<br />

Managing Director<br />

Other ELT members<br />

Fixed remuneration<br />

Target short-term incentives<br />

Target long-term incentives<br />

12 mirvac group annual report <strong>2012</strong><br />

In order to reweight executives’ remuneration mix towards<br />

equity, Fy12 saw the introduction of Minimum Securityholding<br />

Guidelines for eLT members, as follows:<br />

Level Minimum securityholding<br />

Managing Director 100% of fixed remuneration<br />

other eLT members 50% of fixed remuneration<br />

This initiative will further align the interests of eLT members<br />

with the interests of securityholders. executives covered<br />

by the Minimum Securityholding Guidelines will have five<br />

years to build up their securityholding to the suggested level.<br />

Consistent with this approach, from Fy13 25 per cent of any<br />

STI allocation to an eLT member will be paid in equity (rather<br />

than cash), with the intention that executives will use those<br />

securities to build up part of their minimum securityholding.<br />

4 ReMuneRAtion coMponents AnD outcoMes<br />

foR the elt<br />

At <strong>Mirvac</strong>, the three components of executive remuneration<br />

— fixed remuneration, sti grants and lti grants —<br />

are weighted so as to direct executives’ focus towards<br />

building long-term value for the group. to earn their<br />

at-risk components, executives must first create<br />

sustainable value for securityholders.<br />

a) fixed remuneration<br />

Fixed remuneration acts as a base-level reward for a<br />

competent level of performance in an executive’s particular<br />

role. It includes cash, compulsory superannuation and any<br />

salary-sacrifice items (including FBT). The following factors<br />

are taken into account when setting fixed remuneration<br />

levels at <strong>Mirvac</strong>:<br />

— the size and complexity of the role;<br />

— role accountabilities;<br />

— skills and experience of the individual; and<br />

— market pay levels for comparable roles.<br />

The opportunity value for the at-risk components<br />

of remuneration is determined by reference to fixed<br />

remuneration, so <strong>Mirvac</strong> is conscious that any adjustments<br />

to fixed remuneration have a flow-on impact on the<br />

executive’s potential STI and LTI awards.<br />

<strong>Mirvac</strong> regularly considers benchmarking information<br />

and, having regard to its market positioning strategy and<br />

the desired remuneration mix, decides whether to adjust<br />

fixed remuneration for each executive. Following a review<br />

conducted during Fy12, the fixed remuneration levels for<br />

some eLT members will be reduced effective 1 July <strong>2012</strong>.<br />

To recognise their acceptance of reduced fixed remuneration,<br />

the affected executives will receive increased LTI awards<br />

in the Fy13 and Fy14 grants. The additional awards will be<br />

“at risk” to the executive and subject to applicable<br />

performance hurdles and service conditions. Specific<br />

details of the adjustments will be included in the Fy13<br />

remuneration disclosures.<br />

31% 23% 46%<br />

37% 26% 37%