MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

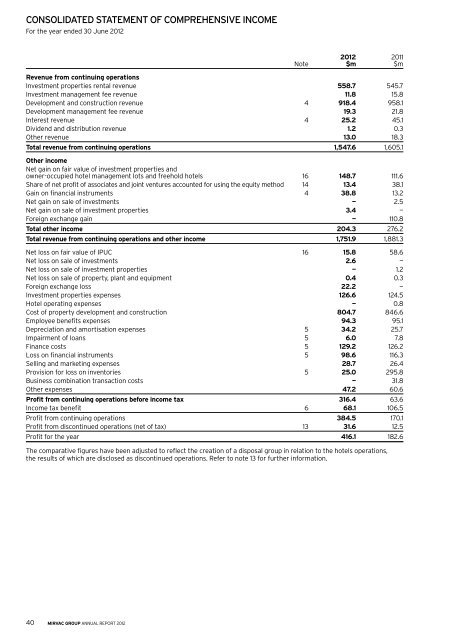

ConsolIDAteD stAteMent of CoMpReHensIVe InCoMe<br />

For the year ended 30 June <strong>2012</strong><br />

40 mirvac group annual report <strong>2012</strong><br />

<strong>2012</strong> 2011<br />

Note $m $m<br />

Revenue from continuing operations<br />

Investment properties rental revenue 558.7 545.7<br />

Investment management fee revenue 11.8 15.8<br />

Development and construction revenue 4 918.4 958.1<br />

Development management fee revenue 19.3 21.8<br />

Interest revenue 4 25.2 45.1<br />

Dividend and distribution revenue 1.2 0.3<br />

other revenue 13.0 18.3<br />

total revenue from continuing operations 1,547.6 1,605.1<br />

other income<br />

Net gain on fair value of investment properties and<br />

owner-occupied hotel management lots and freehold hotels 16 148.7 111.6<br />

Share of net profit of associates and joint ventures accounted for using the equity method 14 13.4 38.1<br />

Gain on financial instruments 4 38.8 13.2<br />

Net gain on sale of investments — 2.5<br />

Net gain on sale of investment properties 3.4 —<br />

Foreign exchange gain — 110.8<br />

total other income 204.3 276.2<br />

total revenue from continuing operations and other income 1,751.9 1,881.3<br />

Net loss on fair value of IPuC 16 15.8 58.6<br />

Net loss on sale of investments 2.6 —<br />

Net loss on sale of investment properties — 1.2<br />

Net loss on sale of property, plant and equipment 0.4 0.3<br />

Foreign exchange loss 22.2 —<br />

Investment properties expenses 126.6 124.5<br />

hotel operating expenses — 0.8<br />

Cost of property development and construction 804.7 846.6<br />

employee benefits expenses 94.3 95.1<br />

Depreciation and amortisation expenses 5 34.2 25.7<br />

Impairment of loans 5 6.0 7.8<br />

Finance costs 5 129.2 126.2<br />

Loss on financial instruments 5 98.6 116.3<br />

Selling and marketing expenses 28.7 26.4<br />

Provision for loss on inventories 5 25.0 295.8<br />

Business combination transaction costs — 31.8<br />

other expenses 47.2 60.6<br />

profit from continuing operations before income tax 316.4 63.6<br />

Income tax benefit 6 68.1 106.5<br />

Profit from continuing operations 384.5 170.1<br />

Profit from discontinued operations (net of tax) 13 31.6 12.5<br />

Profit for the year 416.1 182.6<br />

The comparative figures have been adjusted to reflect the creation of a disposal group in relation to the hotels operations,<br />

the results of which are disclosed as discontinued operations. Refer to note 13 for further information.