MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIReCtoRs’ <strong>RepoRt</strong><br />

7 non-eXecutive DiRectoRs’ ReMuneRAtion / continueD<br />

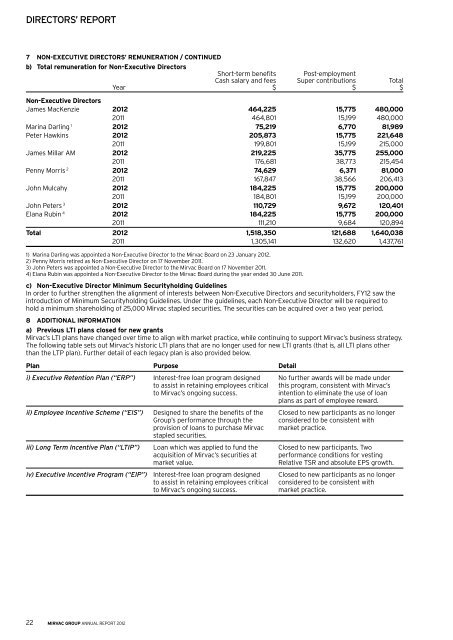

b) total remuneration for non-executive Directors<br />

Short-term benefits Post-employment<br />

Cash salary and fees Super contributions Total<br />

year $ $ $<br />

non-executive Directors<br />

James MacKenzie <strong>2012</strong> 464,225 15,775 480,000<br />

2011 464,801 15,199 480,000<br />

Marina Darling 1 <strong>2012</strong> 75,219 6,770 81,989<br />

Peter hawkins <strong>2012</strong> 205,873 15,775 221,648<br />

2011 199,801 15,199 215,000<br />

James Millar AM <strong>2012</strong> 219,225 35,775 255,000<br />

2011 176,681 38,773 215,454<br />

Penny Morris 2 <strong>2012</strong> 74,629 6,371 81,000<br />

2011 167,847 38,566 206,413<br />

John Mulcahy <strong>2012</strong> 184,225 15,775 200,000<br />

2011 184,801 15,199 200,000<br />

John Peters 3 <strong>2012</strong> 110,729 9,672 120,401<br />

elana Rubin 4 <strong>2012</strong> 184,225 15,775 200,000<br />

2011 111,210 9,684 120,894<br />

total <strong>2012</strong> 1,518,350 121,688 1,640,038<br />

2011 1,305,141 132,620 1,437,761<br />

1) Marina Darling was appointed a Non-executive Director to the <strong>Mirvac</strong> Board on 23 January <strong>2012</strong>.<br />

2) Penny Morris retired as Non-executive Director on 17 November 2011.<br />

3) John Peters was appointed a Non-executive Director to the <strong>Mirvac</strong> Board on 17 November 2011.<br />

4) elana Rubin was appointed a Non-executive Director to the <strong>Mirvac</strong> Board during the year ended 30 June 2011.<br />

c) non-executive Director Minimum securityholding guidelines<br />

In order to further strengthen the alignment of interests between Non-executive Directors and securityholders, Fy12 saw the<br />

introduction of Minimum Securityholding Guidelines. under the guidelines, each Non-executive Director will be required to<br />

hold a minimum shareholding of 25,000 <strong>Mirvac</strong> stapled securities. The securities can be acquired over a two year period.<br />

8 ADDitionAl infoRMAtion<br />

a) previous lti plans closed for new grants<br />

<strong>Mirvac</strong>’s LTI plans have changed over time to align with market practice, while continuing to support <strong>Mirvac</strong>’s business strategy.<br />

The following table sets out <strong>Mirvac</strong>’s historic LTI plans that are no longer used for new LTI grants (that is, all LTI plans other<br />

than the LTP plan). Further detail of each legacy plan is also provided below.<br />

plan purpose Detail<br />

i) executive Retention plan (“eRp”) Interest-free loan program designed<br />

to assist in retaining employees critical<br />

to <strong>Mirvac</strong>’s ongoing success.<br />

ii) employee Incentive scheme (“eIs”) Designed to share the benefits of the<br />

<strong>Group</strong>’s performance through the<br />

provision of loans to purchase <strong>Mirvac</strong><br />

stapled securities.<br />

iii) long term Incentive plan (“ltIp”) Loan which was applied to fund the<br />

acquisition of <strong>Mirvac</strong>’s securities at<br />

market value.<br />

iv) executive Incentive program (“eIp”) Interest-free loan program designed<br />

to assist in retaining employees critical<br />

to <strong>Mirvac</strong>’s ongoing success.<br />

22 mirvac group annual report <strong>2012</strong><br />

No further awards will be made under<br />

this program, consistent with <strong>Mirvac</strong>’s<br />

intention to eliminate the use of loan<br />

plans as part of employee reward.<br />

Closed to new participants as no longer<br />

considered to be consistent with<br />

market practice.<br />

Closed to new participants. Two<br />

performance conditions for vesting<br />

Relative TSR and absolute ePS growth.<br />

Closed to new participants as no longer<br />

considered to be consistent with<br />

market practice.