MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIReCtoRs’ <strong>RepoRt</strong><br />

8 ADDitionAl infoRMAtion / continueD<br />

on vesting, 53.5 per cent of the original loan to fund the purchase of the vested securities was waived. The remaining balance<br />

of the loan will continue to be reduced by post-tax distributions until either the loan has been fully repaid or the eight year<br />

term expires, whichever occurs first. If a participant terminates their employment, any outstanding loans must be repaid in full<br />

immediately or the underlying securities will be forfeited.<br />

The LTIP is closed to new participants and will be run down until all loans under it are extinguished. At 30 June <strong>2012</strong>, 408,192<br />

(2011: 498,074) securities remain on issue under the 2006 plan.<br />

iv) eIp<br />

The final loans amounts under the eIP were drawn down during the year ended 30 June 2008. The amounts of the loans range<br />

from $50,000 to $800,000 with <strong>Mirvac</strong> holding security over the assets purchased with the loan proceeds. A progressively<br />

increasing forgiveness schedule applied which allowed the total loan balance to be forgiven if the employee remained employed<br />

on the final forgiveness date.<br />

The Chief executive officer — Development is the sole remaining participant in the scheme with amounts yet to be forgiven.<br />

The Chief executive officer — Development had $150,000 forgiven during the year, leaving an outstanding balance of $200,000<br />

at 30 June <strong>2012</strong>. Subject to continued employment, the remaining $200,000 is due to be forgiven during the year ending<br />

30 June 2013.<br />

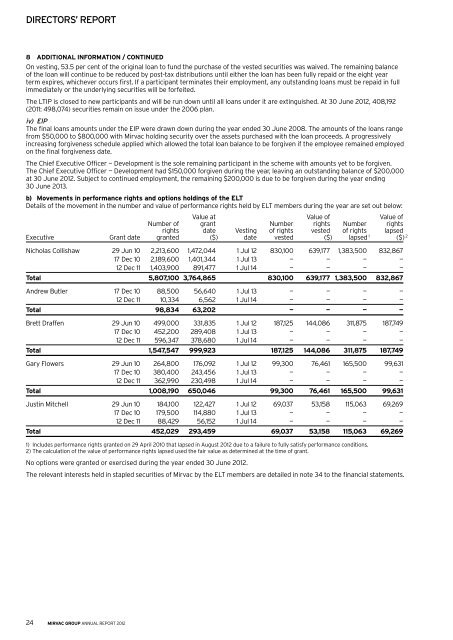

b) Movements in performance rights and options holdings of the elt<br />

Details of the movement in the number and value of performance rights held by eLT members during the year are set out below:<br />

value at value of value of<br />

Number of grant Number rights Number rights<br />

rights date vesting of rights vested of rights lapsed<br />

executive Grant date granted ($) date vested ($) lapsed 1 ($) 2<br />

Nicholas Collishaw 29 Jun 10 2,213,600 1,472,044 1 Jul 12 830,100 639,177 1,383,500 832,867<br />

17 Dec 10 2,189,600 1,401,344 1 Jul 13 — — — —<br />

12 Dec 11 1,403,900 891,477 1 Jul 14 — — — —<br />

total 5,807,100 3,764,865 830,100 639,177 1,383,500 832,867<br />

Andrew Butler 17 Dec 10 88,500 56,640 1 Jul 13 — — — —<br />

12 Dec 11 10,334 6,562 1 Jul 14 — — — —<br />

total 98,834 63,202 — — — —<br />

Brett Draffen 29 Jun 10 499,000 331,835 1 Jul 12 187,125 144,086 311,875 187,749<br />

17 Dec 10 452,200 289,408 1 Jul 13 — — — —<br />

12 Dec 11 596,347 378,680 1 Jul 14 — — — —<br />

total 1,547,547 999,923 187,125 144,086 311,875 187,749<br />

Gary Flowers 29 Jun 10 264,800 176,092 1 Jul 12 99,300 76,461 165,500 99,631<br />

17 Dec 10 380,400 243,456 1 Jul 13 — — — —<br />

12 Dec 11 362,990 230,498 1 Jul 14 — — — —<br />

total 1,008,190 650,046 99,300 76,461 165,500 99,631<br />

Justin Mitchell 29 Jun 10 184,100 122,427 1 Jul 12 69,037 53,158 115,063 69,269<br />

17 Dec 10 179,500 114,880 1 Jul 13 — — — —<br />

12 Dec 11 88,429 56,152 1 Jul 14 — — — —<br />

total 452,029 293,459 69,037 53,158 115,063 69,269<br />

1) Includes performance rights granted on 29 April 2010 that lapsed in August <strong>2012</strong> due to a failure to fully satisfy performance conditions.<br />

2) The calculation of the value of performance rights lapsed used the fair value as determined at the time of grant.<br />

No options were granted or exercised during the year ended 30 June <strong>2012</strong>.<br />

The relevant interests held in stapled securities of <strong>Mirvac</strong> by the eLT members are detailed in note 34 to the financial statements.<br />

24 mirvac group annual report <strong>2012</strong>