MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

MIRVAC gRoup AnnuAl RepoRt 2012 - Mirvac - Mirvac Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

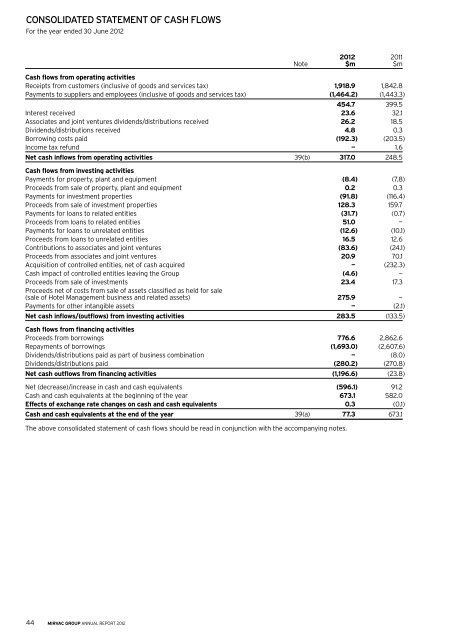

ConsolIDAteD stAteMent of CAsH flows<br />

For the year ended 30 June <strong>2012</strong><br />

44 mirvac group annual report <strong>2012</strong><br />

<strong>2012</strong> 2011<br />

Note $m $m<br />

cash flows from operating activities<br />

Receipts from customers (inclusive of goods and services tax) 1,918.9 1,842.8<br />

Payments to suppliers and employees (inclusive of goods and services tax) (1,464.2) (1,443.3)<br />

454.7 399.5<br />

Interest received 23.6 32.1<br />

Associates and joint ventures dividends/distributions received 26.2 18.5<br />

Dividends/distributions received 4.8 0.3<br />

Borrowing costs paid (192.3) (203.5)<br />

Income tax refund — 1.6<br />

net cash inflows from operating activities 39(b) 317.0 248.5<br />

cash flows from investing activities<br />

Payments for property, plant and equipment (8.4) (7.8)<br />

Proceeds from sale of property, plant and equipment 0.2 0.3<br />

Payments for investment properties (91.8) (116.4)<br />

Proceeds from sale of investment properties 128.3 159.7<br />

Payments for loans to related entities (31.7) (0.7)<br />

Proceeds from loans to related entities 51.0 —<br />

Payments for loans to unrelated entities (12.6) (10.1)<br />

Proceeds from loans to unrelated entities 16.5 12.6<br />

Contributions to associates and joint ventures (83.6) (24.1)<br />

Proceeds from associates and joint ventures 20.9 70.1<br />

Acquisition of controlled entities, net of cash acquired — (232.3)<br />

Cash impact of controlled entities leaving the <strong>Group</strong> (4.6) —<br />

Proceeds from sale of investments 23.4 17.3<br />

Proceeds net of costs from sale of assets classified as held for sale<br />

(sale of hotel Management business and related assets) 275.9 —<br />

Payments for other intangible assets — (2.1)<br />

net cash inflows/(outflows) from investing activities 283.5 (133.5)<br />

cash flows from financing activities<br />

Proceeds from borrowings 776.6 2,862.6<br />

Repayments of borrowings (1,693.0) (2,607.6)<br />

Dividends/distributions paid as part of business combination — (8.0)<br />

Dividends/distributions paid (280.2) (270.8)<br />

net cash outflows from financing activities (1,196.6) (23.8)<br />

Net (decrease)/increase in cash and cash equivalents (596.1) 91.2<br />

Cash and cash equivalents at the beginning of the year 673.1 582.0<br />

effects of exchange rate changes on cash and cash equivalents 0.3 (0.1)<br />

cash and cash equivalents at the end of the year 39(a) 77.3 673.1<br />

The above consolidated statement of cash flows should be read in conjunction with the accompanying notes.