CONSOLIDATED STATEMENT OF INCOME - Total.com

CONSOLIDATED STATEMENT OF INCOME - Total.com

CONSOLIDATED STATEMENT OF INCOME - Total.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

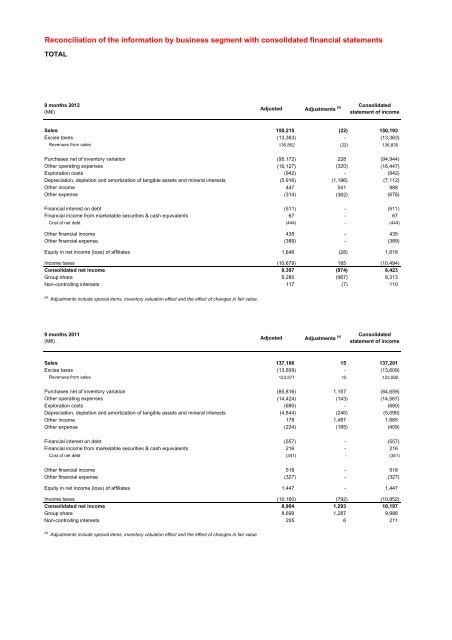

Reconciliation of the information by business segment with consolidated financial statements<br />

TOTAL<br />

(unaudited)<br />

9 months 2012<br />

(M€)<br />

Adjusted Adjustments (a) Consolidated<br />

statement of in<strong>com</strong>e<br />

Sales 150,215 (22) 150,193<br />

Excise taxes (13,363) - (13,363)<br />

Revenues from sales 136,852 (22) 136,830<br />

Purchases net of inventory variation (95,172) 228 (94,944)<br />

Other operating expenses (16,127) (320) (16,447)<br />

Exploration costs (942) - (942)<br />

Depreciation, depletion and amortization of tangible assets and mineral interests (5,916) (1,196) (7,112)<br />

Other in<strong>com</strong>e 447 541 988<br />

Other expense (314) (362) (676)<br />

Financial interest on debt (511) - (511)<br />

Financial in<strong>com</strong>e from marketable securities & cash equivalents 67 - 67<br />

Cost of net debt (444) - (444)<br />

Other financial in<strong>com</strong>e 435 - 435<br />

Other financial expense (389) - (389)<br />

Equity in net in<strong>com</strong>e (loss) of affiliates 1,646 (28) 1,618<br />

In<strong>com</strong>e taxes (10,679) 185 (10,494)<br />

Consolidated net in<strong>com</strong>e 9,397 (974) 8,423<br />

Group share 9,280 (967) 8,313<br />

Non-controlling interests 117 (7) 110<br />

(a) Adjustments include special items, inventory valuation effect and the effect of changes in fair value.<br />

9 months 2011<br />

(M€)<br />

Adjusted Adjustments (a) Consolidated<br />

statement of in<strong>com</strong>e<br />

Sales 137,186 15 137,201<br />

Excise taxes (13,609) - (13,609)<br />

Revenues from sales 123,577 15 123,592<br />

Purchases net of inventory variation (85,816) 1,157 (84,659)<br />

Other operating expenses (14,424) (143) (14,567)<br />

Exploration costs (680) - (680)<br />

Depreciation, depletion and amortization of tangible assets and mineral interests (4,844) (246) (5,090)<br />

Other in<strong>com</strong>e 178 1,487 1,665<br />

Other expense (224) (185) (409)<br />

Financial interest on debt (557) - (557)<br />

Financial in<strong>com</strong>e from marketable securities & cash equivalents 216 - 216<br />

Cost of net debt (341) - (341)<br />

Other financial in<strong>com</strong>e 518 - 518<br />

Other financial expense (327) - (327)<br />

Equity in net in<strong>com</strong>e (loss) of affiliates 1,447 - 1,447<br />

In<strong>com</strong>e taxes (10,160) (792) (10,952)<br />

Consolidated net in<strong>com</strong>e 8,904 1,293 10,197<br />

Group share 8,699 1,287 9,986<br />

Non-controlling interests 205 6 211<br />

(a) Adjustments include special items, inventory valuation effect and the effect of changes in fair value.