megatrends

megatrends

megatrends

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ability - or otherwise - of the industry to supply<br />

gallon jugs of an inert liquid to truckstop shelves.<br />

Piping natural gas to those same truckstops<br />

would seem like a rather more involved<br />

undertaking, but it is clearly one that has to be<br />

addressed before any form of wider spread<br />

adoption can even begin to be considered. Does<br />

this make natural gas a simple energy play in this<br />

context? At one level, yes, but infrastructure<br />

issues are not the only restraint here.<br />

Limited choice in NG engine offerings…<br />

Diesel is currently the dominant fuel in the HD<br />

segment, and there are plenty of diesel engines<br />

from which to choose. Natural gas does not<br />

suffer from the same plentitude, with only two<br />

engine choices on offer. Both produced by the<br />

Cummins Westport JV, the ISL G is an 8.9-litre<br />

250-320 bhp offering that falls short of the<br />

requirements of mainstream Class 8 trucks,<br />

while the HD15 15-litre unit, which outputs<br />

400-550 bhp, is realistically the only choice<br />

available to HD operators requiring a like-forlike<br />

natural gas alternative.<br />

This lack of choice appears to act as a restraint<br />

in two ways. On the one hand, what amounts to<br />

a single engine choice may serve to delegitimise<br />

natural gas as a genuine alternative to diesel in<br />

the mindset of the mainstream North American<br />

trucking industry. And perhaps in part because<br />

of the scarcity value, the on-cost of specifying a<br />

natural gas unit is significant: the incremental<br />

cost generally cited ranges between US$45,000<br />

- US$100,000 over a comparable dieselpowered<br />

truck. This additional expense lies in<br />

Q1 2013<br />

the engine (30%) and the gas tanks (70%), and is<br />

clearly noteworthy. So too are the costs<br />

inherent in retrofitting service bays for natural<br />

gas trucks, at US$200,000 - US$300,000. In<br />

summation, opting for natural gas requires<br />

considerable upfront investment.<br />

…but this may be about to change<br />

A key catalyst to development here looks to be<br />

the launch later this year of the Cummins<br />

Westport ISX 12 G 12-litre unit. While this is<br />

being slow-marched to market, it will be<br />

followed in 2014 by Volvo’s dual fuel 13-litre<br />

unit, and in 2015 by Cummins’ own gaspowered<br />

15-litre unit. It seems reasonable to<br />

assume that a broader engine choice will serve<br />

to address both the legitimacy argument and<br />

possibly reduce the initial cost implications too.<br />

If the natural gas product range increases, then it<br />

seems reasonable to assume that so too will the<br />

willingness on the part of the suppliers to grow<br />

infrastructure. If these two key restraints are<br />

removed, then the third, less obvious but equally<br />

important barrier to adoption should also be<br />

mitigated, and a larger adoption rate should<br />

allow some semblance of residual value<br />

discussion to take place.<br />

Will North America welcome NG?<br />

Natural gas exists in a strange place at present.<br />

There is an abundance of supply, and the<br />

technology exists to harness it. And while some<br />

fleets have pointed to improved fuel efficiency<br />

at EPA 10 as narrowing the reckoning<br />

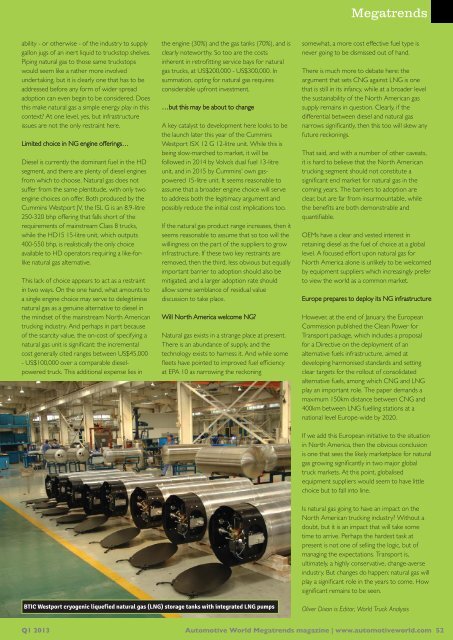

BTIC Westport cryogenic liquefied natural gas (LNG) storage tanks with integrated LNG pumps<br />

Megatrends<br />

somewhat, a more cost effective fuel type is<br />

never going to be dismissed out of hand.<br />

There is much more to debate here: the<br />

argument that sets CNG against LNG is one<br />

that is still in its infancy, while at a broader level<br />

the sustainability of the North American gas<br />

supply remains in question. Clearly, if the<br />

differential between diesel and natural gas<br />

narrows significantly, then this too will skew any<br />

future reckonings.<br />

That said, and with a number of other caveats,<br />

it is hard to believe that the North American<br />

trucking segment should not constitute a<br />

significant end market for natural gas in the<br />

coming years. The barriers to adoption are<br />

clear, but are far from insurmountable, while<br />

the benefits are both demonstrable and<br />

quantifiable.<br />

OEMs have a clear and vested interest in<br />

retaining diesel as the fuel of choice at a global<br />

level. A focused effort upon natural gas for<br />

North America alone is unlikely to be welcomed<br />

by equipment suppliers which increasingly prefer<br />

to view the world as a common market.<br />

Europe prepares to deploy its NG infrastructure<br />

However, at the end of January, the European<br />

Commission published the Clean Power for<br />

Transport package, which includes a proposal<br />

for a Directive on the deployment of an<br />

alternative fuels infrastructure, aimed at<br />

developing harmonised standards and setting<br />

clear targets for the rollout of consolidated<br />

alternative fuels, among which CNG and LNG<br />

play an important role. The paper demands a<br />

maximum 150km distance between CNG and<br />

400km between LNG fuelling stations at a<br />

national level Europe-wide by 2020.<br />

If we add this European initiative to the situation<br />

in North America, then the obvious conclusion<br />

is one that sees the likely marketplace for natural<br />

gas growing significantly in two major global<br />

truck markets. At this point, globalised<br />

equipment suppliers would seem to have little<br />

choice but to fall into line.<br />

Is natural gas going to have an impact on the<br />

North American trucking industry? Without a<br />

doubt, but it is an impact that will take some<br />

time to arrive. Perhaps the hardest task at<br />

present is not one of selling the logic, but of<br />

managing the expectations. Transport is,<br />

ultimately, a highly conservative, change-averse<br />

industry. But changes do happen: natural gas will<br />

play a significant role in the years to come. How<br />

significant remains to be seen.<br />

Oliver Dixon is Editor, World Truck Analysis<br />

Automotive World Megatrends magazine | www.automotiveworld.com<br />

52