Annual Report 2005 - Tenaris

Annual Report 2005 - Tenaris

Annual Report 2005 - Tenaris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Explanatory notes<br />

.<br />

60. <strong>Tenaris</strong>Confab<br />

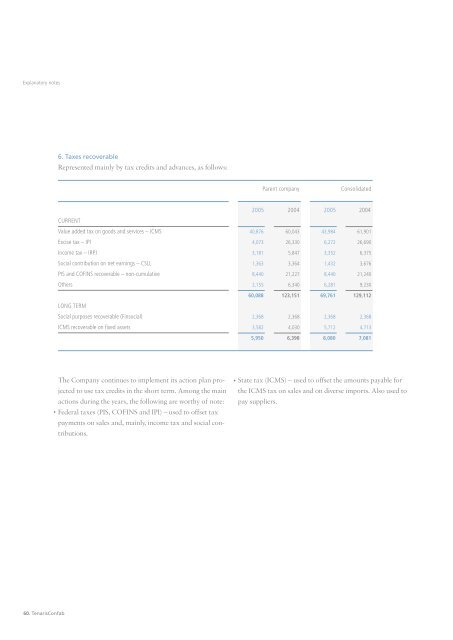

6. Taxes recoverable<br />

Represented mainly by tax credits and advances, as follows:<br />

CURRENT<br />

Value added tax on goods and services – ICMS<br />

Excise tax – IPI<br />

Income tax – IRPJ<br />

Social contribution on net earnings – CSLL<br />

PIS and COFINS recoverable – non-cumulative<br />

Others<br />

LONG TERM<br />

Social purposes recoverable (Finsocial)<br />

ICMS recoverable on fixed assets<br />

The Company continues to implement its action plan projected<br />

to use tax credits in the short term. Among the main<br />

actions during the years, the following are worthy of note:<br />

Federal taxes (PIS, COFINS and IPI) – used to offset tax<br />

payments on sales and, mainly, income tax and social contributions.<br />

.<br />

<strong>2005</strong><br />

40,876<br />

4,073<br />

3,181<br />

1,363<br />

8,440<br />

2,155<br />

60,088<br />

2,368<br />

3,582<br />

5,950<br />

Parent company Consolidated<br />

2004<br />

60,043<br />

26,330<br />

5,847<br />

3,364<br />

21,227<br />

6,340<br />

123,151<br />

2,368<br />

4,030<br />

6,398<br />

<strong>2005</strong><br />

43,984<br />

6,272<br />

3,352<br />

1,432<br />

8,440<br />

6,281<br />

69,761<br />

2,368<br />

5,712<br />

8,080<br />

2004<br />

61,901<br />

26,690<br />

6,375<br />

3,676<br />

21,240<br />

9,230<br />

129,112<br />

2,368<br />

4,713<br />

7,081<br />

State tax (ICMS) – used to offset the amounts payable for<br />

the ICMS tax on sales and on diverse imports. Also used to<br />

pay suppliers.