Annual Report 2005 - Tenaris

Annual Report 2005 - Tenaris

Annual Report 2005 - Tenaris

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

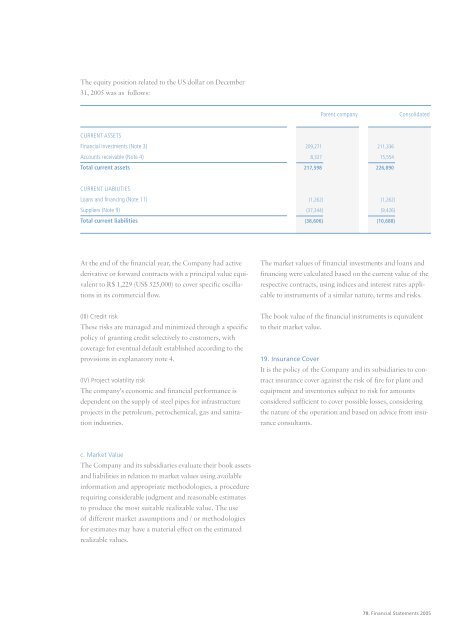

The equity position related to the US dollar on December<br />

31, <strong>2005</strong> was as follows:<br />

CURRENT ASSETS<br />

Financial investments (Note 3)<br />

Accounts receivable (Note 4)<br />

Total current assets<br />

CURRENT LIABILITIES<br />

Loans and financing (Note 11)<br />

Suppliers (Note 9)<br />

Total current liabilities<br />

At the end of the financial year, the Company had active<br />

derivative or forward contracts with a principal value equivalent<br />

to R$ 1,229 (US$ 525,000) to cover specific oscillations<br />

in its commercial flow.<br />

(III) Credit risk<br />

These risks are managed and minimized through a specific<br />

policy of granting credit selectively to customers, with<br />

coverage for eventual default established according to the<br />

provisions in explanatory note 4.<br />

(IV) Project volatility risk<br />

The company's economic and financial performance is<br />

dependent on the supply of steel pipes for infrastructure<br />

projects in the petroleum, petrochemical, gas and sanitation<br />

industries.<br />

c. Market Value<br />

The Company and its subsidiaries evaluate their book assets<br />

and liabilities in relation to market values using available<br />

information and appropriate methodologies, a procedure<br />

requiring considerable judgment and reasonable estimates<br />

to produce the most suitable realizable value. The use<br />

of different market assumptions and / or methodologies<br />

for estimates may have a material effect on the estimated<br />

realizable values.<br />

209,271<br />

8,327<br />

217,598<br />

(1,262)<br />

(37,344)<br />

(38,606)<br />

Parent company Consolidated<br />

211,336<br />

15,554<br />

226,890<br />

(1,262)<br />

(9,426)<br />

(10,688)<br />

The market values of financial investments and loans and<br />

financing were calculated based on the current value of the<br />

respective contracts, using indices and interest rates applicable<br />

to instruments of a similar nature, terms and risks.<br />

The book value of the financial instruments is equivalent<br />

to their market value.<br />

19. Insurance Cover<br />

It is the policy of the Company and its subsidiaries to contract<br />

insurance cover against the risk of fire for plant and<br />

equipment and inventories subject to risk for amounts<br />

considered sufficient to cover possible losses, considering<br />

the nature of the operation and based on advice from insurance<br />

consultants.<br />

79. Financial Statements <strong>2005</strong>