kenmare - MyHome.ie

kenmare - MyHome.ie

kenmare - MyHome.ie

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34 taxbreaks<br />

Units registered on the ‘Register of Holiday Cottages’ will qualify for capital<br />

allowances based on the construction expenditure incurred on the units.<br />

The percentage of the purchase price of the units on which capital allowances<br />

will be available is expected to be approximately 75%.<br />

The capital allowances will be available to a purchaser at 10% over each year<br />

for 10 years for offset against Irish rental income.<br />

The units are anticipated to be completed in 2007 and the capital allowances<br />

should be available for the tax year 2007 onwards.<br />

Planning permission for the units was appl<strong>ie</strong>d for prior to 31 December 2004<br />

and certain transitional requirements in Finance Act 2006 (to extend the<br />

period in which construction can take place to 31 July 2008) have been and will<br />

be met.<br />

A clawback of the capital allowances will arise if the unit is sold within 10 years<br />

of being first let.<br />

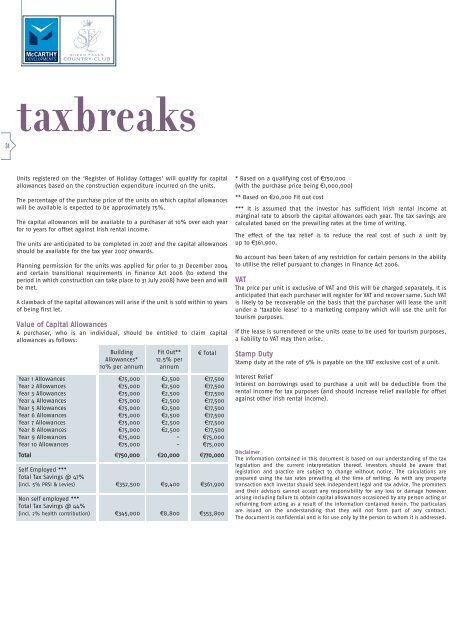

Value of Capital Allowances<br />

A purchaser, who is an individual, should be entitled to claim capital<br />

allowances as follows:<br />

Building<br />

Allowances*<br />

10% per annum<br />

Fit Out**<br />

12.5% per<br />

annum<br />

€ Total<br />

Year 1 Allowances €75,000 €2,500 €77,500<br />

Year 2 Allowances €75,000 €2,500 €77,500<br />

Year 3 Allowances €75,000 €2,500 €77,500<br />

Year 4 Allowances €75,000 €2,500 €77,500<br />

Year 5 Allowances €75,000 €2,500 €77,500<br />

Year 6 Allowances €75,000 €2,500 €77,500<br />

Year 7 Allowances €75,000 €2,500 €77,500<br />

Year 8 Allowances €75,000 €2,500 €77,500<br />

Year 9 Allowances €75,000 - €75,000<br />

Year 10 Allowances €75,000 - €75,000<br />

Total €750,000 €20,000 €770,000<br />

Self Employed ***<br />

Total Tax Savings @ 47%<br />

(incl. 5% PRSI & Lev<strong>ie</strong>s) €352,500 €9,400 €361,900<br />

Non self employed ***<br />

Total Tax Savings @ 44%<br />

(incl. 2% health contribution) €345,000 €8,800 €353,800<br />

* Based on a qualifying cost of €750,000<br />

(with the purchase price being €1,000,000)<br />

** Based on €20,000 Fit out cost<br />

*** It is assumed that the investor has suffic<strong>ie</strong>nt Irish rental income at<br />

marginal rate to absorb the capital allowances each year. The tax savings are<br />

calculated based on the prevailing rates at the time of writing.<br />

The effect of the tax rel<strong>ie</strong>f is to reduce the real cost of such a unit by<br />

up to €361,900.<br />

No account has been taken of any restriction for certain persons in the ability<br />

to utilise the rel<strong>ie</strong>f pursuant to changes in Finance Act 2006.<br />

VAT<br />

The price per unit is exclusive of VAT and this will be charged separately. It is<br />

anticipated that each purchaser will register for VAT and recover same. Such VAT<br />

is likely to be recoverable on the basis that the purchaser will lease the unit<br />

under a ‘taxable lease’ to a marketing company which will use the unit for<br />

tourism purposes.<br />

If the lease is surrendered or the units cease to be used for tourism purposes,<br />

a liability to VAT may then arise.<br />

Stamp Duty<br />

Stamp duty at the rate of 9% is payable on the VAT exclusive cost of a unit.<br />

Interest Rel<strong>ie</strong>f<br />

Interest on borrowings used to purchase a unit will be deductible from the<br />

rental income for tax purposes (and should increase rel<strong>ie</strong>f available for offset<br />

against other Irish rental income).<br />

Disclaimer<br />

The information contained in this document is based on our understanding of the tax<br />

legislation and the current interpretation thereof. Investors should be aware that<br />

legislation and practice are subject to change without notice. The calculations are<br />

prepared using the tax rates prevailing at the time of writing. As with any property<br />

transaction each investor should seek independent legal and tax advice. The promoters<br />

and their advisors cannot accept any responsibility for any loss or damage however<br />

arising including failure to obtain capital allowances occasioned by any person acting or<br />

refraining from acting as a result of the information contained herein. The particulars<br />

are issued on the understanding that they will not form part of any contract.<br />

The document is confidential and is for use only by the person to whom it is addressed.