Notice of Annual General Meeting - Announcements - Bursa Malaysia

Notice of Annual General Meeting - Announcements - Bursa Malaysia

Notice of Annual General Meeting - Announcements - Bursa Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

54<br />

ANNUAL REPORT 2012 GROMUTUAL BERHAD (Company No. 625034-X)<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2012 (continue)<br />

Freehold land <strong>of</strong> the Group with carrying amount <strong>of</strong> RM20,372,283 (RM6,628,514 in 2011) are charged to<br />

licensed banks for bank facilities granted to the Group as disclosed in Note 22.<br />

Included in development expenditure <strong>of</strong> the Group is interest capitalised during the financial year<br />

amounting to RM756,124 (RM325,708 in 2011).<br />

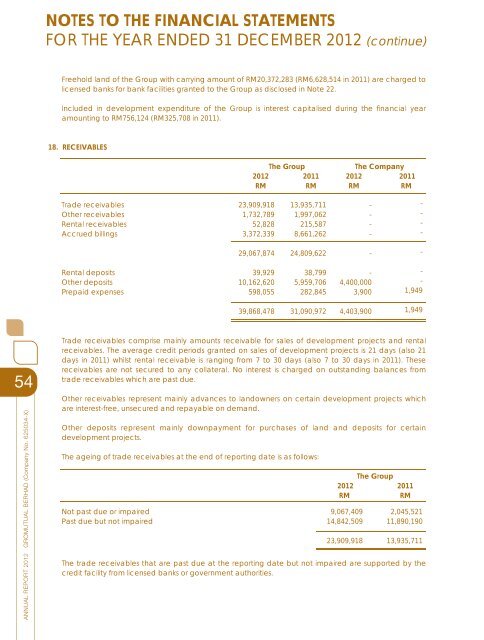

18. RECEIVABLES<br />

Trade receivables<br />

Other receivables<br />

Rental receivables<br />

Accrued billings<br />

Rental deposits<br />

Other deposits<br />

Prepaid expenses<br />

The Group The Company<br />

2012 2011 2012 2011<br />

RM RM RM RM<br />

Trade receivables comprise mainly amounts receivable for sales <strong>of</strong> development projects and rental<br />

receivables. The average credit periods granted on sales <strong>of</strong> development projects is 21 days (also 21<br />

days in 2011) whilst rental receivable is ranging from 7 to 30 days (also 7 to 30 days in 2011). These<br />

receivables are not secured to any collateral. No interest is charged on outstanding balances from<br />

trade receivables which are past due.<br />

Other receivables represent mainly advances to landowners on certain development projects which<br />

are interest-free, unsecured and repayable on demand.<br />

Other deposits represent mainly downpayment for purchases <strong>of</strong> land and deposits for certain<br />

development projects.<br />

The ageing <strong>of</strong> trade receivables at the end <strong>of</strong> reporting date is as follows:<br />

Not past due or impaired<br />

Past due but not impaired<br />

23,909,918<br />

1,732,789<br />

52,828<br />

3,372,339<br />

29,067,874<br />

39,929<br />

10,162,620<br />

598,055<br />

39,868,478<br />

13,935,711<br />

1,997,062<br />

215,587<br />

8,661,262<br />

24,809,622<br />

38,799<br />

5,959,706<br />

282,845<br />

31,090,972<br />

The Group<br />

2012 2011<br />

RM RM<br />

The trade receivables that are past due at the reporting date but not impaired are supported by the<br />

credit facility from licensed banks or government authorities.<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

4,400,000<br />

3,900<br />

4,403,900<br />

9,067,409<br />

14,842,509<br />

23,909,918<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

1,949<br />

1,949<br />

2,045,521<br />

11,890,190<br />

13,935,711