Titel-Trader 2.2009.indd - Agritechnica Trader

Titel-Trader 2.2009.indd - Agritechnica Trader

Titel-Trader 2.2009.indd - Agritechnica Trader

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMPANIES AND MARKETS<br />

In Focus:<br />

The fi rst fi ve years of the fi rst<br />

decade in the 21st century<br />

were still characterised<br />

by largely stagnating agricultural<br />

machinery markets. These<br />

were years of corporate consolidation<br />

– for example addressingthe<br />

consequences of the Case<br />

IH and New Holland merger to<br />

form the CNH Group, the takeover<br />

of Valtra by Agco, the entry<br />

of Claas into the former Renault<br />

tractor production segment, and<br />

many vigorous consolidation activities<br />

by progressive mediumsized<br />

manufacturers of agricultural<br />

machinery in Europe.<br />

Greater momentum came into<br />

the EU markets (the number<br />

of member States has now increased<br />

to 27, including 10<br />

Central East European countries)<br />

after the new EU agricultural<br />

policy was adopted, with<br />

a considerable rise in planning<br />

certainty for European farmers<br />

up to the year 2013.<br />

22 TRADER | 2 | 2009<br />

Agricultural machinery industry<br />

Big tigers,<br />

little tigers<br />

The present decade has so far been characterised by branch consolidation and enormous growth<br />

of leading agricultural machinery manufacturers – 2008 was the record year. In the current year<br />

2009 agricultural machinery production in Europe has dropped back to the 2006/2007 level.<br />

Three exciting boom years<br />

for agricultural machinery then<br />

followed from 2006 to 2008,<br />

fuelled by the growing demand<br />

for agricultural food products<br />

and production of renewable<br />

raw materials for the energy industry.<br />

In these boom years the<br />

production value of agricultural<br />

machinery in the EU Member<br />

States increased from 20.5 billion<br />

euros in 2005 to 27.7 billion<br />

euros in 2008:<br />

Production volume of<br />

agricultural machinery in<br />

the European Union<br />

2005 = 20.5 billion euros<br />

2006 = 21.7 billion euros<br />

2007 = 23.8 billion euros<br />

2008 = 27.7 billion euros<br />

An abrupt reversal in the<br />

trend began as a consequence<br />

of the global fi nancial and economic<br />

crisis starting in the second<br />

half of 2008, after grain and<br />

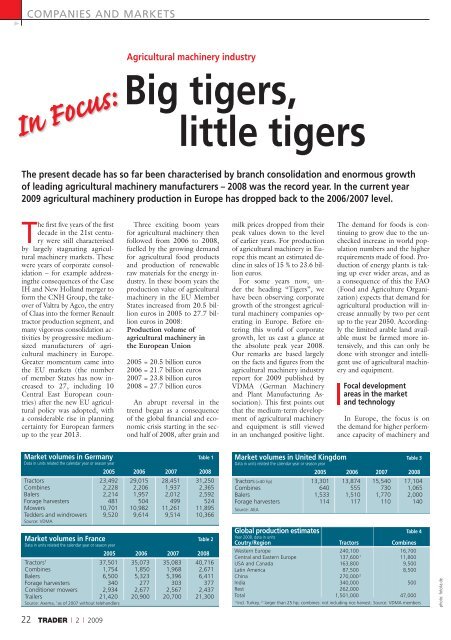

Market volumes in Germany<br />

Data in units related the calendar year or season year<br />

Table 1<br />

2005 2006 2007 2008<br />

Tractors 23,492 29,015 28,451 31,250<br />

Combines 2,228 2,206 1,937 2,365<br />

Balers 2,214 1,957 2,012 2,592<br />

Forage harvesters 481 504 499 524<br />

Mowers 10,701 10,982 11,261 11,895<br />

Tedders and windrowers<br />

Source: VDMA<br />

9,520 9,614 9,514 10,366<br />

Market volumes in France<br />

Data in units related the calendar year or season year<br />

Table 2<br />

2005 2006 2007 2008<br />

Tractors1 37,501 35,073 35,083 40,716<br />

Combines 1,754 1,850 1,968 2,671<br />

Balers 6,500 5,323 5,396 6,411<br />

Forage harvesters 340 277 303 377<br />

Conditioner mowers 2,934 2,677 2,567 2,437<br />

Trailers 21,420 20,900 20,700 21,300<br />

Source: Axema, 1as of 2007 without telehandlers<br />

milk prices dropped from their<br />

peak values down to the level<br />

of earlier years. For production<br />

of agricultural machinery in Europe<br />

this meant an estimated decline<br />

in sales of 15 % to 23.6 billion<br />

euros.<br />

For some years now, under<br />

the heading “Tigers”, we<br />

have been observing corporate<br />

growth of the strongest agricultural<br />

machinery companies operating<br />

in Europe. Before entering<br />

this world of corporate<br />

growth, let us cast a glance at<br />

the absolute peak year 2008.<br />

Our remarks are based largely<br />

on the facts and fi gures from the<br />

agricultural machinery industry<br />

report for 2009 published by<br />

VDMA (German Machinery<br />

and Plant Manufacturing Association).<br />

This fi rst points out<br />

that the medium-term development<br />

of agricultural machinery<br />

and equipment is still viewed<br />

in an unchanged positive light.<br />

The demand for foods is continuing<br />

to grow due to the unchecked<br />

increase in world population<br />

numbers and the higher<br />

requirements made of food. Production<br />

of energy plants is taking<br />

up ever wider areas, and as<br />

a consequence of this the FAO<br />

(Food and Agriculture Organization)<br />

expects that demand for<br />

agricultural production will increase<br />

annually by two per cent<br />

up to the year 2050. Accordingly<br />

the limited arable land available<br />

must be farmed more intensively,<br />

and this can only be<br />

done with stronger and intelligent<br />

use of agricultural machinery<br />

and equipment.<br />

Focal development<br />

areas in the market<br />

and technology<br />

In Europe, the focus is on<br />

the demand for higher performance<br />

capacity of machinery and<br />

Market volumes in United Kingdom<br />

Data in units related the calendar year or season year<br />

Table 3<br />

2005 2006 2007 2008<br />

Tractors (>40 hp) 13,301 13,874 15,540 17,104<br />

Combines 640 555 730 1,065<br />

Balers 1,533 1,510 1,770 2,000<br />

Forage harvesters<br />

Source: AEA<br />

114 117 110 140<br />

Global production estimates<br />

Year 2008, data in units<br />

Table 4<br />

Coutry/Region Tractors Combines<br />

Western Europe 240,100 16,700<br />

Central and Eastern Europe 137,600 1 11,800<br />

USA and Canada 163,800 9,500<br />

Latin America 87,500 8,500<br />

China 270,000 2<br />

India 340,000 500<br />

Rest 262,000<br />

Total 1,501,000 47,000<br />

1) 2) Incl. Turkey, larger than 25 hp; combines: not including rice harvest. Source: VDMA members<br />

photo: fotolia.de